Question: a) Compute the mean monthly returns and standard deviations for the monthly returns of each of the stocks. Convert the monthly statistics to annual statistics

a) Compute the mean monthly returns and standard deviations for the monthly returns of each of the stocks. Convert the monthly statistics to annual statistics for easier interpretation.

b) Compute the mean and standard deviation of monthly returns for the equally weighted portfolio. Convert these monthly statistics to annual statistics for interpretation.

c) What do you notice about the average of the volatilities of the individual stocks, compared to the volatility of the equally weighted portfolio?

d) Rebalance the portfolio with the optimum weights that will provide the best risk and return combinations for the new 12-stock portfolio. Comment on your findings.

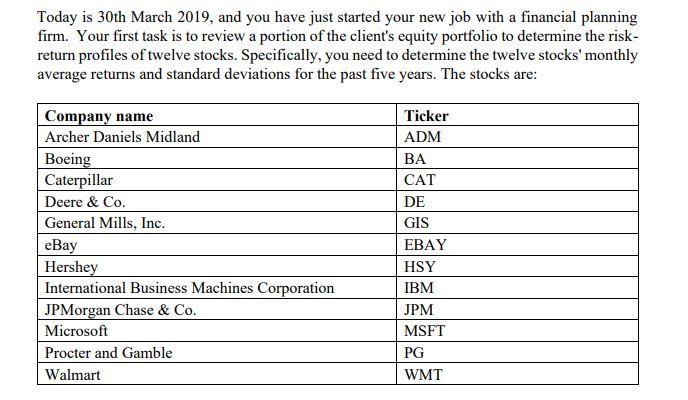

Today is 30th March 2019, and you have just started your new job with a financial planning firm. Your first task is to review a portion of the client's equity portfolio to determine the risk- return profiles of twelve stocks. Specifically, you need to determine the twelve stocks' monthly average returns and standard deviations for the past five years. The stocks are: Company name Archer Daniels Midland Boeing Caterpillar Deere & Co. General Mills, Inc. eBay Hershey International Business Machines Corporation JPMorgan Chase & Co. Microsoft Procter and Gamble Walmart Ticker ADM BA CAT DE GIS EBAY HSY IBM JPM MSFT PG WMT Today is 30th March 2019, and you have just started your new job with a financial planning firm. Your first task is to review a portion of the client's equity portfolio to determine the risk- return profiles of twelve stocks. Specifically, you need to determine the twelve stocks' monthly average returns and standard deviations for the past five years. The stocks are: Company name Archer Daniels Midland Boeing Caterpillar Deere & Co. General Mills, Inc. eBay Hershey International Business Machines Corporation JPMorgan Chase & Co. Microsoft Procter and Gamble Walmart Ticker ADM BA CAT DE GIS EBAY HSY IBM JPM MSFT PG WMT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts