Question: a) Compute the net present value of each project. (b) Compute the profitability index of each project. (c) Which project should be selected? Why? Additional

a) Compute the net present value of each project.

(b) Compute the profitability index of each project.

(c) Which project should be selected? Why?

Additional requirement:

Calculate the Cash Payback period of each project

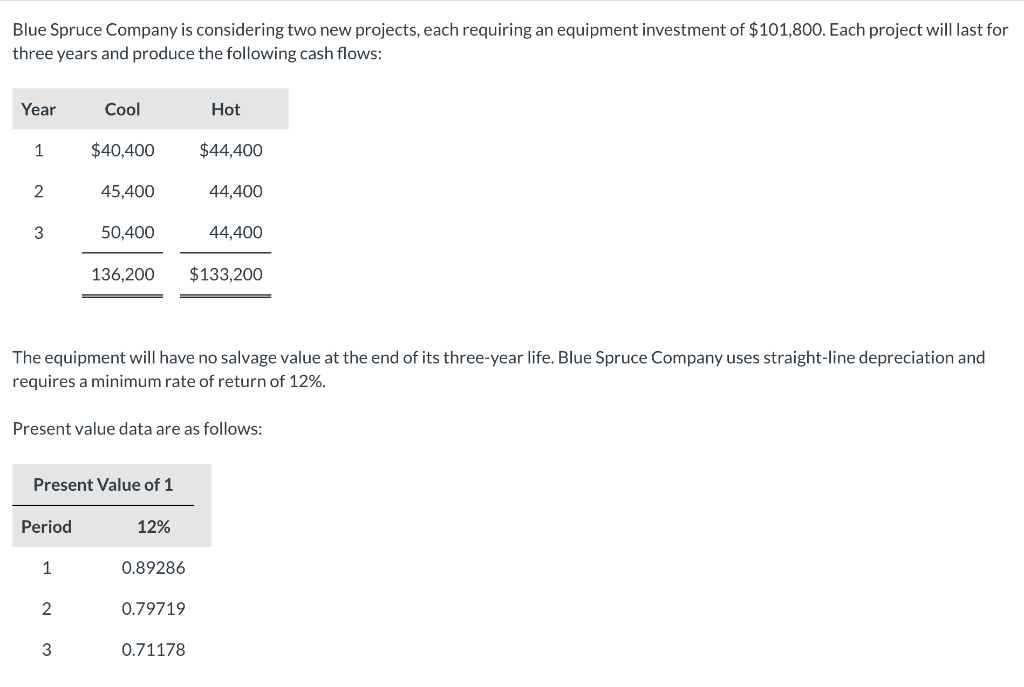

Blue Spruce Company is considering two new projects, each requiring an equipment investment of $101,800. Each project will last for three years and produce the following cash flows: Year Cool Hot 1 $40,400 $44,400 2 45,400 44,400 3 50,400 44,400 136,200 $133,200 The equipment will have no salvage value at the end of its three-year life. Blue Spruce Company uses straight-line depreciation and requires a minimum rate of return of 12%. Present value data are as follows: Present Value of 1 Period 12% 1 0.89286 2 0.79719 3 0.71178 Present value data are as follows: Present Value of 1 Period 12% 1 0.89286 2 0.79719 3 0.71178 Present Value of an Annuity of 1 Period 12% 1 0.89286 2 1.69005 3 2.40183

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts