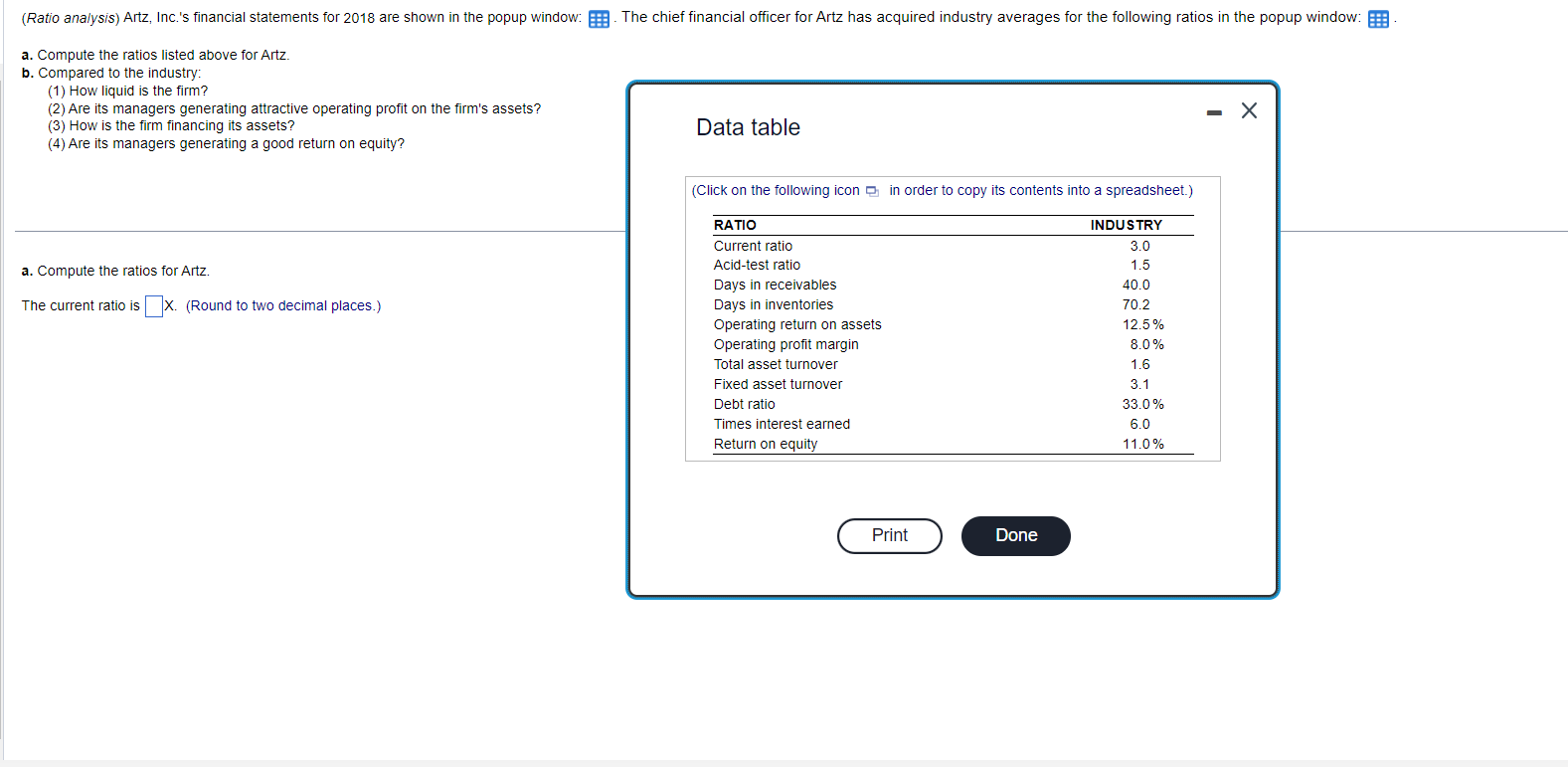

Question: a. Compute the ratios listed above for Artz. b. Compared to the industry: (1) How liquid is the firm? (2) Are its managers generating attractive

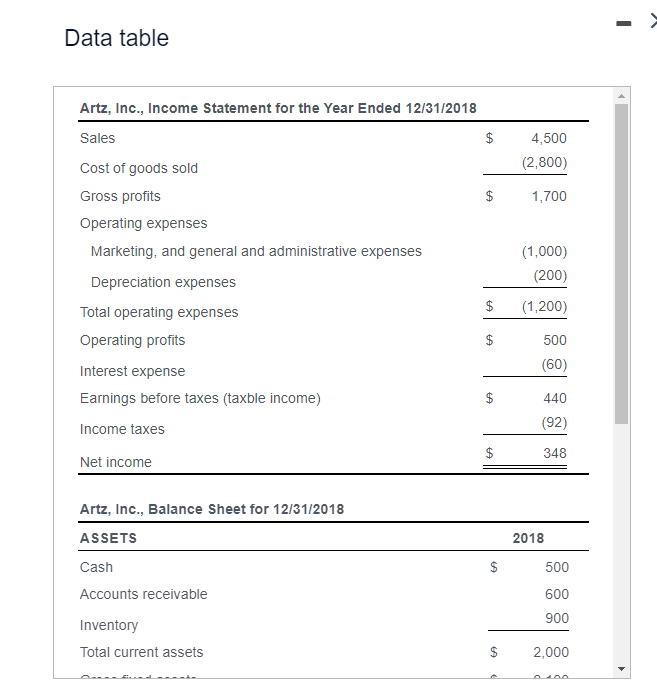

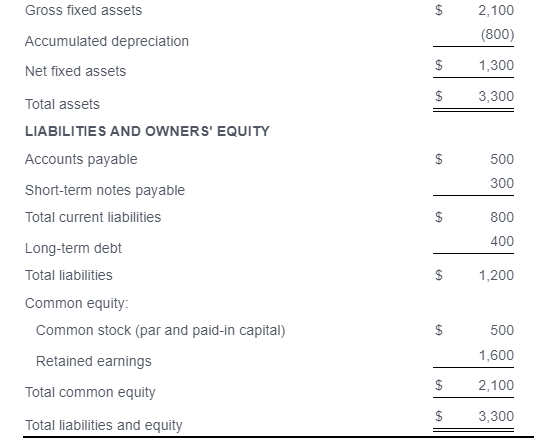

a. Compute the ratios listed above for Artz. b. Compared to the industry: (1) How liquid is the firm? (2) Are its managers generating attractive operating profit on the firm's assets? (3) How is the firm financing its assets? (4) Are its managers generating a good return on equity? Data table a. Compute the ratios for Artz. The current ratio is X. (Round to two decimal places.) (Click on the following icon in order to copy its contents into a spreadsheet.) Data table \begin{tabular}{|c|c|c|} \hline Gross fixed assets & $ & 2,100 \\ \hline Accumulated depreciation & & (800) \\ \hline Net fixed assets & $ & 1,300 \\ \hline Total assets & $ & 3,300 \\ \hline \multicolumn{3}{|l|}{ LIABILITIES AND OWNERS' EQUITY } \\ \hline Accounts payable & $ & 500 \\ \hline Short-term notes payable & & 300 \\ \hline Total current liabilities & $ & 800 \\ \hline Long-term debt & & 400 \\ \hline Total liabilities & $ & 1,200 \\ \hline \multicolumn{3}{|l|}{ Common equity: } \\ \hline Common stock (par and paid-in capital) & $ & 500 \\ \hline Retained earnings & & 1,600 \\ \hline Total common equity & $ & 2,100 \\ \hline Total liabilities and equity & $ & 3,300 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts