Question: a. Compute the tax payable by Razman for the year of assessment 2020, if they opted for separate assessment. b. Compute the tax payable by

a. Compute the tax payable by Razman for the year of assessment 2020, if they opted for separate assessment.

b. Compute the tax payable by Juliana for the year of assessment 2020, under separate assessment. Indicate “nil” in the appropriate column to any item that does not require adjustment

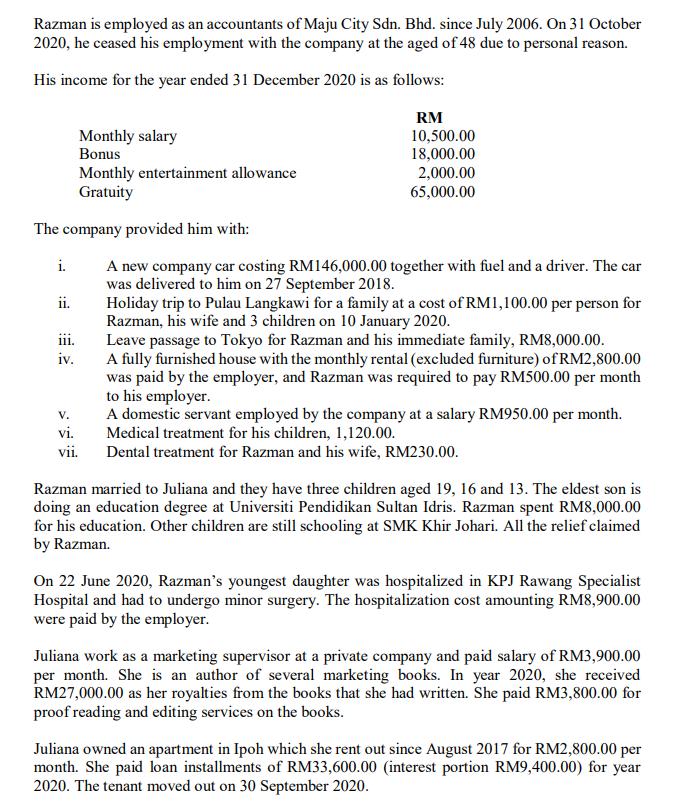

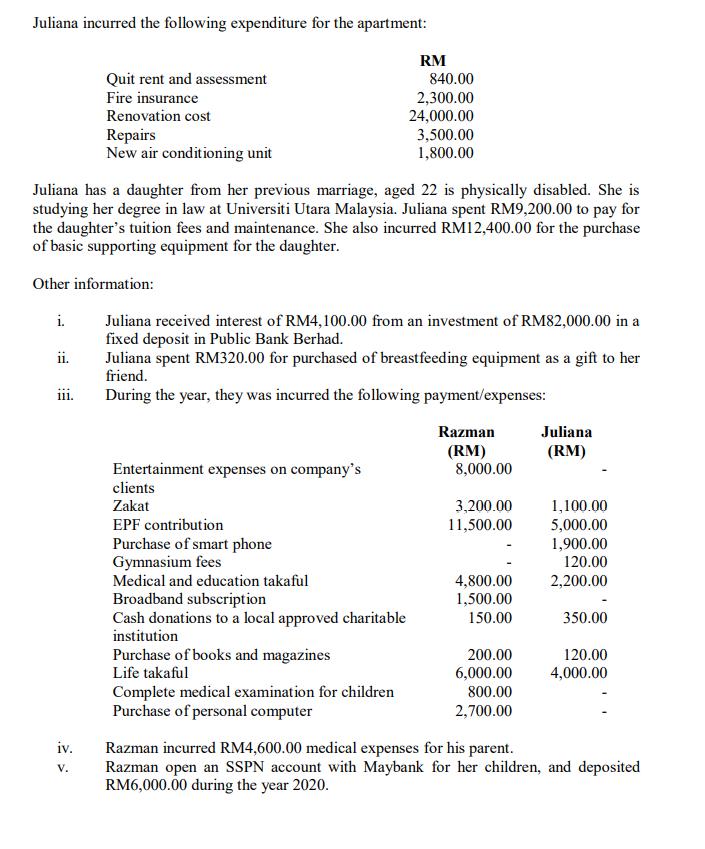

Razman is employed as an accountants of Maju City Sdn. Bhd. since July 2006. On 31 October 2020, he ceased his employment with the company at the aged of 48 due to personal reason. His income for the year ended 31 December 2020 is as follows: i. The company provided him with: ii. Monthly salary Bonus iii. iv. Monthly entertainment allowance Gratuity V. vi. vii. RM 10,500.00 18,000.00 2,000.00 65,000.00 A new company car costing RM146,000.00 together with fuel and a driver. The car was delivered to him on 27 September 2018. Holiday trip to Pulau Langkawi for a family at a cost of RM1,100.00 per person for Razman, his wife and 3 children on 10 January 2020. Leave passage to Tokyo for Razman and his immediate family, RM8,000.00. A fully furnished house with the monthly rental (excluded furniture) of RM2,800.00 was paid by the employer, and Razman was required to pay RM500.00 per month to his employer. A domestic servant employed by the company at a salary RM950.00 per month. Medical treatment for his children, 1,120.00. Dental treatment for Razman and his wife, RM230.00. Razman married to Juliana and they have three children aged 19, 16 and 13. The eldest son is doing an education degree at Universiti Pendidikan Sultan Idris. Razman spent RM8,000.00 for his education. Other children are still schooling at SMK Khir Johari. All the relief claimed by Razman. On 22 June 2020, Razman's youngest daughter was hospitalized in KPJ Rawang Specialist Hospital and had to undergo minor surgery. The hospitalization cost amounting RM8,900.00 were paid by the employer. Juliana work as a marketing supervisor at a private company and paid salary of RM3,900.00 per month. She is an author of several marketing books. In year 2020, she received RM27,000.00 as her royalties from the books that she had written. She paid RM3,800.00 for proof reading and editing services on the books. Juliana owned an apartment in Ipoh which she rent out since August 2017 for RM2,800.00 per month. She paid loan installments of RM33,600.00 (interest portion RM9,400.00) for year 2020. The tenant moved out on 30 September 2020.

Step by Step Solution

There are 3 Steps involved in it

Question Answer a Tax payable by ... View full answer

Get step-by-step solutions from verified subject matter experts