Question: a) Conduct a Variance / Profitability Analysis explaining the differences in EBITDA between the LIFT subsidiaries in GERmany and FRAnce. Number of NI, subscriptions (=size

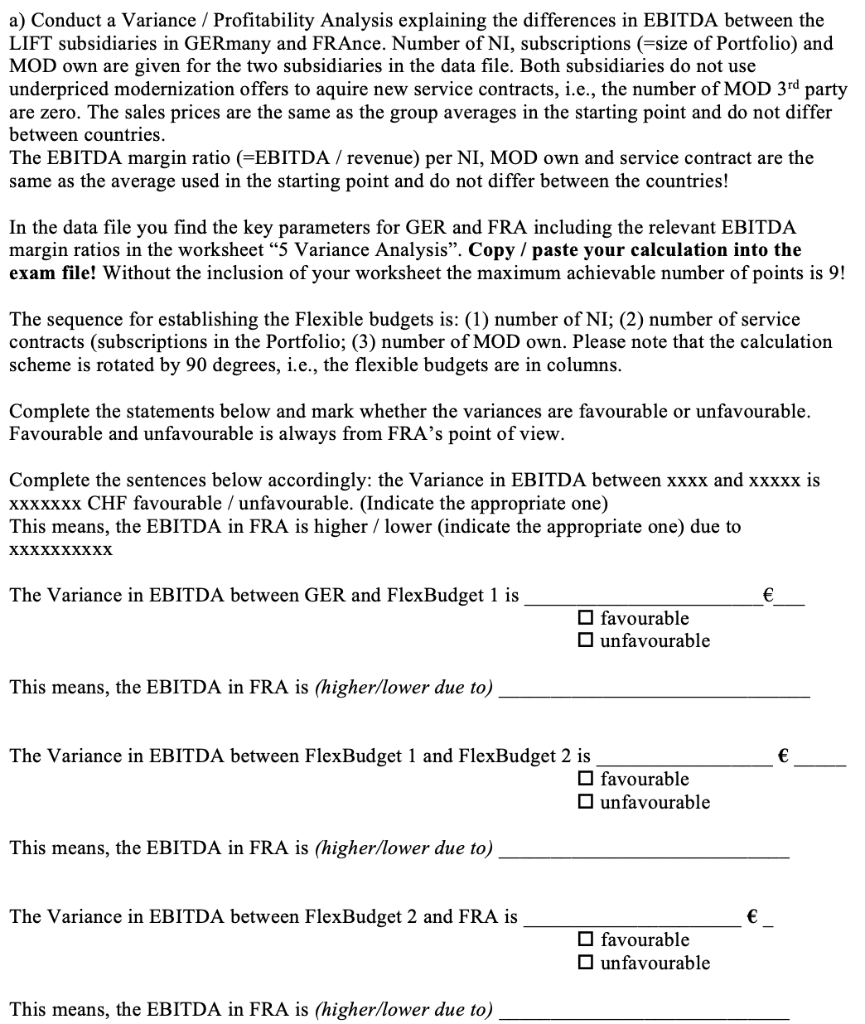

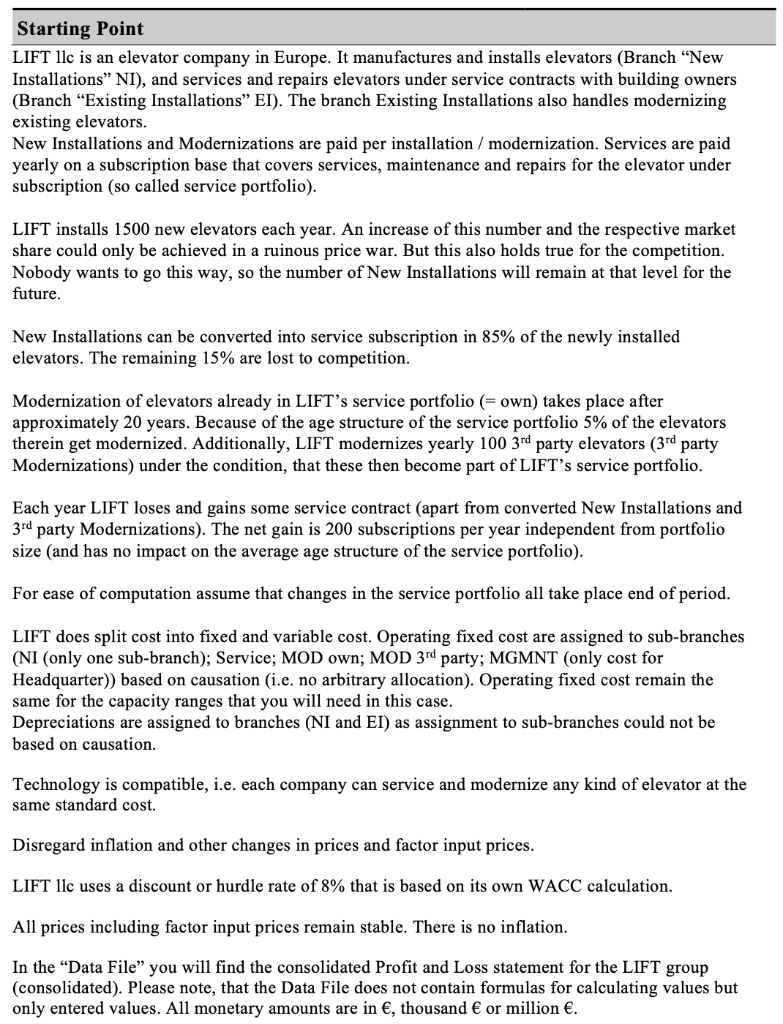

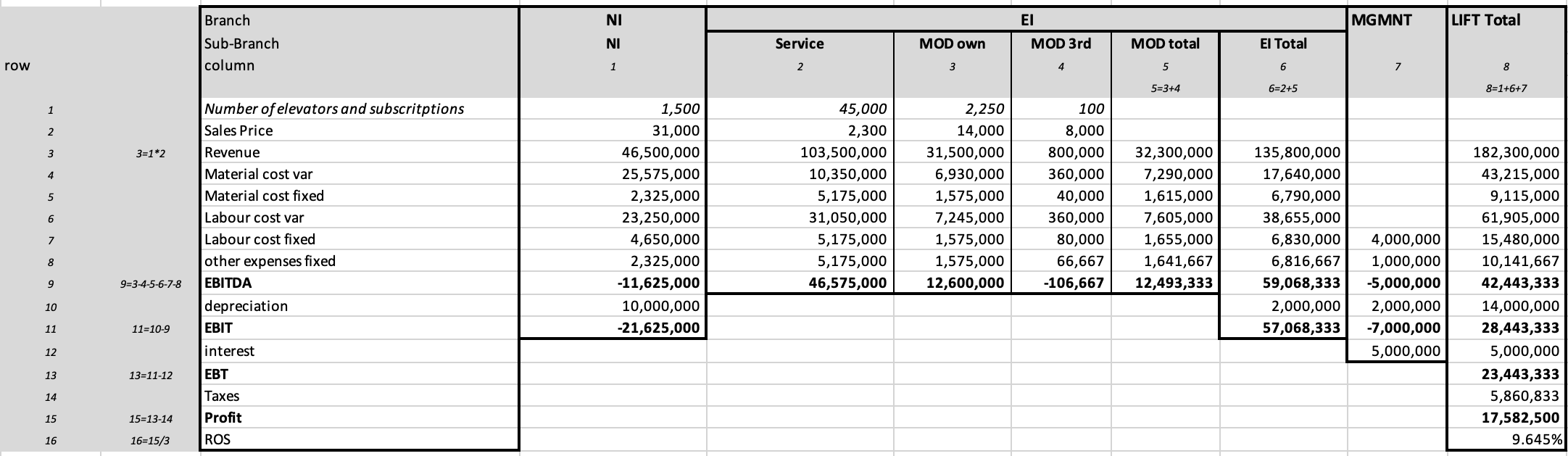

a) Conduct a Variance / Profitability Analysis explaining the differences in EBITDA between the LIFT subsidiaries in GERmany and FRAnce. Number of NI, subscriptions (=size of Portfolio) and MOD own are given for the two subsidiaries in the data file. Both subsidiaries do not use underpriced modernization offers to aquire new service contracts, i.e., the number of MOD 3rd party are zero. The sales prices are the same as the group averages in the starting point and do not differ between countries. The EBITDA margin ratio (=EBITDA / revenue) per NI, MOD own and service contract are the same as the average used in the starting point and do not differ between the countries! In the data file you find the key parameters for GER and FRA including the relevant EBITDA margin ratios in the worksheet "5 Variance Analysis". Copy / paste your calculation into the exam file! Without the inclusion of your worksheet the maximum achievable number of points is 9 ! The sequence for establishing the Flexible budgets is: (1) number of NI; (2) number of service contracts (subscriptions in the Portfolio; (3) number of MOD own. Please note that the calculation scheme is rotated by 90 degrees, i.e., the flexible budgets are in columns. Complete the statements below and mark whether the variances are favourable or unfavourable. Favourable and unfavourable is always from FRA's point of view. Complete the sentences below accordingly: the Variance in EBITDA between xx and xxxx is xxxxxxx CHF favourable / unfavourable. (Indicate the appropriate one) This means, the EBITDA in FRA is higher / lower (indicate the appropriate one) due to xxxxxxxxxx The Variance in EBITDA between GER and FlexBudget 1 is This means, the EBITDA in FRA is (higher/lower due to). The Variance in EBITDA between FlexBudget 1 and FlexBudget 2 is favourable unfavourable This means, the EBITDA in FRA is (higher/lower due to) The Variance in EBITDA between FlexBudget 2 and FRA is. unfavourable favourable unfavourable This means, the EBITDA in FRA is (higher/lower due to) Starting Point LIFT 1lc is an elevator company in Europe. It manufactures and installs elevators (Branch "New Installations" NI), and services and repairs elevators under service contracts with building owners (Branch "Existing Installations" EI). The branch Existing Installations also handles modernizing existing elevators. New Installations and Modernizations are paid per installation / modernization. Services are paid yearly on a subscription base that covers services, maintenance and repairs for the elevator under subscription (so called service portfolio). LIFT installs 1500 new elevators each year. An increase of this number and the respective market share could only be achieved in a ruinous price war. But this also holds true for the competition. Nobody wants to go this way, so the number of New Installations will remain at that level for the future. New Installations can be converted into service subscription in 85% of the newly installed elevators. The remaining 15% are lost to competition. Modernization of elevators already in LIFT's service portfolio (= own) takes place after approximately 20 years. Because of the age structure of the service portfolio 5% of the elevators therein get modernized. Additionally, LIFT modernizes yearly 1003rd party elevators (3rd party Modernizations) under the condition, that these then become part of LIFT's service portfolio. Each year LIFT loses and gains some service contract (apart from converted New Installations and 3rd party Modernizations). The net gain is 200 subscriptions per year independent from portfolio size (and has no impact on the average age structure of the service portfolio). For ease of computation assume that changes in the service portfolio all take place end of period. LIFT does split cost into fixed and variable cost. Operating fixed cost are assigned to sub-branches (NI (only one sub-branch); Service; MOD own; MOD 3rd party; MGMNT (only cost for Headquarter)) based on causation (i.e. no arbitrary allocation). Operating fixed cost remain the same for the capacity ranges that you will need in this case. Depreciations are assigned to branches (NI and EI) as assignment to sub-branches could not be based on causation. Technology is compatible, i.e. each company can service and modernize any kind of elevator at the same standard cost. Disregard inflation and other changes in prices and factor input prices. LIFT 1lc uses a discount or hurdle rate of 8% that is based on its own WACC calculation. All prices including factor input prices remain stable. There is no inflation. In the "Data File" you will find the consolidated Profit and Loss statement for the LIFT group (consolidated). Please note, that the Data File does not contain formulas for calculating values but only entered values. All monetary amounts are in , thousand or million

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock