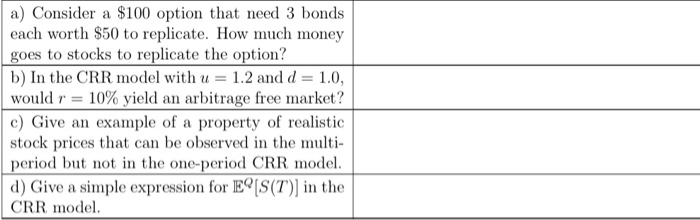

Question: a) Consider a $100 option that need 3 bonds each worth $50 to replicate. How much money goes to stocks to replicate the option? b)

a) Consider a $100 option that need 3 bonds each worth $50 to replicate. How much money goes to stocks to replicate the option? b) In the CRR model with u = 1.2 and d = 1.0, would r = 10% yield an arbitrage free market? c) Give an example of a property of realistic stock prices that can be observed in the multi- period but not in the one period CRR model. d) Give a simple expression for EPS(T)] in the CRR model a) Consider a $100 option that need 3 bonds each worth $50 to replicate. How much money goes to stocks to replicate the option? b) In the CRR model with u = 1.2 and d = 1.0, would r = 10% yield an arbitrage free market? c) Give an example of a property of realistic stock prices that can be observed in the multi- period but not in the one period CRR model. d) Give a simple expression for EPS(T)] in the CRR model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts