Question: a. Consider a call option. If in a two-state model, a stock can take a price of $128 or $96, what would be the hedge

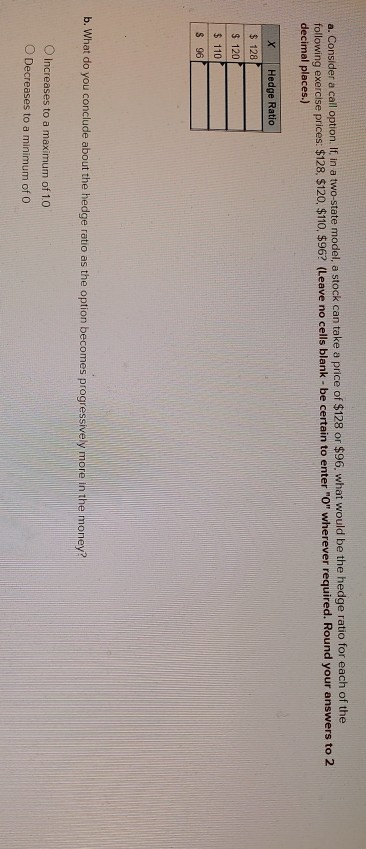

a. Consider a call option. If in a two-state model, a stock can take a price of $128 or $96, what would be the hedge ratio for each of the following exercise prices: $128. $120, $110, $962 (Leave no cells blank - be certain to enter "0" wherever required. Round your answers to 2 decimal places.) Hedge Ratio X $ 128 $ 120 $ 110 $ 96 b. What do you conclude about the hedge ratio as the option becomes progressively more in the money? Increases to a maximum of 10 O Decreases to a minimum of O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts