Question: a) Consider a compound option that is a call on a put. Does this compound option cost less than the put? Explain your answer. 1

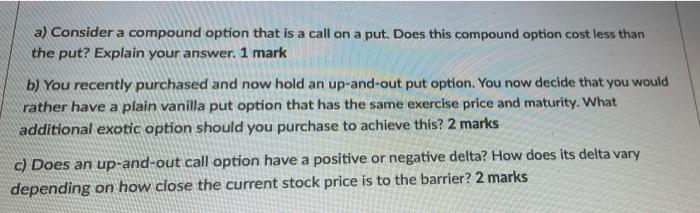

a) Consider a compound option that is a call on a put. Does this compound option cost less than the put? Explain your answer. 1 mark b) You recently purchased and now hold an up-and-out put option. You now decide that you would rather have a plain vanilla put option that has the same exercise price and maturity. What additional exotic option should you purchase to achieve this? 2 marks c) Does an up-and-out call option have a positive or negative delta? How does its delta vary depending on how close the current stock price is to the barrier? 2 marks a) Consider a compound option that is a call on a put. Does this compound option cost less than the put? Explain your answer. 1 mark b) You recently purchased and now hold an up-and-out put option. You now decide that you would rather have a plain vanilla put option that has the same exercise price and maturity. What additional exotic option should you purchase to achieve this? 2 marks c) Does an up-and-out call option have a positive or negative delta? How does its delta vary depending on how close the current stock price is to the barrier? 2 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts