Question: ( a ) Consider a four - month call option on the British pound. Suppose that the current exchange rate is USD / GBP 1

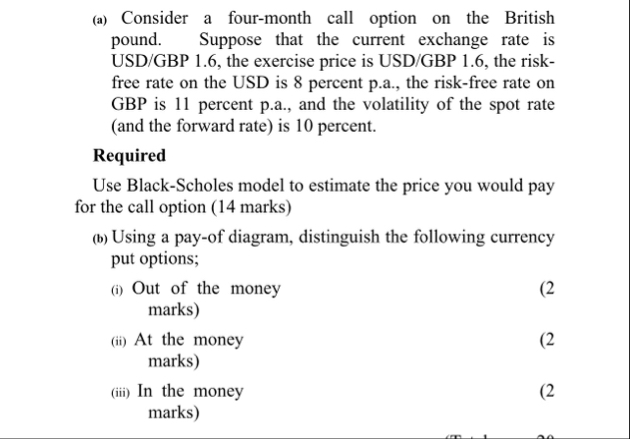

a Consider a fourmonth call option on the British pound. Suppose that the current exchange rate is USDGBP the exercise price is USDGBP the riskfree rate on the USD is percent pa the riskfree rate on GBP is percent pa and the volatility of the spot rate and the forward rate is percent.

Required

Use BlackScholes model to estimate the price you would pay for the call option marks

b Using a payof diagram, distinguish the following currency put options;

i Out of the money marks

ii At the money

marks

iii In the money

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock