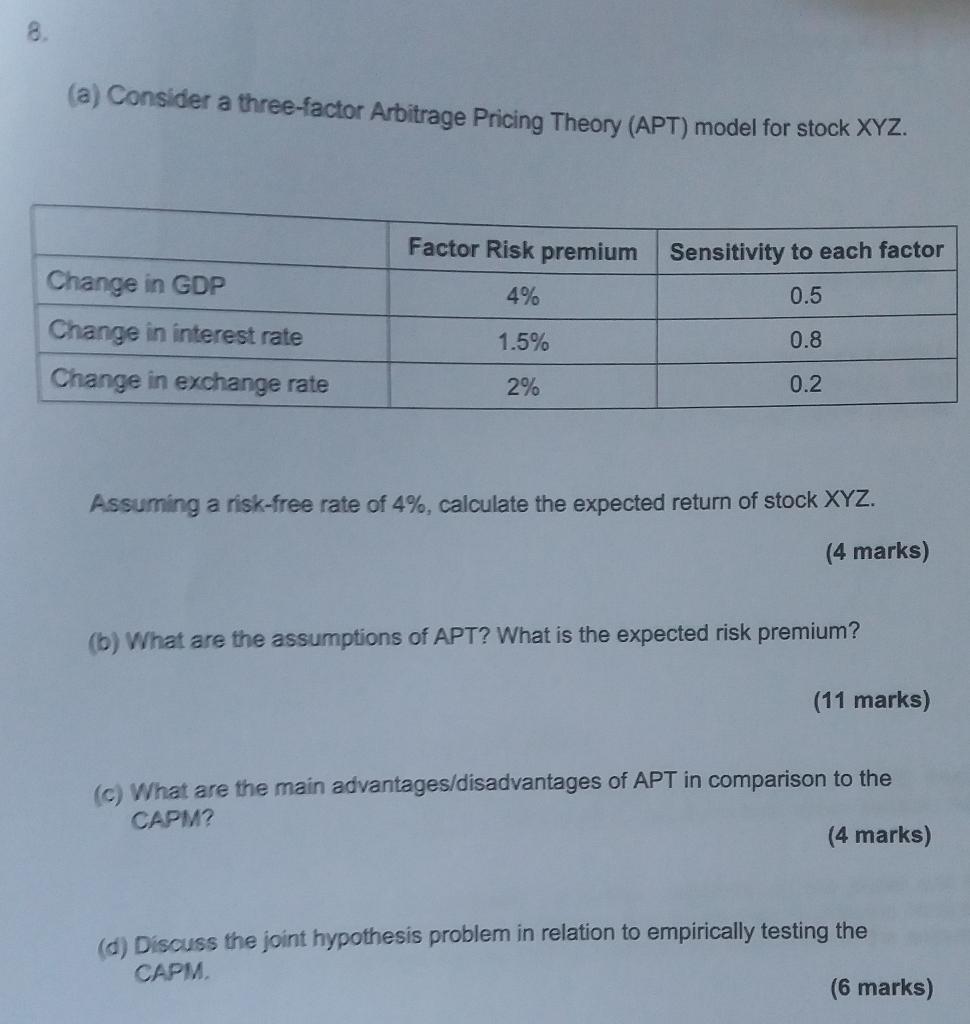

Question: (a) Consider a three-factor Arbitrage Pricing Theory (APT) model for stock XYZ. Factor Risk premium Sensitivity to each factor 4% 0.5 Change in GDP Change

(a) Consider a three-factor Arbitrage Pricing Theory (APT) model for stock XYZ. Factor Risk premium Sensitivity to each factor 4% 0.5 Change in GDP Change in interest rate Change in exchange rate 1.5% 0.8 2% 0.2 Assuming a risk-free rate of 4%, calculate the expected return of stock XYZ. (4 marks) (b) What are the assumptions of APT? What is the expected risk premium? (11 marks) (c) What are the main advantages/disadvantages of APT in comparison to the CAPM? (4 marks) (d) Discuss the joint hypothesis problem in relation to empirically testing the CAPM. (6 marks) (a) Consider a three-factor Arbitrage Pricing Theory (APT) model for stock XYZ. Factor Risk premium Sensitivity to each factor 4% 0.5 Change in GDP Change in interest rate Change in exchange rate 1.5% 0.8 2% 0.2 Assuming a risk-free rate of 4%, calculate the expected return of stock XYZ. (4 marks) (b) What are the assumptions of APT? What is the expected risk premium? (11 marks) (c) What are the main advantages/disadvantages of APT in comparison to the CAPM? (4 marks) (d) Discuss the joint hypothesis problem in relation to empirically testing the CAPM. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts