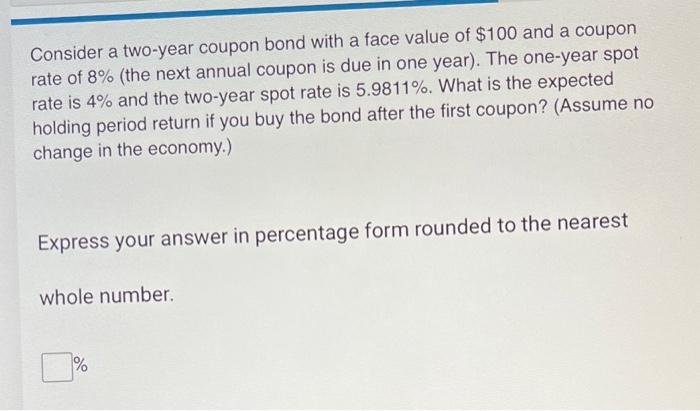

Question: a Consider a two-year coupon bond with a face value of $100 and a coupon rate of 8% (the next annual coupon is due in

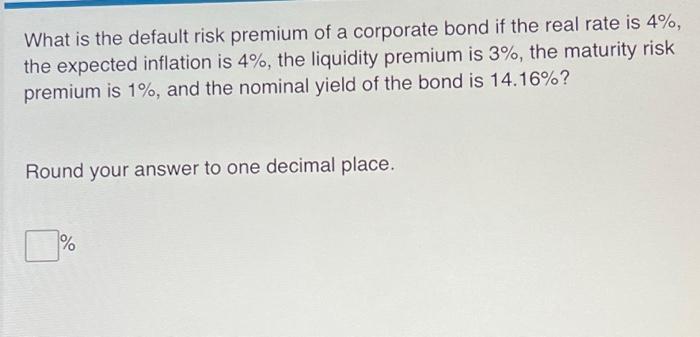

a Consider a two-year coupon bond with a face value of $100 and a coupon rate of 8% (the next annual coupon is due in one year). The one-year spot rate is 4% and the two-year spot rate is 5.9811%. What is the expected holding period return if you buy the bond after the first coupon? (Assume no change in the economy.) Express your answer in percentage form rounded to the nearest whole number % What is the default risk premium of a corporate bond if the real rate is 4%, the expected inflation is 4%, the liquidity premium is 3%, the maturity risk premium is 1%, and the nominal yield of the bond is 14.16%? Round your answer to one decimal place. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts