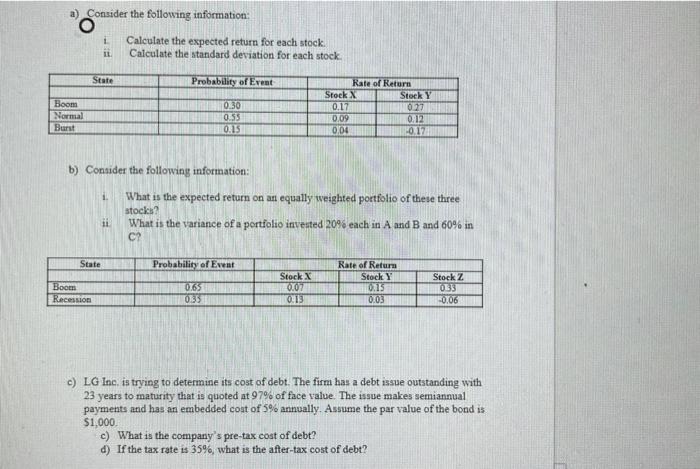

Question: a) Consider the following information: 1 Calculate the expected return for each stock. Calculate the standard deviation for each stock. IL State Probability of Event

a) Consider the following information: 1 Calculate the expected return for each stock. Calculate the standard deviation for each stock. IL State Probability of Event Boom Normal Burst 0.30 0.55 0.15 Rate of Return Stock X Stock Y 0.17 0.27 0.09 0.12 0.04 0.1 b) Consider the following information: 1 What is the expected return on an equally weighted portfolio of these three stocks What is the variance of a portfolio invested 20% each in A and B and 60% in ii C? State Probability of Event Boom Recession 0.65 0.35 Stock X 0.02 0.13 Rate of Retur Stock Y 0215 0.03 Stock Z 033 0.06 c) LG Inc. is trying to determine its cost of debt. The firm has a debt issue outstanding with 23 years to maturity that is quoted at 97% of face value. The issue makes semiannual payments and has an embedded cost of 5% annually. Assume the par value of the bond is $1,000 c) What is the company's pre-tax cost of debt? d) If the tax rate is 35%, what is the after-tax cost of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts