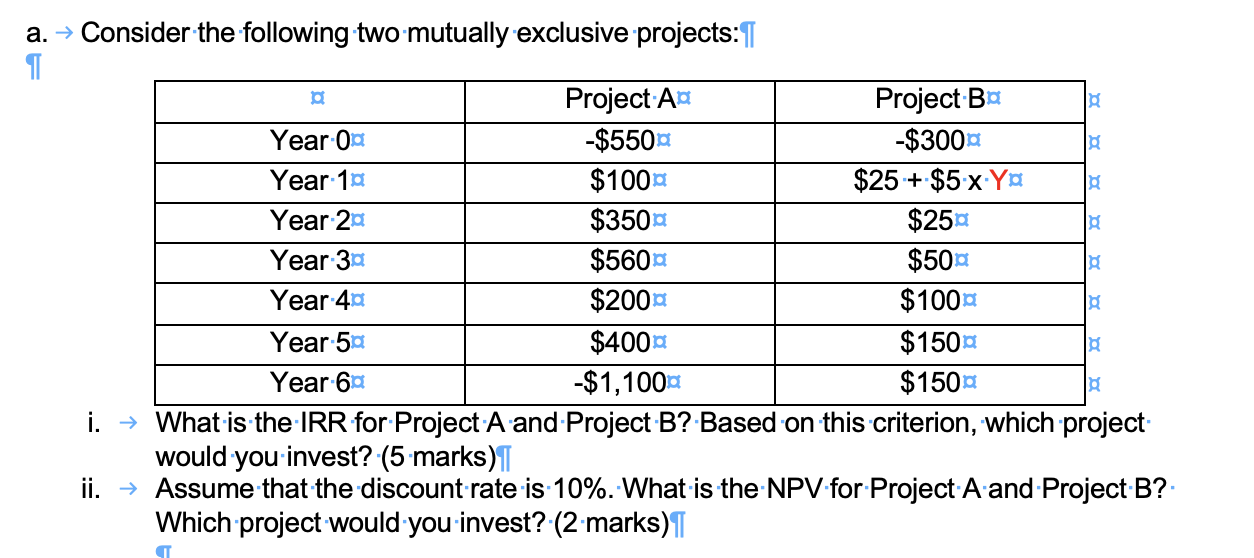

Question: a. Consider the following two mutually exclusive projects: Year 0 Year 1 Year 2 Year 3 Year 4 Project A -$550 $100 Year 5 Year

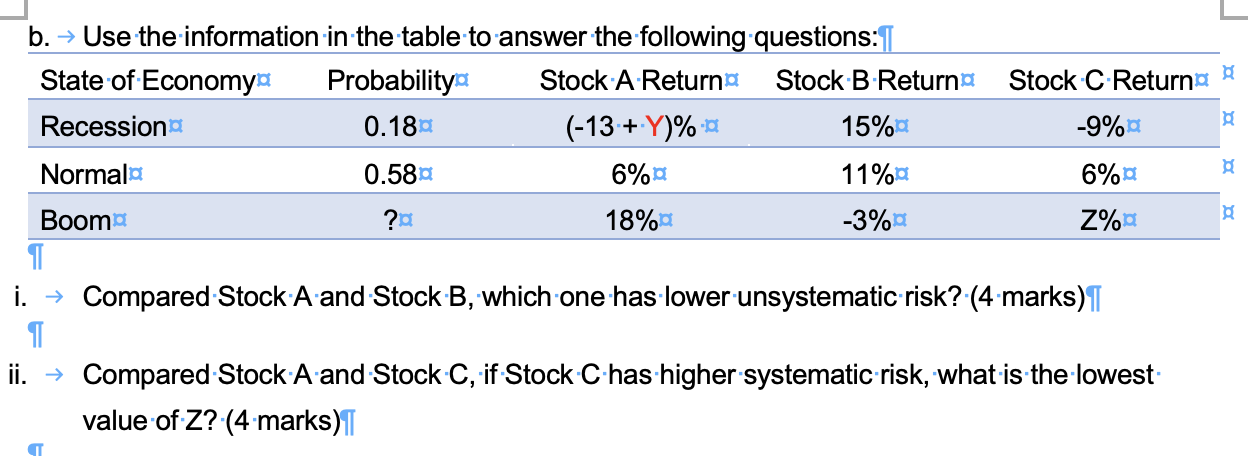

a. Consider the following two mutually exclusive projects: Year 0 Year 1 Year 2 Year 3 Year 4 Project A -$550 $100 Year 5 Year 6 Project B -$300 $25 + $5 x Ya $25 $50 $100 P P P P R $150 P $150 B i. What is the IRR for Project A and Project B? Based on this criterion, which project would you invest? (5 marks) ii. Assume that the discount rate is 10%. What is the NPV for Project A and Project B? Which project would you invest? (2 marks) T $350a $560 $200 $400 -$1,100 B b. Use the information in the table to answer the following questions: State of Economy Probability Stock A Return Stock B Return Recession 0.18 (-13 + Y)% 15% Normala 0.58 6% 11% Boom ?a 18% -3% Stock C Return -9% T 6% Z% i. Compared Stock A and Stock B, which one has lower unsystematic risk? (4 marks) ii. Compared Stock A and Stock C, if Stock C has higher systematic risk, what is the lowest value of Z? (4 marks) X a. Consider the following two mutually exclusive projects: Year 0 Year 1 Year 2 Year 3 Year 4 Project A -$550 $100 Year 5 Year 6 Project B -$300 $25 + $5 x Ya $25 $50 $100 P P P P R $150 P $150 B i. What is the IRR for Project A and Project B? Based on this criterion, which project would you invest? (5 marks) ii. Assume that the discount rate is 10%. What is the NPV for Project A and Project B? Which project would you invest? (2 marks) T $350a $560 $200 $400 -$1,100 B b. Use the information in the table to answer the following questions: State of Economy Probability Stock A Return Stock B Return Recession 0.18 (-13 + Y)% 15% Normala 0.58 6% 11% Boom ?a 18% -3% Stock C Return -9% T 6% Z% i. Compared Stock A and Stock B, which one has lower unsystematic risk? (4 marks) ii. Compared Stock A and Stock C, if Stock C has higher systematic risk, what is the lowest value of Z? (4 marks) X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts