Question: a. construct the loss matrix for david byrne'. Make sure you show loss in the top row and out-of-pocket cost in the bottom row in

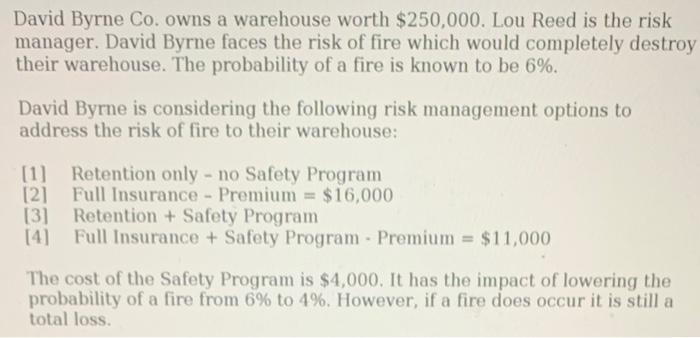

David Byrne Co. owns a warehouse worth $250,000. Lou Reed is the risk manager. David Byrne faces the risk of fire which would completely destroy their warehouse. The probability of a fire is known to be 6%. David Byrne is considering the following risk management options to address the risk of fire to their warehouse: [1] Retention only - no Safety Program [2] Full Insurance Premium = $16,000 [3] Retention + Safety Program [4] Full Insurance + Safety Program Premium = $11,000 The cost of the Safety Program is $4,000. It has the impact of lowering the probability of a fire from 6% to 4%. However, if a fire does occur it is still a total loss. David Byrne Co. owns a warehouse worth $250,000. Lou Reed is the risk manager. David Byrne faces the risk of fire which would completely destroy their warehouse. The probability of a fire is known to be 6%. David Byrne is considering the following risk management options to address the risk of fire to their warehouse: [1] Retention only - no Safety Program [2] Full Insurance Premium = $16,000 [3] Retention + Safety Program [4] Full Insurance + Safety Program Premium = $11,000 The cost of the Safety Program is $4,000. It has the impact of lowering the probability of a fire from 6% to 4%. However, if a fire does occur it is still a total loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts