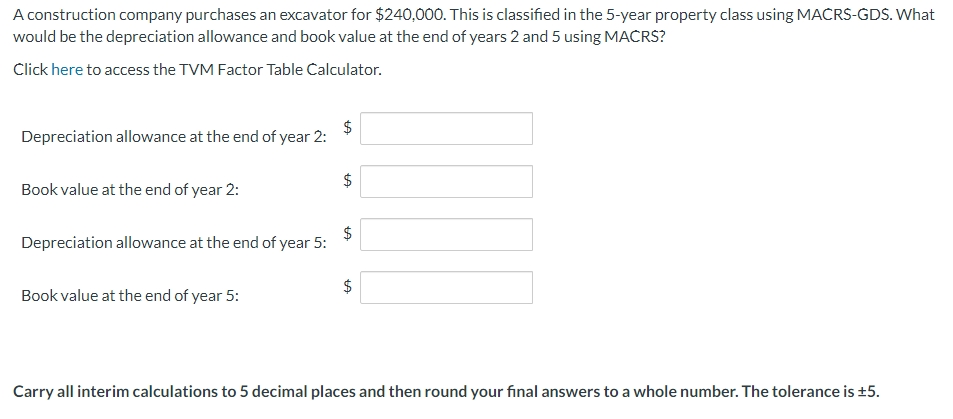

Question: A construction company purchases an excavator for ( $ 2 4 0 , 0 0 0 ) . This is classified in

A construction company purchases an excavator for $ This is classified in the year property class using MACRSGDS What would be the depreciation allowance and book value at the end of years and using MACRS?

Click here to access the TVM Factor Table Calculator.

Depreciation allowance at the end of year : $ $

Book value at the end of year :

$

Depreciation allowance at the end of year :

$

Book value at the end of year :

$

Carry all interim calculations to decimal places and then round your final answers to a whole number. The tolerance is pm

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock