Question: A construction firm needs a new small loader. It can be purchased for $20,000. The firm expects the loader to have a salvage value of

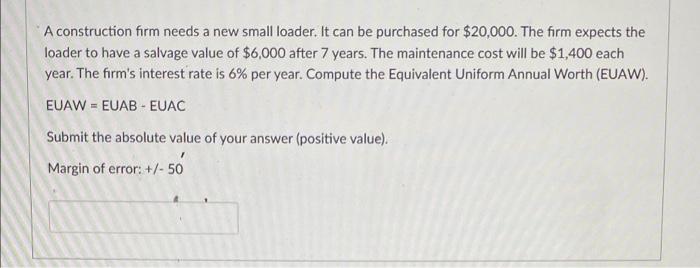

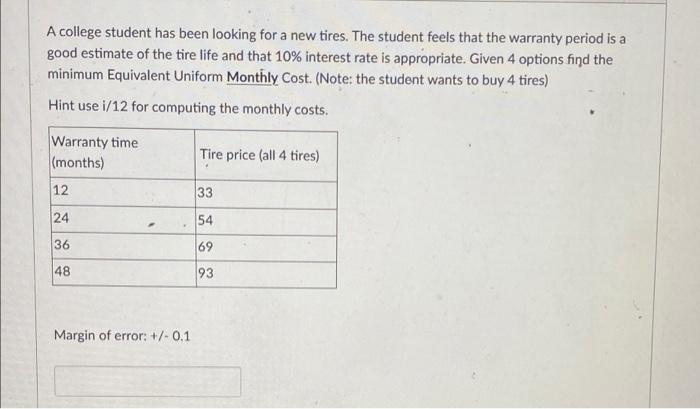

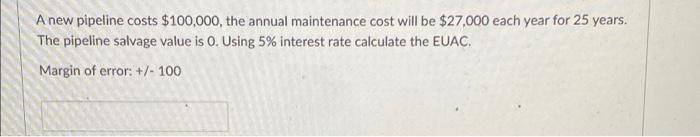

A construction firm needs a new small loader. It can be purchased for $20,000. The firm expects the loader to have a salvage value of $6,000 after 7 years. The maintenance cost will be $1,400 each year. The firm's interest rate is 6% per year. Compute the Equivalent Uniform Annual Worth (EUAW). EUAW = EUAB - EUAC Submit the absolute value of your answer (positive value). Margin of error: +/- 50 1 A college student has been looking for a new tires. The student feels that the warranty period is a good estimate of the tire life and that 10% interest rate is appropriate. Given 4 options find the minimum Equivalent Uniform Monthly Cost. (Note: the student wants to buy 4 tires) Hint use i/12 for computing the monthly costs. Warranty time (months) Tire price (all 4 tires) 12 33 24 54 36 69 48 93 Margin of error: +/-0.1 A new pipeline costs $100,000, the annual maintenance cost will be $27,000 each year for 25 years. The pipeline salvage value is 0. Using 5% interest rate calculate the EUAC. Margin of error: +/- 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts