Question: A consumer electronics retailer can place orders for flat panel TVs at the beginning of each day. All orders are delivered immediately. Every time an

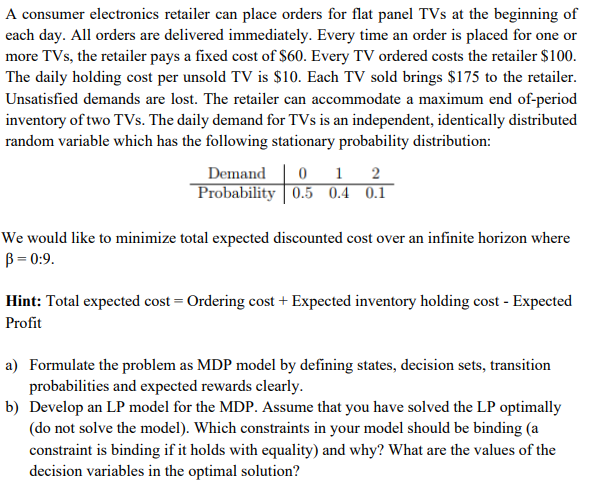

A consumer electronics retailer can place orders for flat panel TVs at the beginning of each day. All orders are delivered immediately. Every time an order is placed for one or more TVs, the retailer pays a fixed cost of $60. Every TV ordered costs the retailer $100. The daily holding cost per unsold TV is $10. Each TV sold brings $175 to the retailer. Unsatisfied demands are lost. The retailer can accommodate a maximum end of-period inventory of two TVs. The daily demand for TVs is an independent, identically distributed random variable which has the following stationary probability distribution: We would like to minimize total expected discounted cost over an infinite horizon where = 0:9. Hint: Total expected cost = Ordering cost + Expected inventory holding cost - Expected Profit a) Formulate the problem as MDP model by defining states, decision sets, transition probabilities and expected rewards clearly. b) Develop an LP model for the MDP. Assume that you have solved the LP optimally (do not solve the model). Which constraints in your model should be binding (a constraint is binding if it holds with equality) and why? What are the values of the decision variables in the optimal solution?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts