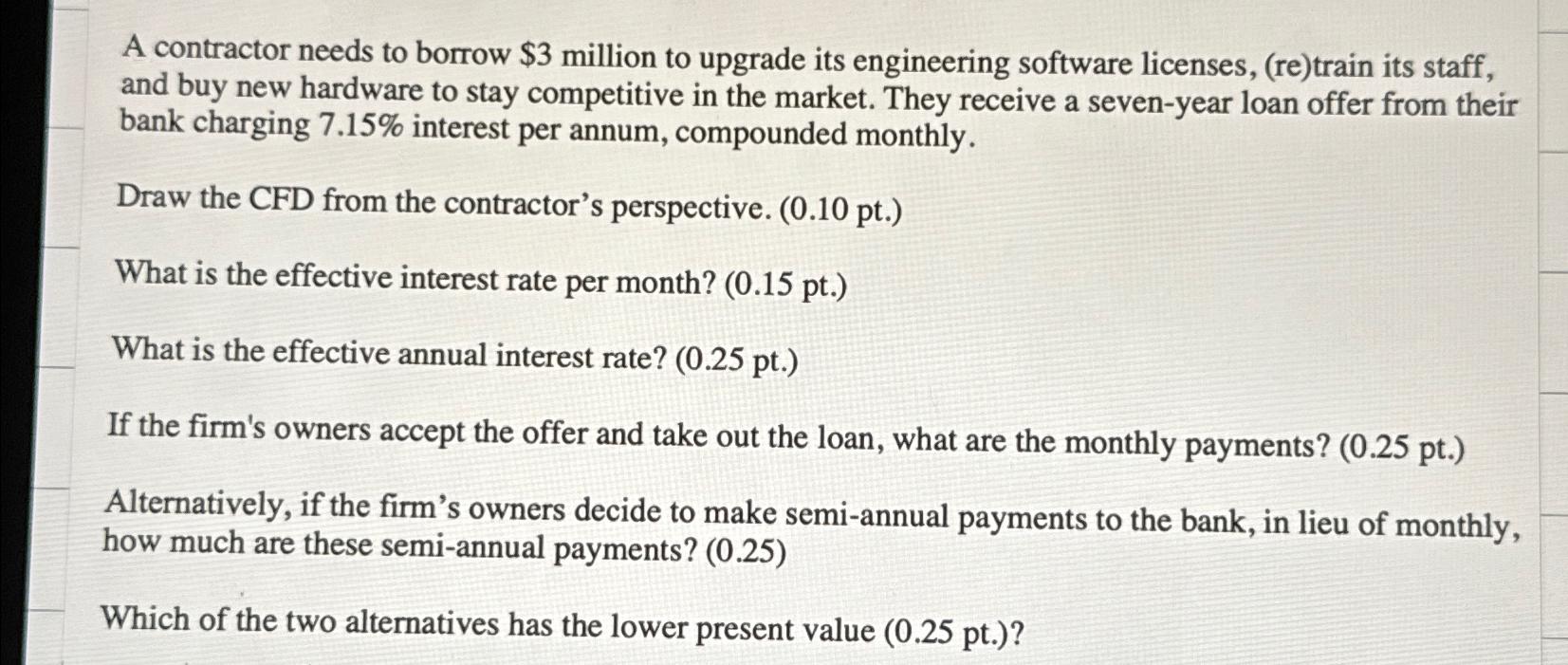

Question: A contractor needs to borrow $ 3 million to upgrade its engineering software licenses, ( re ) train its staff, and buy new hardware to

A contractor needs to borrow $ million to upgrade its engineering software licenses, retrain its staff, and buy new hardware to stay competitive in the market. They receive a sevenyear loan offer from their bank charging interest per annum, compounded monthly.

Draw the CFD from the contractor's perspective.

What is the effective interest rate per month? pt

What is the effective annual interest rate?

If the firm's owners accept the offer and take out the loan, what are the monthly payments?

Alternatively, if the firm's owners decide to make semiannual payments to the bank, in lieu of monthly, how much are these semiannual payments?

Which of the two alternatives has the lower present value

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock