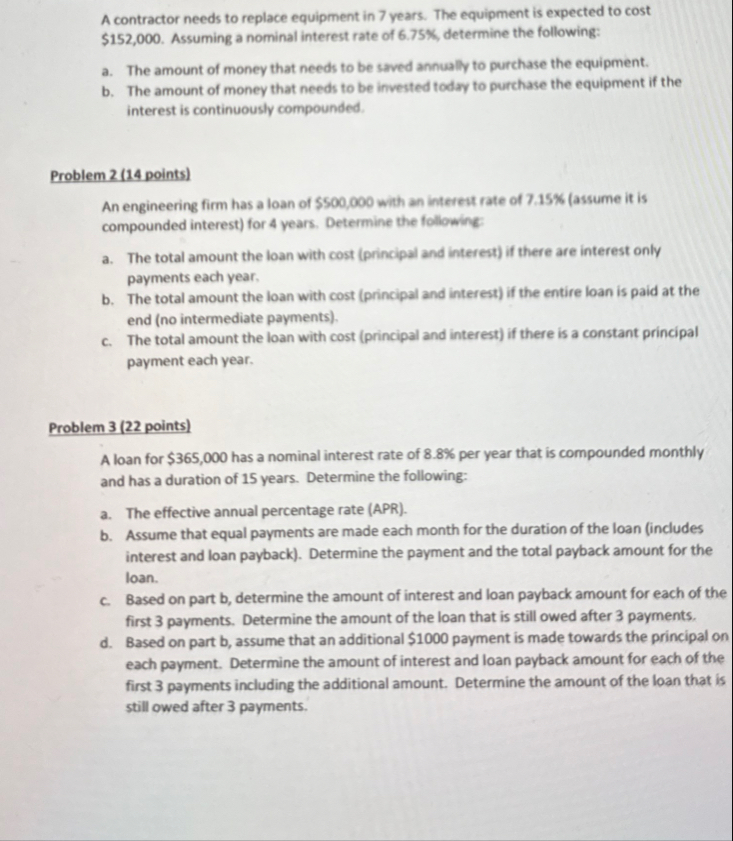

Question: A contractor needs to replace equipment in 7 years. The equipment is expected to cost $ 1 5 2 , 0 0 0 . Assuming

A contractor needs to replace equipment in years. The equipment is expected to cost $ Assuming a nominal interest rate of determine the folfowing:

a The amount of money that needs to be saved annually to purchase the equipment.

b The amount of money that needs to be invested today to purchase the equipment if the interest is continuously compounded.

Problem points

An engineering firm has a loan of $ with an interest rate of assume it is compounded interest for years. Determine the following:

a The total amount the loan with cost principal and interest if there are interest only payments each year.

b The total amount the loan with cost principal and interest if the entire loan is paid at the end no intermediate payments

c The total amount the loan with cost principal and interest if there is a constant principal payment each year.

Problem points

A loan for $ has a nominal interest rate of per year that is compounded monthly and has a duration of years. Determine the following:

a The effective annual percentage rate APR

b Assume that equal payments are made each month for the duration of the loan includes interest and loan payback Determine the payment and the total payback amount for the loan.

c Based on part b determine the amount of interest and loan payback amount for each of the first payments. Determine the amount of the loan that is still owed after payments.

d Based on part b assume that an additional $ payment is made towards the principal on each payment. Determine the amount of interest and loan payback amount for each of the first payments including the additional amount. Determine the amount of the loan that is still owed after payments.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock