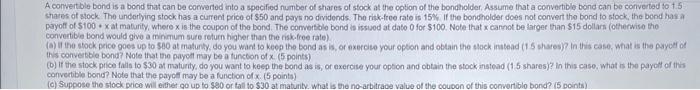

Question: A convert ble bond is a bond that can be converted into a specified number of shares of stock at the option of the bondholder,

A convert ble bond is a bond that can be converted into a specified number of shares of stock at the option of the bondholder, Assume that a convertible bond can be converted to t.5 stares of stock. The underlying stock has a current prico of $50 and prys no dividends. The risk-free rato is 15%. If the bonoholder does not convert the bond to stock, the bend has a payoff of 5100+x at maturity, where x is the coupon of the bond. The convertolo bond is issuod at dato 0 for $100. Note that x cannot be larger than 515 dollars (otherwise the converibla bond would give a minimum sure return higher than the risk.free rale) (a) It the sock price goes up to $100 at matunty, do you want to keee the bond as is, or exercise your opton and obtain the stock inatead (1 5 shares)? In this case, what is the payoer of this converbble bona? Note that the payott may be a functon of x. ( 5 points) (b) If the stock pice falis to $90 at maturity, do you want to keep the bond as is, or exeroise your opton and obtain the stock instead (1.5 shares)? in this case, what is the payol of this convertible bonde? Note that the payct may be a function of x. ( 5 pointa) (c) Suppose the stock price will either go up to seo or tall to $30 at maturity. What is the no-arbitrabe value of the couoon of this converiblo bond? ( 5 boints) A convert ble bond is a bond that can be converted into a specified number of shares of stock at the option of the bondholder, Assume that a convertible bond can be converted to t.5 stares of stock. The underlying stock has a current prico of $50 and prys no dividends. The risk-free rato is 15%. If the bonoholder does not convert the bond to stock, the bend has a payoff of 5100+x at maturity, where x is the coupon of the bond. The convertolo bond is issuod at dato 0 for $100. Note that x cannot be larger than 515 dollars (otherwise the converibla bond would give a minimum sure return higher than the risk.free rale) (a) It the sock price goes up to $100 at matunty, do you want to keee the bond as is, or exercise your opton and obtain the stock inatead (1 5 shares)? In this case, what is the payoer of this converbble bona? Note that the payott may be a functon of x. ( 5 points) (b) If the stock pice falis to $90 at maturity, do you want to keep the bond as is, or exeroise your opton and obtain the stock instead (1.5 shares)? in this case, what is the payol of this convertible bonde? Note that the payct may be a function of x. ( 5 pointa) (c) Suppose the stock price will either go up to seo or tall to $30 at maturity. What is the no-arbitrabe value of the couoon of this converiblo bond? ( 5 boints)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts