Question: A convertible bond can be converted into a fixed number of shares of the company's common stock at the convenience of the bondholder. Assume

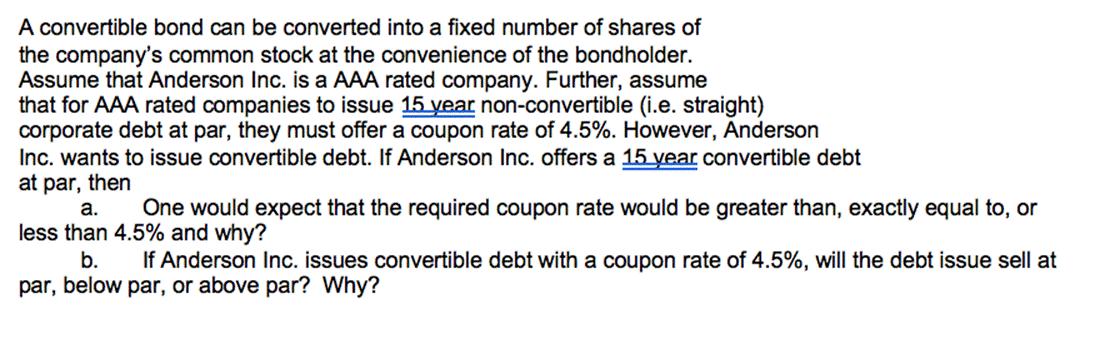

A convertible bond can be converted into a fixed number of shares of the company's common stock at the convenience of the bondholder. Assume that Anderson Inc. is a AAA rated company. Further, assume that for AAA rated companies to issue 15 year non-convertible (i.e. straight) corporate debt at par, they must offer a coupon rate of 4.5%. However, Anderson Inc. wants to issue convertible debt. If Anderson Inc. offers a 15 year convertible debt at par, then a. One would expect that the required coupon rate would be greater than, exactly equal to, or less than 4.5% and why? b. If Anderson Inc. issues convertible debt with a coupon rate of 4.5%, will the debt issue sell at par, below par, or above par? Why?

Step by Step Solution

There are 3 Steps involved in it

Convertible Bond Analysis for Anderson Inc a Required Coupon Rate One would expect the required coupon rate for Anderson Incs convertible debt to be l... View full answer

Get step-by-step solutions from verified subject matter experts