Question: A corporate borrower would like to apply for a 5-year $5 million loan to finance its new project from Monash Bank. Monash bank would

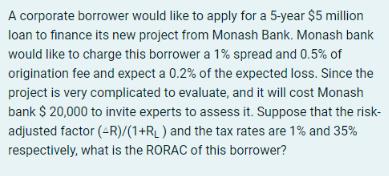

A corporate borrower would like to apply for a 5-year $5 million loan to finance its new project from Monash Bank. Monash bank would like to charge this borrower a 1% spread and 0.5% of origination fee and expect a 0.2% of the expected loss. Since the project is very complicated to evaluate, and it will cost Monash bank $ 20,000 to invite experts to assess it. Suppose that the risk- adjusted factor (4R)/(1+RL) and the tax rates are 1% and 35% respectively, what is the RORAC of this borrower?

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

To calculate the RiskAdjusted Return on Capital RORAC for the borrower we need to consider the sprea... View full answer

Get step-by-step solutions from verified subject matter experts