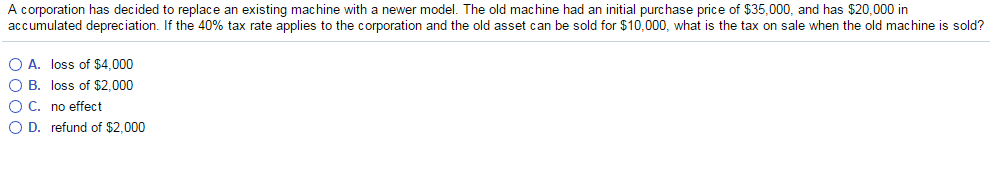

Question: A corporation has decided to replace an existing machine with a newer model. The old machine had an initial purchase price of exist35,000, and has

A corporation has decided to replace an existing machine with a newer model. The old machine had an initial purchase price of exist35,000, and has exist20,000 in accumulated depreciation. If the 40% tax rate applies to the corporation and the old asset can be sold for exist10,000, what is the tax on sale when the old machine is sold? A. loss of exist4,000 B. loss of exist2,000 C. no effect D. refund of exist2,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts