Question: A corporation is faced with a choice between two machines, Beta and Zeta, both of which are designed to improve operations by saving on labour

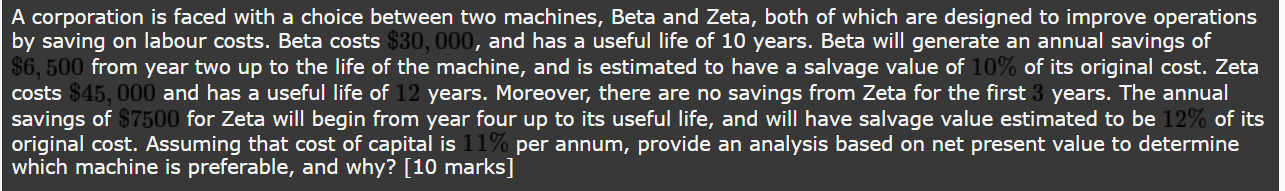

A corporation is faced with a choice between two machines, Beta and Zeta, both of which are designed to improve operations by saving on labour costs. Beta costs $30, 000, and has a useful life of 10 years. Beta will generate an annual savings of $6,500 from year two up to the life of the machine, and is estimated to have a salvage value of 10% of its original cost. Zeta costs $45, 000 and has a useful life of 12 years. Moreover, there are no savings from Zeta for the first 3 years. The annual savings of $7500 for Zeta will begin from year four up to its useful life, and will have salvage value estimated to be 12% of its original cost. Assuming that cost of capital is 11% per annum, provide an analysis based on net present value to determine which machine is preferable, and why? (10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts