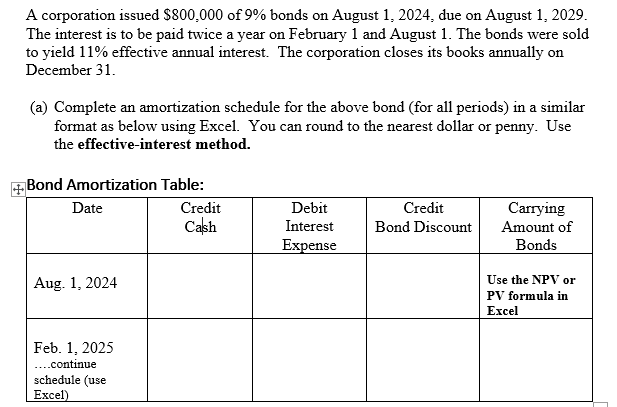

Question: A corporation issued $ 8 0 0 , 0 0 0 of 9 % bonds on August 1 , 2 0 2 4 , due

A corporation issued $ of bonds on August due on August

The interest is to be paid twice a year on February and August The bonds were sold

to yield effective annual interest. The corporation closes its books annually on

December

a Complete an amortization schedule for the above bond for all periods in a similar

format as below using Excel. You can round to the nearest dollar or penny. Use

the effectiveinterest method.

Bond Amortization Table:

YOU MUST SHOW THE WORK IN EXCEL AND HOW TO USE THE FORMULAS c Compute the interest expense to be reported in the income statement for the year ended December and December

d Complete an amortization schedule for the above bond for all periods using the straightline amortization method entries are not required

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock