Question: A corporation issues a 20 year bond with the final redemption value equal to the face value of $1000, and semiannual coupons of 12%. However,

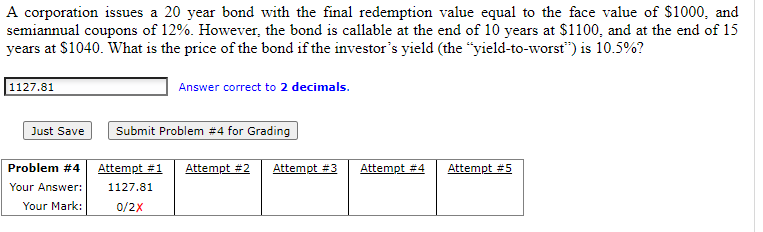

A corporation issues a 20 year bond with the final redemption value equal to the face value of $1000, and semiannual coupons of 12%. However, the bond is callable at the end of 10 years at $1100, and at the end of 15 years at $1040. What is the price of the bond if the investor's yield (the yield-to-worst) is 10.5%? 1127.81 Answer correct to 2 decimals. Just Save Submit Problem #4 for Grading Attempt #2 Attempt #3 Attempt #4 Attempt #5 Problem #4 Your Answer: Your Mark: Attempt #1 1127.81 0/2X

Step by Step Solution

There are 3 Steps involved in it

To find the price of the bond based on the yieldtoworst we need to calculate the price for each call... View full answer

Get step-by-step solutions from verified subject matter experts