Question: a) correct answer b) please do this one You are forecasting the returns for Sage Company, a plumbing supply company, which pays a current dividend

a) correct answer

b) please do this one

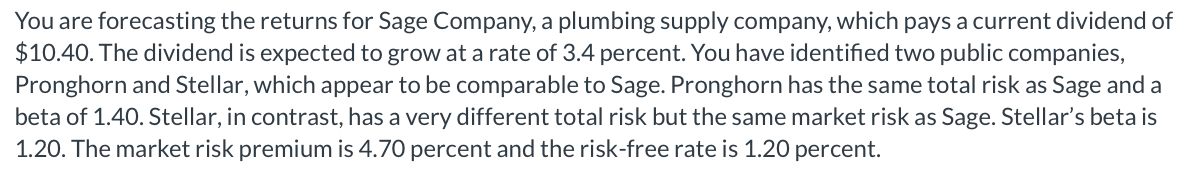

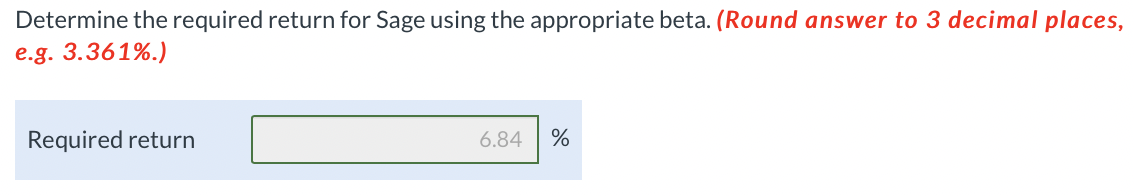

You are forecasting the returns for Sage Company, a plumbing supply company, which pays a current dividend of $10.40. The dividend is expected to grow at a rate of 3.4 percent. You have identified two public companies, Pronghorn and Stellar, which appear to be comparable to Sage. Pronghorn has the same total risk as Sage and a beta of 1.40. Stellar, in contrast, has a very different total risk but the same market risk as Sage. Stellar's beta is 1.20. The market risk premium is 4.70 percent and the risk-free rate is 1.20 percent. Determine the required return for Sage using the appropriate beta. (Round answer to 3 decimal places, e.g. 3.361%.) Determine the price of Sage. (Round answer to 2 decimal places, e.g. 125.61.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts