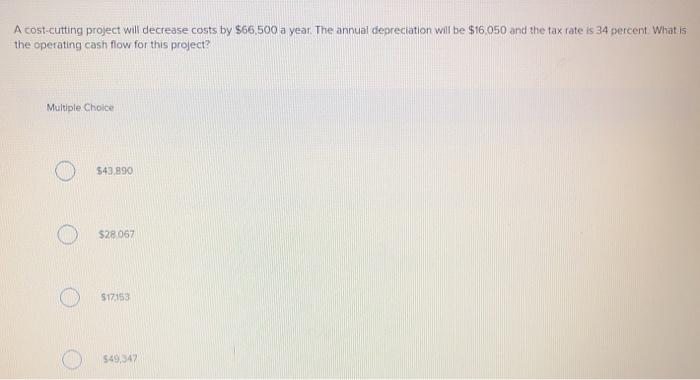

Question: A cost-cutting project will decrease costs by $66,500 a year. The annual depreciation will be $16050 and the tax rate is 34 percent What is

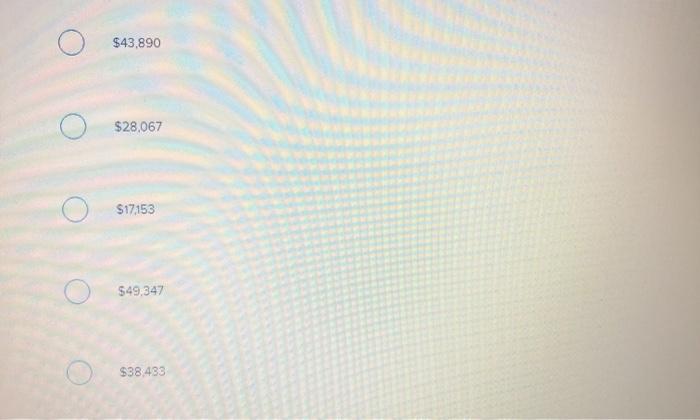

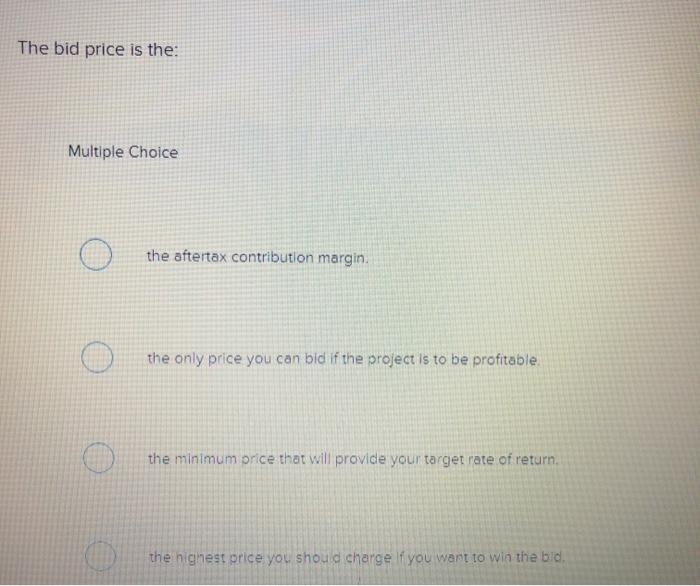

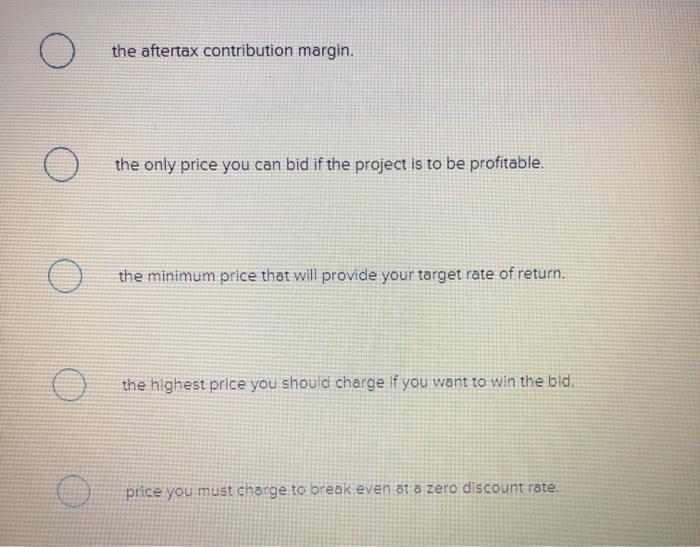

A cost-cutting project will decrease costs by $66,500 a year. The annual depreciation will be $16050 and the tax rate is 34 percent What is the operating cash flow for this project? Multiple Choice $43.890 $28062 $17.153 $49,347 $43,890 $28,067 $17,153 $49,347 $38,433 The bid price is the: Multiple Choice O the aftertax contribution margin. the only price you can bid if the project is to be profitable the minimum price that will provide your target rate of return the highest price you should charge you want to win the bid, O the aftertax contribution margin. the only price you can bid if the project is to be profitable. the minimum price that will provide your target rate of return. the highest price you should charge If you want to win the bid. price you must change to break even at a zero discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts