Question: a) Create an introduction for this analysis b) Describe and compare the competitive positions of the different players in the luxury good business. Who are

a) Create an introduction for this analysis

b) Describe and compare the competitive positions of the different players in the luxury good business. Who are the best positioned players? Why?

c) Do you agree with DeSole's latest (in the case) strategic move to buy Yves Saint Laurent (YSL) and Sergio Rossi?

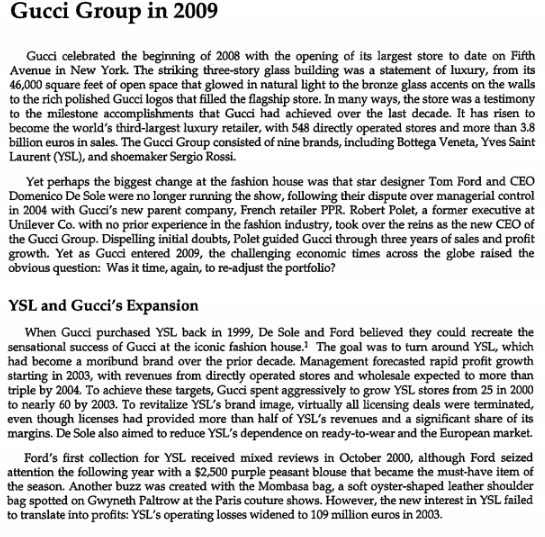

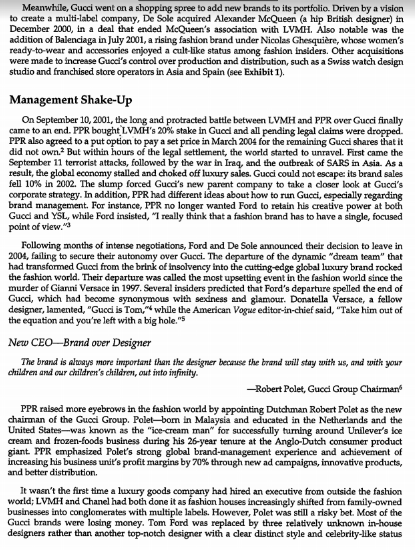

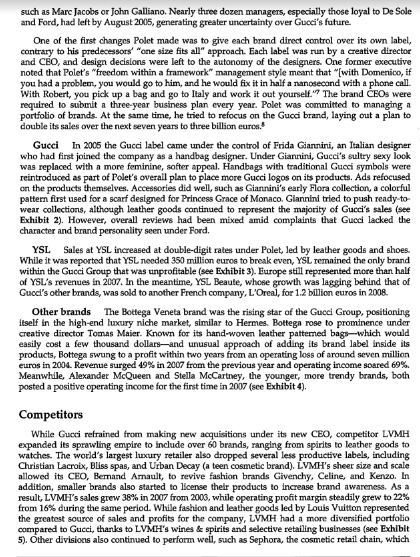

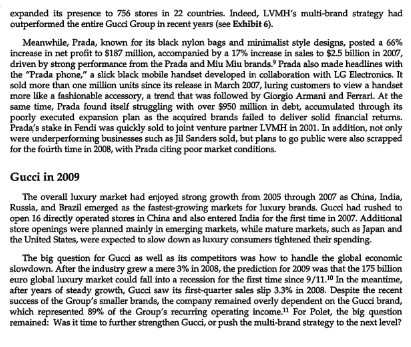

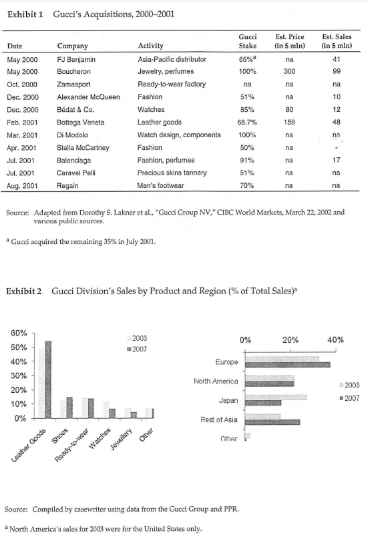

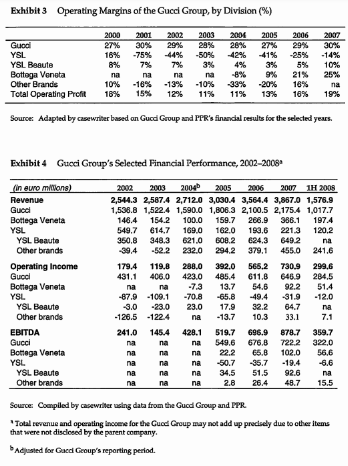

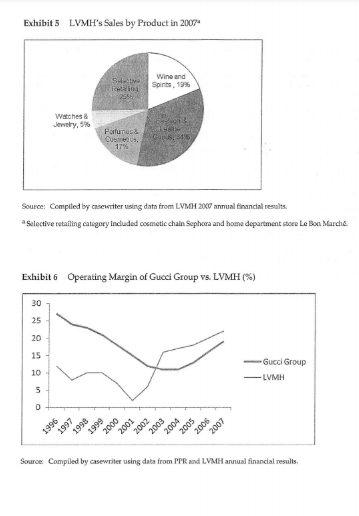

Gucci Group in 2009 Gucci celebrated the beginning of 2008 with the opening of its largest store to date on Fifth Avenue in New York. The striking three-story glass building was a statement of luxury, from its 46,000 square feet of open space that glowed in natural light to the bronze glass accents on the walls to the rich polished Gucci logos that filled the flagship store. In many ways, the store was a testimony to the milestone accomplishments that Gucci had achieved over the last decade. It has risen to become the world's third-largest luxury retailer, with 548 directly operated stores and more than 3.8 billion euros in sales. The Gucci Group consisted of nine brands, including Bottega Veneta, Yves Saint Laurent (YSL), and shoemaker Sergio Rossi. Yet perhaps the biggest change at the fashion house was that star designer Tom Ford and CEO Domenico De Sole were no longer running the show, following their dispute over managerial control in 2004 with Gucci's new parent company, French retailer PPR. Robert Polet, a former executive at Unilever Co. with no prior experience in the fashion industry, took over the reins as the new CEO of the Gucci Group. Dispelling initial doubts, Polet guided Gucci through three years of sales and profit growth. Yet as Gucci entered 2009, the challenging economic times across the globe raised the obvious question: Was it time, again, to re-adjust the portfolio? YSL and Gucci's Expansion When Gucci purchased YSL back in 1999, De Sole and Ford believed they could recreate the sensational success of Gucci at the iconic fashion house. The goal was to turn around YSL, which had become a moribund brand over the prior decade. Management forecasted rapid profit growth starting in 2003, with revenues from directly operated stores and wholesale expected to more than triple by 2004. To achieve these targets, Gucci spent aggressively to grow YSL stores from 25 in 2000 to nearly 60 by 2003. To revitalize YSL's brand image, virtually all licensing deals were terminated, even though licenses had provided more than half of YSL's revenues and a significant share of its margins. De Sole also aimed to reduce YSL's dependence on ready-to-wear and the European market Ford's first collection for YSL received mixed reviews in October 2000, although Ford seized attention the following year with a $2,500 purple peasant blouse that became the must-have item of the season. Another buzz was created with the Mombasa bag, a soft oyster-shaped leather shoulder bag spotted on Gwyneth Paltrow at the Paris couture shows. However, the new interest in YSL failed to translate into profits: YSL's operating losses widened to 109 million euros in 2003. Meanwhile, Gucci went on a shopping spree to add new brands to its portfolio Driven by a vision to create a multi-label company, De Sole acquired Alexander McQueen (a hip British designer) in December 2000, in a deal that ended McQueen's association with LVMH. Also notable was the addition of Balenciaga in July 2001, arising fashion brand under Nicolas Ghesquire, whose women's ready to wear and accessories enjoyed a cult-like status among fashion insiders. Other acquisitions were made to increase Gucci's control over production and distribution, such as a Swiss watch design studio and franchised store operators in Asia and Spain (see Exhibit 1). Management Shake-Up On September 10, 2001, the long and protracted battle between LVMH and PPR over Gud finally came to an end. PPR bought LVMH's 20% stake in Gucci and all pending legal claims were dropped. PPR also agreed to a put option to pay a set price in March 2004 for the remaining Gucci shares that it did not own. But within hours of the legal settlement, the world started to unravel. First came the September 11 terrorist attacks, followed by the war in Iraq, and the outbreak of SARS in Asin. As a result, the global economy stalled and choked off luxury sales. Gucci could not escape: its brand sales fell 10% in 2002. The slump forced Gucci's new parent company to take a closer look at Gucci's corporate strategy. In addition, PPR had different ideas about how to run Gucci, especially regarding brand management. For instance, PPR no longer wanted Ford to retain his creative power at both Gucci and YSL, while Ford insisted, "I really think that a fashion brand has to have a single, focused point of view.3 Following months of intense negotiations, Ford and De Sole announced their decision to leave in 2001, failing to secure their autonomy over Gucci. The departure of the dynamic dream team that had transformed Gued from the brink of Insolvency into the cutting-edge global luxury brand rocked the fashion world. Their departure was called the most upsetting event in the fashion world since the murder of Gianni Versace in 1997. Several insiders predicted that Ford's departure spelled the end of Gucci, which had become synonymous with sexiness and glamour. Donatella Versace, a fellow designer, lamented, "Gucci is Tom," while the American Vogue editor-in-chief said, "Take him out of the equation and you're left with a big hole." New CEO-Brand over Designer The brand is always more important than the designer becomes the brand will stay with us, and with your children and our children's children, out into infinity -Robert Polet, Guod Group Chairman PPR raised more eyebrows in the fashion world by appointing Dutchman Robert Polet as the new chairman of the Gucci Group. Polebom in Malaysia and educated in the Netherlands and the United States-was known as the ice-cream man" for successfully turning around Unilever's loe cream and frozen-foods business during his 26-year tenure at the Anglo-Dutch consumer product giant. PPR emphasized Polet's strong global brand-management experience and achievement of increasing his business unit's profit margins by 70% through new ad campaigns, innovative products, and better distribution It wasn't the first time a luxury goods company had hired an executive from outside the fashion world: LVMH and Chanel had both done it as fashion houses increasingly shifted from family-owned businesses into conglomerates with multiple labels. However, Polet was still a risky bet. Most of the Gucci brands were losing money. Tom Ford was replaced by three relatively unknown in-house designers rather than another top-notch designer with a dear distinct style and celebrity-like status such as Marc Jacobs or John Galliano. Nearly three dozen managers, especially those loyal to De Sole and Ford, had left by August 2005, generating greater uncertainty over Gucci's future One of the first changes Polet made was to give each brand direct control over its own label, contrary to his predecessos "one size fits all' approach. Each label was run by a creative director and CEO, and design decisions were left to the autonomy of the designers. One former executive noted that Polet's "freedom within a framework management style meant that "(with Domenico, if you had a problem, you would go to him, and he would fix it in half a nanosecond with a phone call With Robert, you pick up a bag and go to Italy and work it out yourself. The brand CEOs were required to submit a three year business plan every year. Polet was committed to managing portfolio of brands. At the same time, he tried to refocus on the Gucci brand, laying out a plan to double its sales over the next seven years to three billion euros. Gucci In 2005 the Gucci label came under the control of Frida Giannini, an Italian designer who had first joined the company as a handbag designer. Under Giannini, Gucci's sultry sexy look was replaced with a more feminine, softer appeal. Handbags with traditional Gued symbols were reintroduced as part of Polet's overall plan to place more Gucci logos on its products. Ads refocused on the products themselves. Accessories did well, such as Giannini's early Flora collection, a colorful pattern first used for a scarf designed for Princess Grace of Monaco Giannini tried to push ready to wear collections, although leather goods continued to represent the majority of Gucci's sales (see Exhibit 2). However, overall reviews had been mixed amid complaints that Gued lacked the character and brand personality seen under Ford. YSL Sales at YSL increased at double-digit rates under Polet, led by leather goods and shoes While it was reported that YSL needed 350 million euros to break even, YSL remained the only brand within the Gucci Group that was unprofitable (see Exhibit 3). Europe still represented more than half of YSL's revenues in 2007. In the meantime, YSL Beaute, whose growth was lagging behind that of Gucel's other brands, was sold to another French company, L'Oreal, for 1.2 billion euros in 2008. Other brands The Bottega Veneta brand was the rising star of the Guce Group, positioning Itself in the high-end luxury niche market, similar to Hermes. Bottega rose to prominence under creative director Tomas Maier. Known for its hand-woven leather patterned bags which would easily cost a few thousand dollar and unusual approach of adding its brand label inside its products, Bottega swung to a profit within two years from an operating loss of around seven million curos in 2004. Revenue surged 49% in 2007 from the previous year and operating income soared 69% Meanwhile, Alexander McQueen and Stella McCartney, the younger, more trendy brands, both posted a positive operating income for the first time in 2007 (see Exhibit 4). Competitors While Gucci retrained from making new acquisitions under its new CEO, competitor LVMH expanded its sprawling empire to include over 60 brands, ranging from spirits to leather goods to watches. The world's largest luxury retailer also dropped several less productive labels, including Christian Lacroix, Bliss spas, and Urban Decay (a teen cosmetic brand). LVMH's sheer size and scale allowed its CEO, Bemand Amault, to revive fashion brands Givenchy, Celine, and Kenzo. In addition, smaller brands also started to license their products to increase brand awareness. As a result, LVMH's sales grew 38% in 2007 from 2005, while operating profit marginsteadily grew to 22% from 16% during the same period. While fashion and leather goods led by Louis Vuitton represented the greatest source of sales and profits for the company, LVMH had a more diversified portfolio compared to Gucci, thanks to LVMH's wines & spirits and selective retailing businesses (see Exhibit 5. Other divisions also continued to perform well, such as Sephora, the cosmetic retail chain, which expanded its presence to 756 stores in 22 countries. Indeed, LVMH's multi-brand strategy had outperformed the entire Gued Group in recent years (see Exhibit 6). Meanwhile, Prada, known for its black nylon bags and minimalist style designs, posted a 66% increase in net profit to $187 million, accompanied by a 17% increase in sales to $25 billion in 2007 driven by strong performance from the Prada and Miu Miu brands. Prada also made headlines with the "Trada phone," a slick black mobile handset developed in collaboration with LG Electronics. It sold more than one million units since its release in March 2007. luring customers to view a handset more like a fashionable accessory, a trend that was followed by Glorgio Armani and Ferrari. At the same time, Prada found itself struggling with over $950 million in debt, accumulated through its poorly executed expansion plan as the acquired brands failed to deliver solid financial retums Prada's stake in Fendi was quickly sold to joint venture partner LVMH in 2001. In addition, not only were underperforming businesses such as Jil Sanders sold, but plans to go public were also scrapped for the fourth time in 2008, with Prada citing poor market conditions. Gucci in 2009 The overall luxury market had enjoyed strong growth from 2005 through 2007 as China, India, Russia, and Brazil emerged as the fastest growing markets for luxury brands. Gued had rushed to open 16 directly operated stores in China and also entered India for the first time in 2007. Additional store openings were planned mainly in emerging markets, while mature markets, such as Japan and the United States, were expected to slow down as luxury consumers tightened their spending The big question for Gucci as well as its competitors was how to handle the global economie slowdown. After the industry grew a mere 3% in 2008, the prediction for 2009 was that the 175 billion euro global luxury market could fall into a recession for the first time since 9/11. In the meantime, after years of steady growth, Gucci saw its first quarter sales slip 3.3% in 2008. Despite the recent success of the Group's smaller brands, the company remained overly dependent on the Gucci brand, which represented 89% of the Group's recurring operating income For Polet, the big question remained: Was it time to further strengthen Gucci, or push the multi-brand strategy to the next level? Exhibit 1 Gucci's Acquisitions, 2000-2001 Gucci Surke ExtPrice in min) El Sales in s mind 26% 100% 51% Date May 2000 May 2000 Oct. 2000 Dec. 2000 Dec. 2000 Feb. 2001 Mar. 2001 Apr. 2001 Jul.2001 Jl. 2001 Aug. 2001 Company FJ Benjamin Boucheron Zamasport Alexander McQueen Bidat & Co. Bottega Veneta Di Modelo Stella McCartney Balandsga Caravel Pell Regain Activity Asia-Pacific distributor Jewelry, perfumes Ready-to-wear factory Fashion Watches Lesther goods Watch design, components Fashion Fashion, perfumes Precious skins tannery Men's footwear 100 505 70" Source: Adapted from Dorothy S. Lakner et al., "Guod Group NV," CIBC World Markets, March 22, 2x2 and various public sources Gucci acquired the w ining 3% in July 2001 Exhibit 2 Gucci Division's Sales by Product and Region (% of Total Sales) 60% 50% 2008 2007 0% 20% 40% Europe North America Jepan 10 - 2007 Best of Asia Jestery Leather Goode Pady. Source: Compiled by casewiter using data from the Gucci Group and PPR North America's sales for 2013 were for the United States only. Exhibit Operating Margins of the Gurd Group, by Division (%) Gucci YSL YSL Route Bottega Veneta Other Brands Total Operating Pro 2000 27% 18% 8% na 10% 10% 2001 30% -75% 7% na -16% 15% 2002 29% 44% 7% na -13% 12% 2003 28% -50% 3% na -10% 11% 2004 28% 424 4% 8% 33% 11% 2005 27% 41% 3% 9% -20% 13% 2006 2946 25% 3% 21% 16% 18% Source Adapted by c writer bed on Gucci Group and Pr's financial results for the selected years. Exhibit 4 Gued Group's Selected Financial Performance, 2002-2008 In awo millons) Revenue Gucci Bottega Veneta YSL YSL Beauta Other brands 2002 2,544.3 1,538.8 146.4 549.7 350.8 39,4 2003 2,587.4 1.522.4 154.2 614,7 348.3 -52.2 2004 2,712,0 1,590.0 100.0 1090 621.0 232.0 2005 3,030,4 1,800.3 159.7 1620 608.2 294,2 2006 2007 3,564,4 3,867,0 2,1005 2.175.4 266.9 366.1 162.6 2213 624,3 649.2 379,1 455.0 1H 2008 1,576.9 1.017.7 197.4 120.2 na 241.6 Operating income Guce Bottega Veneta 179.4 431.1 na -87.9 3.0 -126.5 241.0 119.8 4060 na -109.1 -23.0 -1224 298.0 4230 -7. 3 -70.8 23.0 na 392.0 485.4 13.7 -65.8 17. 9 -13.7 565. 2 611,8 54,6 49.4 3 2.2 10.3 730.9 646.9 92. 2 31.9 64.7 33.1 299,6 20.5 51.4 -12.0 YSL YSL Beaute Other brands 7.1 428.1 EBITDA Gucci Bottega Veneta na na 519.7 686.9 549.6 678,8 222 58 50.7 35.7 34.5 515 20264 na na na na 878.7 7222 1020 -19.4 926 487 359.7 3220 56.6 6.6 na 155 YSE YSL Beaute Other brands Source: Compiled by sewer using data from the Guce Group and PR * Total undeperating Income for the use ou may not add up predly due to them that we needs by the parent company A sted for Gard Group's reporting period Exhibit 5 LVMH's Sales by Product in 2007 Wine and Jewelry, Source: Compiled by writer using data from LVMH2X financiales Selective retalling category included cosmetic chain Sephora and home department store Leon Marche Exhibit 6 Operating Margin of Gucci Group vs. LVMH (%) Gucci Group LVMH PAR ATBALSTA S ESSIA So Complied by h e r sing data from Rand LVM financial resultsStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts