Question: a ) Create the appropriate journal entry to remitt all CPP and EI collected, thus far, in the month of January. The Small Company Next

a Create the appropriate journal entry to remitt all CPP and EI collected, thus far, in the month of January. The Small Company Next door

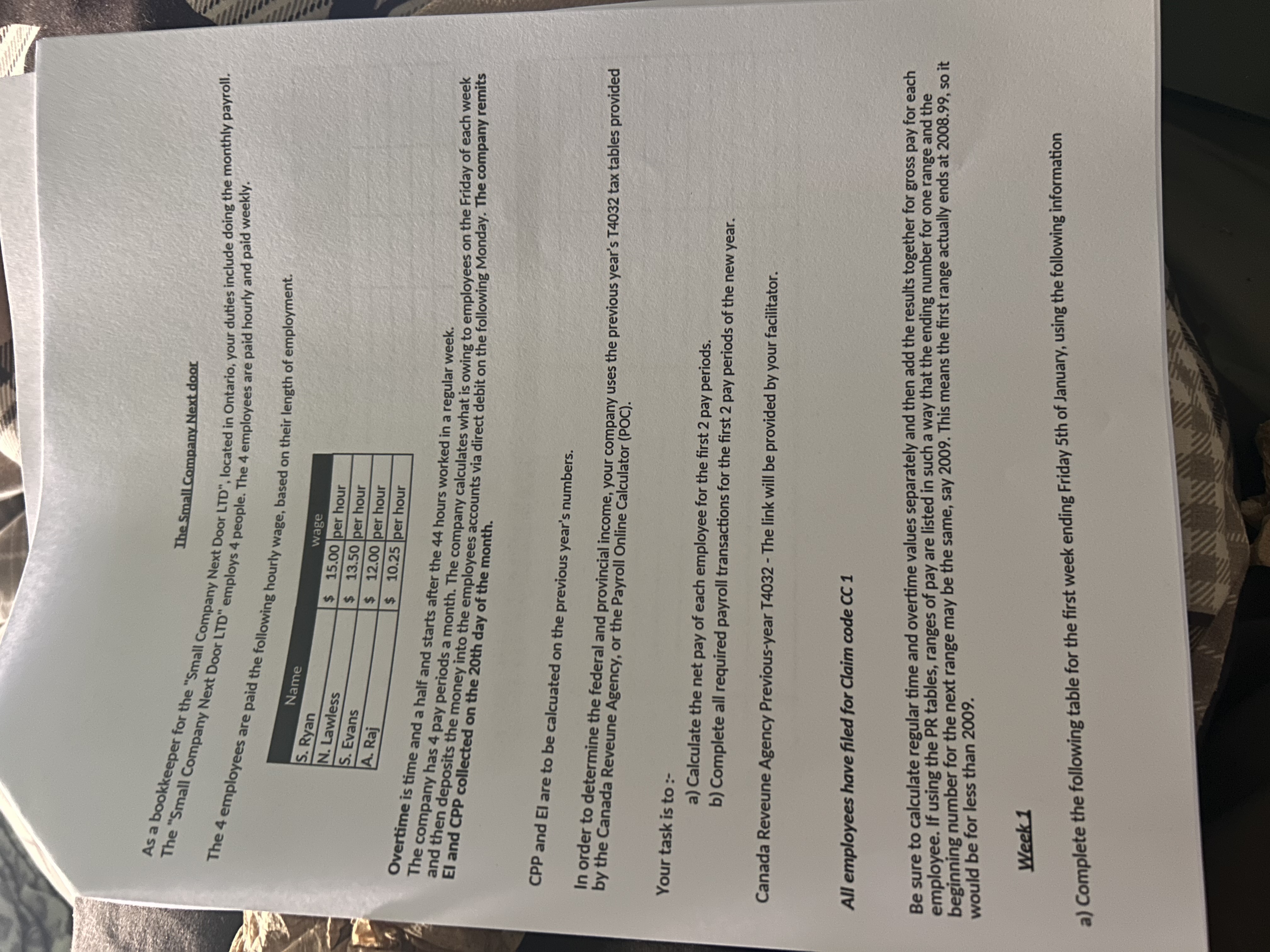

The employees are paid the following hourly wage, based on their length of employment.

Overtime is time and a half and starts after the hours worked in a regular week.

The company has pay periods a month. The company calculates what is owing to employees on the Friday of each week

EI and CPP collected on the th day of the month.

CPP and EI are to be calcuated on the previous year's numbers.

In order to determine the federal and provincial income, your company uses the previous year's T tax tables provided

by the Canada Reveune Agency, or the Payroll Online Calculator POC

Your task is to :

a Calculate the net pay of each employee for the first pay periods.

b Complete all required payroll transactions for the first pay periods of the new year.

Canada Reveune Agency Previousyear T The link will be provided by your facilitator.

All employees have filed for Claim code CC

Be sure to calculate regular time and overtime values separately and then add the results together for gross pay for each

employee. If using the PR tables, ranges of pay are listed in such a way that the ending number for one range and the

beginning number for the next range may be the same, say This means the first range actually ends at so it

would be for less than

Week

a Complete the following table for the first week ending Friday th of January, using the following information Round wages to nearest wholes

b Complete the journal entry on the Friday Jan th to accrue the wages owing and extra benefits due for all employees.

tableDateDescription,DRCR c Complete the journal entry to reflect the payment of wages to employees bank accounts on Monday th of Jan.

Week

a Complete the following table for the nd week ending Friday th of January, using the following information:

Round wages to nearest whole$ Complete the journal entry on the Friday Jan th to accrue the wages owing and extra benefits due for all employees.

tableDateDescription,DRCR

c Complete the journal entry to reflect the payment of wages to employees bank accounts on Monday th of Jan.

tableDateDescription,DRCRa Create the appropriate journal entry to remitt all CPP and EI collected

b Remit all federal taxes collected thus far in the month of January.

b Remit all provincial taxes collected thus far in the month of January.Complete the journal entry on the Friday Jan th to accrue the wages owing and extra benefits due for all employees.

tableDateDescription,DRCR

c Complete the journal entry to reflect the payment of wages to employees bank accounts on Monday th of Jan.

tableDateDescription,DRCRc Complete the journal entry to reflect the payment of wages to employees bank accounts on Monday th of Jan.

Week

a Complete the following table for the nd week ending Friday th of January, using the following information:

Round wages to nearest whole$Round wages to nearest wholes

b Complete the journal entry on the Friday Jan th to accrue the wages owing and extra benefits due for all employees.

tableDateDescription,DRCRThe Small Company Next door

The employees are paid the following hourly wage, based on their length of employment.

Overtime is time and a half and starts after the hours worked in a regular week.

The company has pay periods a month. The company calculates what is owing to employees on the Friday of each week

EI and CPP collected on the th day of the month.

CPP and EI are to be calcuated on the previous year's numbers.

In order to determine the federal and provincial income, your company uses the previous year's T tax tables provided

by the Canada Reveune Agency, or the Payroll Online Calculator POC

Your task is to :

a Calculate the net pay of each employee for the first pay periods.

b Complete all required payroll transactions for the first pay periods of the new year.

Canada Reveune Agency Previousyear T The link will be provided by your facilitator.

All employees have filed for Claim code CC

Be sure to calculate regular time and overtime values separately and then add the results together for gross pay for each

employee. If using the PR tables, ranges of pay are listed in such a way that the ending number for one range and the

beginning number for the next range may be the same, say This means the first range actually ends at

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock