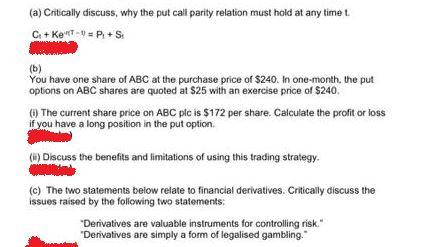

Question: (a) Critically discuss, why the put call parity relation must hold at any timet. C. + Ket=PS (b) You have one share of ABC at

(a) Critically discuss, why the put call parity relation must hold at any timet. C. + Ket=PS (b) You have one share of ABC at the purchase price of $240. In one-month, the put options on ABC shares are quoted at $25 with an exercise price of $240. () The current share price on ABC plc is $172 per share. Calculate the profit or loss if you have a long position in the put option (#) Discuss the benefits and limitations of using this trading strategy. (c) The two statements below relate to financial derivatives. Critically discuss the issues raised by the following two statements: Derivatives are valuable instruments for controlling risk." "Derivatives are simply a form of legalised gambling

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts