Question: a) Critically evaluate the net present value (NPV) and the internal rate of return (IRR) investment appraisal methods. (5 marks) b) An engineering organisation

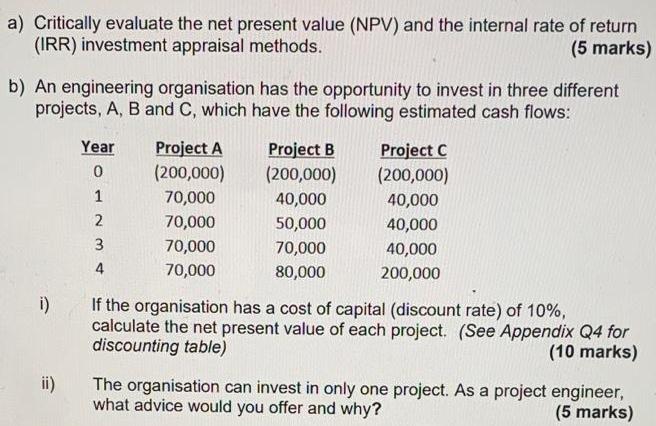

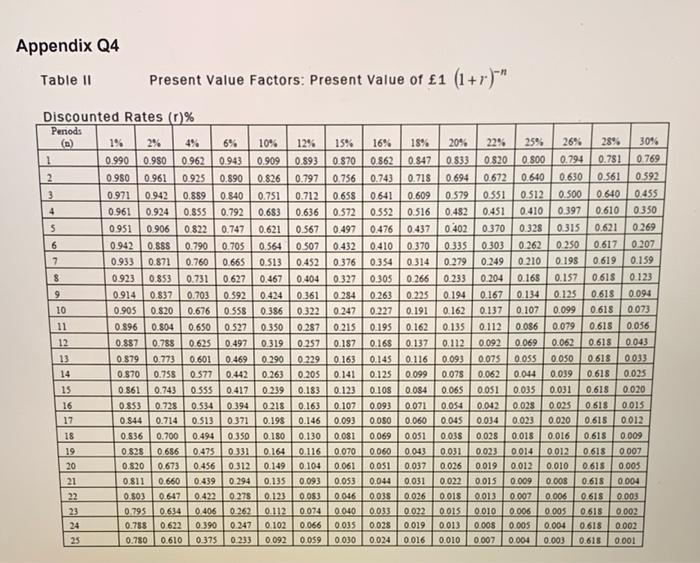

a) Critically evaluate the net present value (NPV) and the internal rate of return (IRR) investment appraisal methods. (5 marks) b) An engineering organisation has the opportunity to invest in three different projects, A, B and C, which have the following estimated cash flows: i) ii) Year Project A Project B Project C 0 (200,000) (200,000) (200,000) 1 70,000 40,000 40,000 2 70,000 50,000 40,000 3 70,000 70,000 40,000 4 70,000 80,000 200,000 If the organisation has a cost of capital (discount rate) of 10%, calculate the net present value of each project. (See Appendix Q4 for discounting table) (10 marks) The organisation can invest in only one project. As a project engineer, what advice would you offer and why? (5 marks) Appendix Q4 Table II Present Value Factors: Present Value of 1 (1+r)" Discounted Rates (r)% Periods () 1% 2% 4% 1 2 0.980 0.961 3 0.971 0.942 0.990 0.980 0.962 0.925 0.890 0.889 6% 0.943 10% 0.909 0.826 0.840 0.751 4 0.961 0.924 0.855 0.792 0.683 5 0.951 0.906 0.822 0.747 0.621 6 0.942 0.SSS 0.790 0.705 0.564 7 0.933 0.871 0.760 0.665 S 0.923 0.853 0.731 0.627 9 0.914 0.837 10 0.905 0.820 0.676 11 0.896 0.804 0.650 0.703 0.592 0.558 0.527 12 13 14. 0.887 0.788 0.625 0.497 0.879 0.773 0.601 0.469 0.870 0.758 0.577 0.442 15 0.205 0.183 16 17 18 19 0.853 0.728 0.534 0.394 0.218 0.163 0.844 0.714 0.513 0.371 0.198 0.146 0.836 0.700 0.494 0.350 0.180 0.130 0.828 0.686 0.475 0.331 0.164 0.116 20 21 22 23 0.795 24 0.758 25 0.780 0.610 0.375 0.233 0.092 12% 15% 16% 18% 20% 22% 25% 26% 28% 30% 0.893 0.870 0.862 0.847 0.833 0.820 0.800 0.794 0.781 0769 0.797 0.756 0.743 0.718 0.694 0.672 0.640 0.630 0.561 0.592 0.712 0.658 0.641 0.609 0.579 0.551 0.512 0.500 0.640 0455 0.636 0.572 0.552 0.516 0.482 0.451 0.410 0.397 0.610 0.350 0.567 0.497 0.476 0.437 0.402 0.370 0.328 0.315 0.621 0.269 0.507 0.432 0.410 0.370 0.335 0.303 0.262 0.250 0.617 0207 0.513 0.452 0.376 0.354 0.314 0.279 0.249 0.210 0.198 0.619 0.159 0.467 0.404 0.327 0.305 0.266 0.233 0.204 0.168 0.157 0.61$ 0.123 0.424 0.361 0.284 0.263 0.225 0.194 0.167 0.134 0.125 0.618 0.094 0.386 0.322 0.247 0.227 0.191 0.162 0.137 0.107 0.099 0.618 0.073 0.350 0.287 0.215 0.195 0.162 0.135 0.112 0.086 0.079 0.618 0.056 0.319 0.257 0.187 0.168 0.137 0.112 0.092 0.069 0.062 0.618 0.043 0.290 0.229 0.163 0.145 0.116 0.093 0.075 0.055 0.050 0.618 0033 0.263 0.141 0.125 0.039 0.618 0.025 0.861 0.743 0.555 0.417 0.239 0.123 0.108 0.084 0.065 0.051 0.035 0.031 0.618 0.020 0.107 0.093 0.071 0.054 0.042 0.028 0.025 0.618 0.015 0.093 0.080 0.060 0.045 0.034 0.023 0.020 0.618 0.012 0.081 0.069 0.051 0.038 0.028 0.018 0.016 0.615 0.009 0.070 0.060 0.043 0.031 0.023 0.014 0.012 0.618 0.007 0.820 0.673 0.456 0.312 0.149 0.104 0.061 0.051 0.037 0.026 0.019 0.012 0.010 0.618 0.005 0.811 0.660 0.439 0.294 0.135 0.093 0.053 0.044 0.031 0.022 0.015 0.009 0.008 0.618 0.004 0.803 0.647 0.422 0.278 0.123 0.083 0.046 0.038 0.026 0.018 0.013 0.007 0.006 0.618 0.003 0.634 0.406 0.262 0.112 0.074 0.040 0.033 0.022 0.015 0.010 0.006 0.005 0.618 0.002 0.622 0.390 0.247 0.102 0.066 0.035 0.028 0.019 0.013 0.008 0.005 0.004 0.618 0.002 0.059 0.030 0.024 0.016 0.010 0.007 0.004 0.003 0.618 0.001 0.099 0.078 0.062 0.044

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts