Question: a. Current ratio b. Operating return on assets c. Times interest earned d. Debt ratio e. Inventory turnover f. Average collection period g. Total asset

a. Current ratio

b. Operating return on assets

c. Times interest earned

d. Debt ratio

e. Inventory turnover

f. Average collection period

g. Total asset turnover

h. Fixed asset turnover

i. Operating profit margin

j. Return on equity

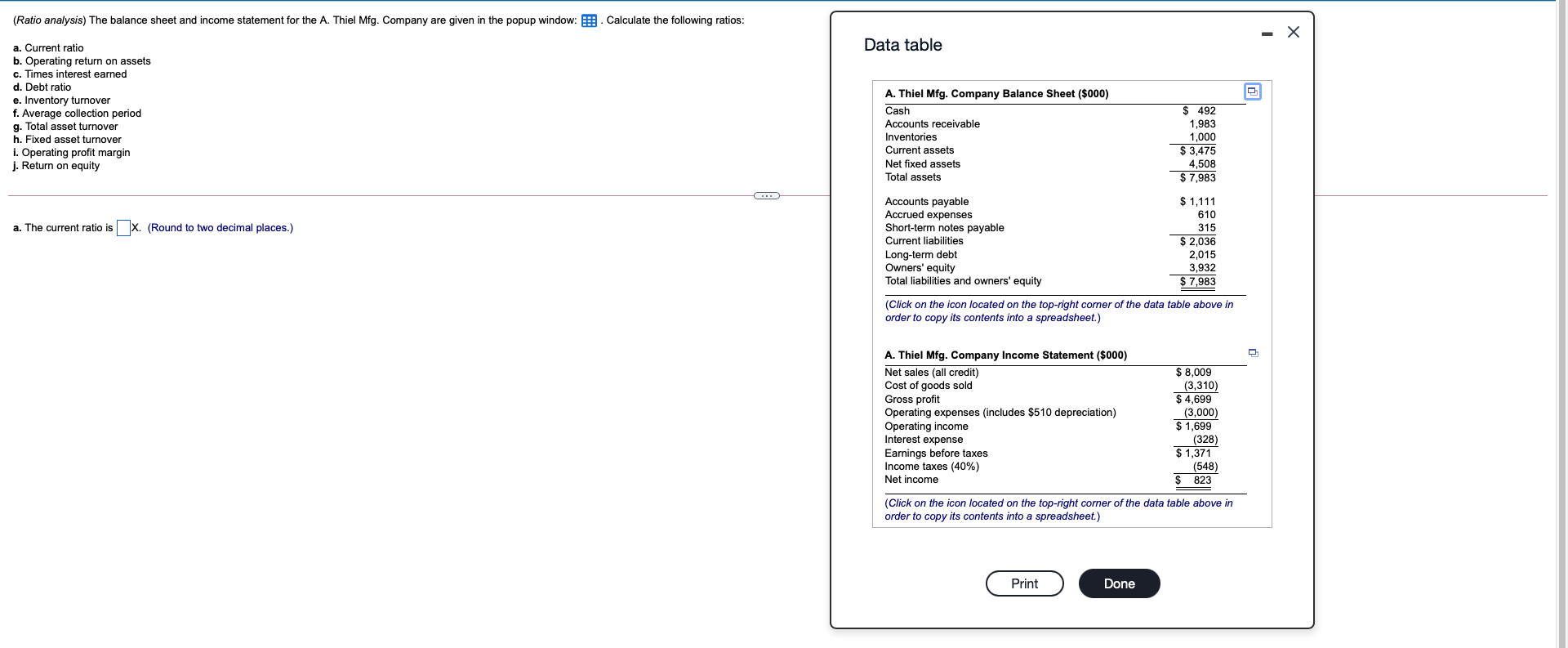

(Ratio analysis) The balance sheet and income statement for the A. Thiel Mfg. Company are given in the popup window: . Calculate the following ratios: Data table a. Current ratio b. Operating return on assets c. Times interest earned d. Debt ratio e. Inventory turnover f. Average collection period g. asset turnover h. Fixed asset turnover i. Operating profit margin j. Return on equity $ 492 Total 1,983 A. Thiel Mfg. Company Balance Sheet ($000) Cash Accounts receivable Inventories Current assets Net fixed assets Total assets 1,000 $ 3,475 4,508 $ 7,983 ... $ 1,111 610 315 a. The current ratio is x. (Round to two decimal places.) Accounts payable Accrued expenses Short-term notes payable Current liabilities Long-term debt Owners' equity Total liabilities and owners' equity $ 2,036 2,015 3,932 $ 7,983 (Click on the icon located on the top-right corner of the data table above in order to copy its contents into a spreadsheet.) A. Thiel Mfg. Company Income Statement ($000) Net sales (all credit) $ 8,009 Cost of goods sold (3,310) Gross profit $ 4,699 Operating expenses (includes $510 depreciation) (3,000) Operating income $ 1,699 Interest expense (328) Earnings before taxes $ 1,371 Income taxes (40%) (548) Net income 823 (Click on the icon located on the top-right corner of the data table above in order to copy its contents into a spreadsheet.) Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts