Question: A. Current Ratio B. Quick Ratio C. Cash Ratio D. NWC to total assets ratio E. Debt-equity ratio and equity multiplier F. Total debt ratio

A. Current Ratio

B. Quick Ratio

C. Cash Ratio

D. NWC to total assets ratio

E. Debt-equity ratio and equity multiplier

F. Total debt ratio and long-term debt ratio

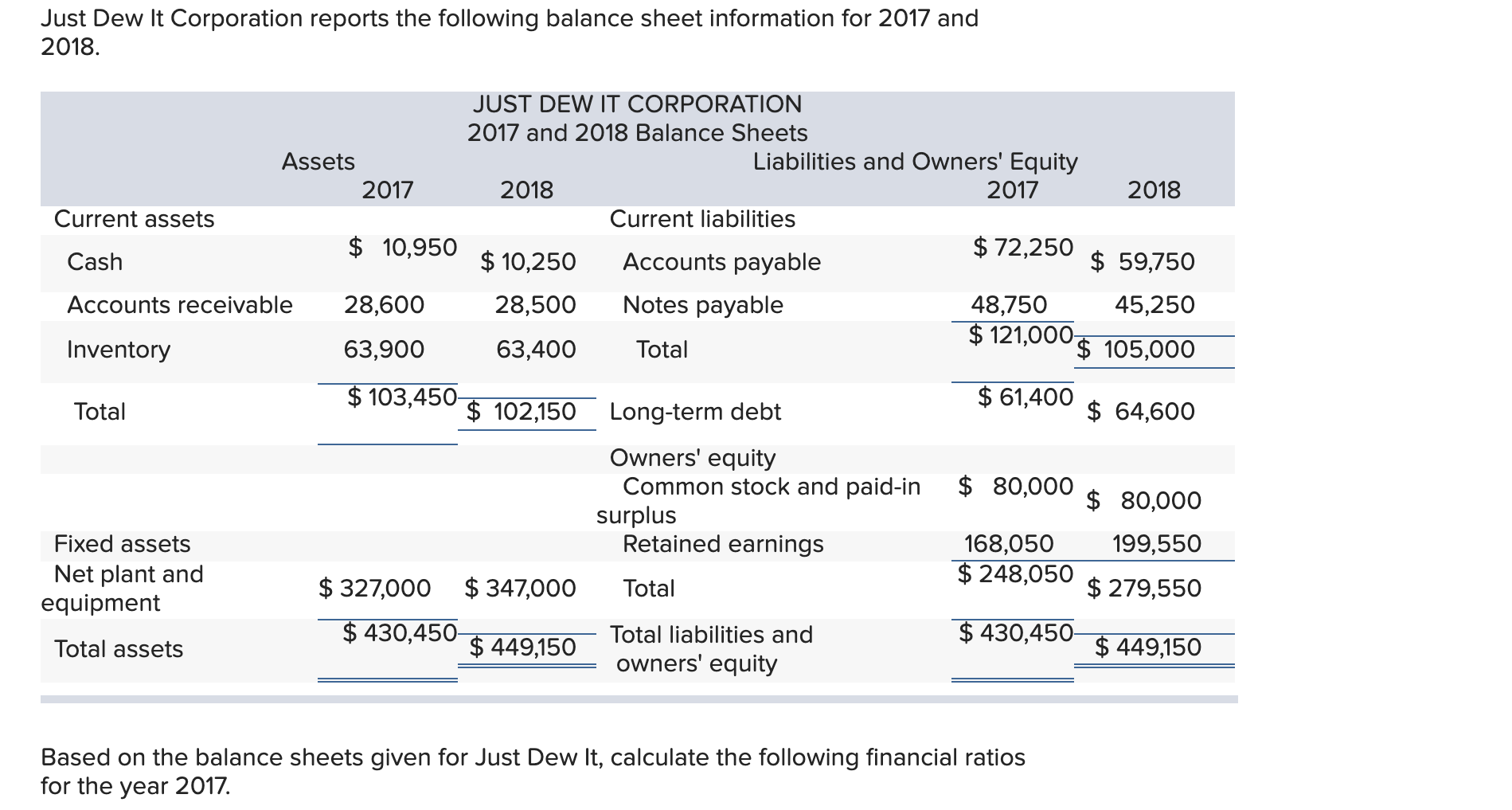

| Based on the balance sheets given for Just Dew It, calculate the following financial ratios for the year 2018. A. Current Ratio B. Quick Ratio C. Cash Ratio D. NWC to total assets ratio E. Debt-equity ratio and equity multiplier F. Total debt ratio and long-term debt ratio

|

Just Dew It Corporation reports the following balance sheet information for 2017 and 2018. JUST DEW IT CORPORATION 2017 and 2018 Balance Sheets Assets Liabilities and Owners' Equity 2017 2018 2017 2018 Current assets Current liabilities $ 10,950 $ 10.250 Cash Accounts payable Accounts receivable 28,600 28,500 Notes payable 48,750 45,250 Inventory 63,900 63,400 $ 121,000 $ 105,000 Total $ 72,250 $ 59,750 $ 103,450 $ 102,150 $61,400 $ 64,600 Total Long-term debt $ 80,000 $ 80.000 168,050 199,550 Fixed assets Net plant and equipment Owners' equity Common stock and paid-in surplus Retained earnings Total Total liabilities and owners' equity $ 248,050 $ 279,550 $ 327,000 $347,000 $ 430,450-4449150 $ 430,450 $ 449.150 Total assets Based on the balance sheets given for Just Dew It, calculate the following financial ratios for the year 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts