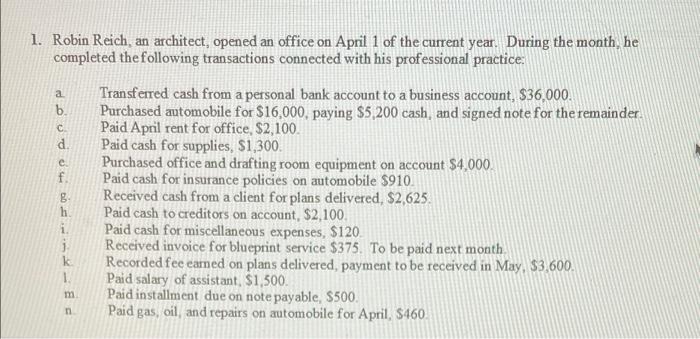

Question: a d 1. Robin Reich, an architect, opened an office on April 1 of the current year. During the month, he completed the following transactions

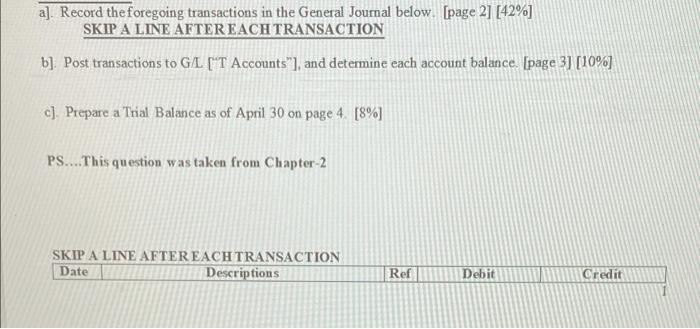

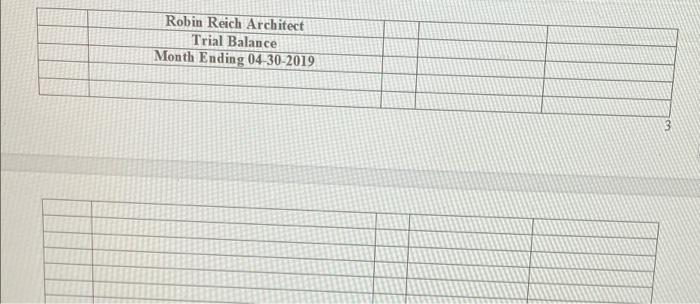

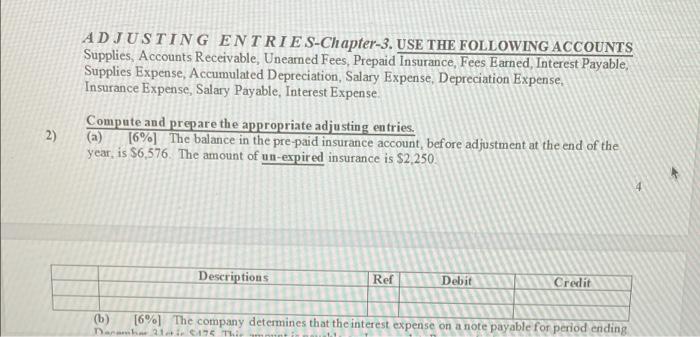

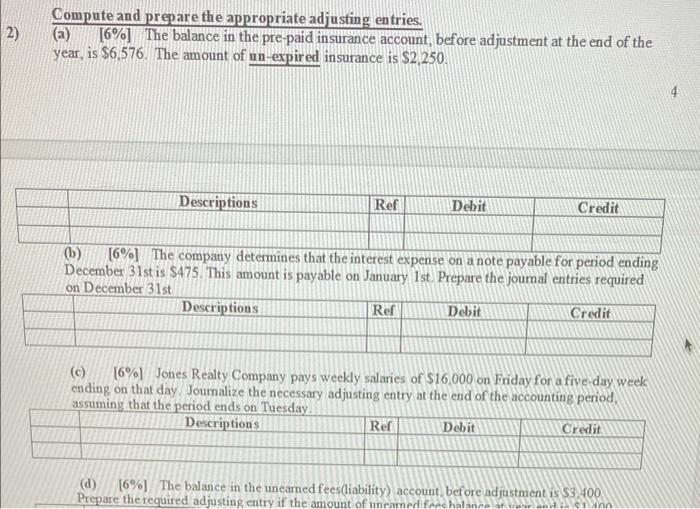

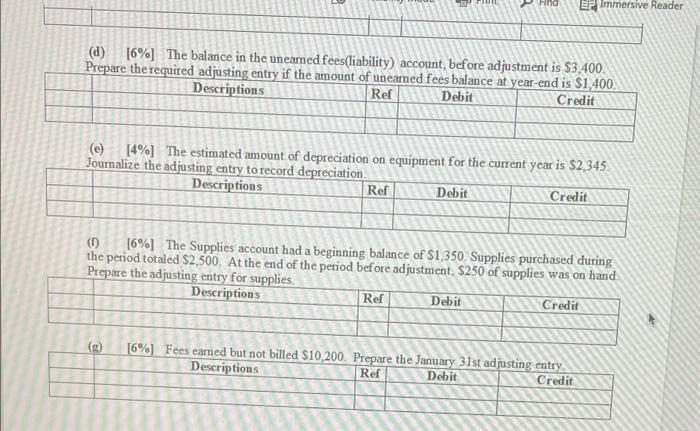

a d 1. Robin Reich, an architect, opened an office on April 1 of the current year. During the month, he completed the following transactions connected with his professional practice: Transferred cash from a personal bank account to a business account, $36,000. b Purchased automobile for $16,000, paying $5,200 cash, and signed note for the remainder Paid April rent for office, $2,100. Paid cash for supplies, $1,300. Purchased office and drafting room equipment on account $4,000 f. Paid cash for insurance policies on automobile $910 Received cash from a client for plans delivered, $2,625 Paid cash to creditors on account, $2,100 Paid cash for miscellaneous expenses, $120 Received invoice for blueprint service $375. To be paid next month k Recorded fee eamed on plans delivered payment to be received in May, $3,600 1 Paid salary of assistant, $1,500. Paid installment due on note payable, $500. Paid gas, oil and repairs on automobile for April, $460 g h m n a]. Record the foregoing transactions in the General Journal below. (page 2] [42%] SKIP A LINE AFTEREACH TRANSACTION b]. Post transactions to G/L ['T Accounts"), and determine each account balance (page 31 (10%) c). Prepare a Trial Balance as of April 30 on page 4 [8%) PS...This question was taken from Chapter-2 SKIP A LINE AFTER EACH TRANSACTION Date Descriptions Ref Debit Credit Robin Reich Architect Trial Balance Month Ending 04-30-2019 ADJUSTING ENTRIES-Chapter-3. USE THE FOLLOWING ACCOUNTS Supplies, Accounts Receivable, Unearned Fees, Prepaid Insurance, Fees Earned, Interest Payable, Supplies Expense, Accumulated Depreciation, Salary Expense, Depreciation Expense. Insurance Expense, Salary Payable, Interest Expense. Compute and prepare the appropriate adjusting entries. (a) [6%] The balance in the pre-paid insurance account, before adjustment at the end of the year is 56,576. The amount of un-expired insurance is $2,250 2 2) Descriptions Ref Debit Credit (b) [6%] The company determines that the interest expense on a note payable for period ending Da2101 The 2) Compute and prepare the appropriate adjusting entries. (a) [6%] The balance in the pre-paid insurance account, before adjustment at the end of the year, is $6,576. The amount of un-expired insurance is $2,250. Descriptions Ref Debit Credit (6) [6%] The company determines that the interest expense on a note payable for period ending December 31st is $475. This amount is payable on January 1st. Prepare the journal entries required on December 31st Descriptions Ref Debit Credit (c) 16% Jones Realty Company pays weekly salaries of $16,000 on Friday for a five-day week ending on that day Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Tuesday Descriptions Ref Debit Credit (d) [6%) The balance in the uneamed fees(liability) account before adjustment is $3,400 Prepare the required adjusting entry if the amount of uneamed free 10 Find EF Immersive Reader (d) [6%] The balance in the uneared fees(liability) account, before adjustment is $3,400. Prepare the required adjusting entry if the amount of uneared fees balance at year-end is $1,400. Descriptions Ref Debit Credit (e (e) [4%] The estimated amount of depreciation on equipment for the current year is $2,345. Journalize the adjusting entry to record depreciation Descriptions Ref Debit Credit (1) [6%] The Supplies account had a beginning balance of $1,350 Supplies purchased during the period totaled $2,500. At the end of the period before adjustment, S250 of supplies was on hand Prepare the adjusting entry for supplies, Descriptions Ref Debit Credit 16%] Fees earned but not billed $10,200. Prepare the January 31st adjusting entry Descriptions Ref Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts