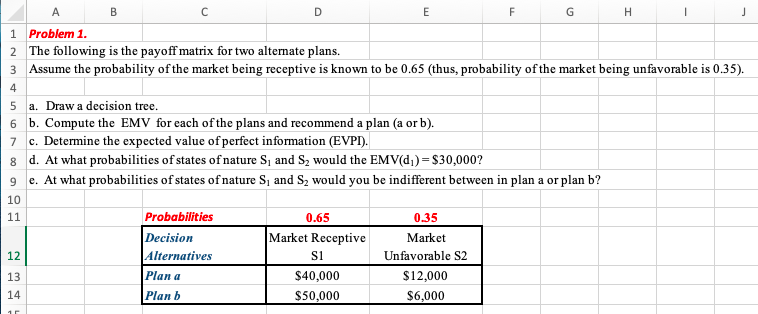

Question: A D E F H j B 1 Problem 1. 2 The following is the payoff matrix for two alternate plans. 3 Assume the probability

A D E F H j B 1 Problem 1. 2 The following is the payoff matrix for two alternate plans. 3 Assume the probability of the market being receptive is known to be 0.65 (thus, probability of the market being unfavorable is 0.35). 4 5 a. Draw a decision tree. 6 b. Compute the EMV for each of the plans and recommend a plan (a or b). 7 c. Determine the expected value of perfect information (EVPI). 8 d. At what probabilities of states of nature S, and S2 would the EMV(d))=$30,000? 9 e. At what probabilities of states of nature S, and S, would you be indifferent between in plan a or plan b? 10 Probabilities 0.65 0.35 Decision Market Receptive 12 Alternatives S1 Unfavorable S2 Plan a $40,000 $12,000 14 Plan b $50,000 $6,000 11 Market 13 1 A D E F H j B 1 Problem 1. 2 The following is the payoff matrix for two alternate plans. 3 Assume the probability of the market being receptive is known to be 0.65 (thus, probability of the market being unfavorable is 0.35). 4 5 a. Draw a decision tree. 6 b. Compute the EMV for each of the plans and recommend a plan (a or b). 7 c. Determine the expected value of perfect information (EVPI). 8 d. At what probabilities of states of nature S, and S2 would the EMV(d))=$30,000? 9 e. At what probabilities of states of nature S, and S, would you be indifferent between in plan a or plan b? 10 Probabilities 0.65 0.35 Decision Market Receptive 12 Alternatives S1 Unfavorable S2 Plan a $40,000 $12,000 14 Plan b $50,000 $6,000 11 Market 13 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts