Question: A D E H 9 B B C G 1 Question 10 2 3 The following figure forms ten portfolios based on stocks' prior one-year

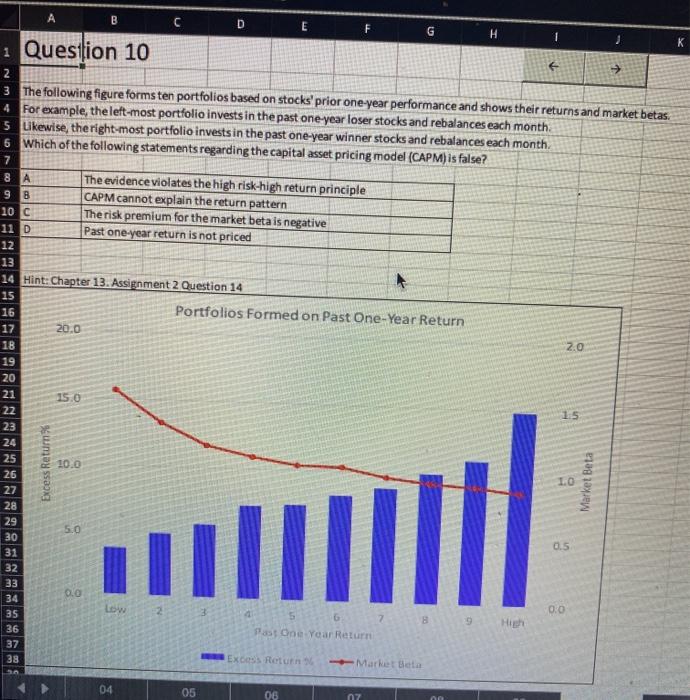

A D E H 9 B B C G 1 Question 10 2 3 The following figure forms ten portfolios based on stocks' prior one-year performance and shows their returns and market betas. 4 For example, the left-most portfolio invests in the past one year loser stocks and rebalances each month 5 Likewise, the right-most portfolio invests in the past one-year winner stocks and rebalances each month 6 Which of the following statements regarding the capital asset pricing model (CAPM) is false? 7 8 A The evidence violates the high risk-high return principle CAPM cannot explain the return pattern 10 c The risk premium for the market beta is negative 11 D Past one year return is not priced 12 13 14 Hint: Chapter 13. Assignment 2 Question 14 15 16 Portfolios formed on Past One-Year Return 17 20.0 18 2.0 19 20 21 15.0 22 15 23 24 25 26 27 28 29 30 Excess Return 10.0 10 Market Beta 50 31 0.5 0.0 32 33 34 35 36 37 38 Low 0.0 5 6 7 at One Year Return High Ex Return Market Beta 04 05 06 07

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts