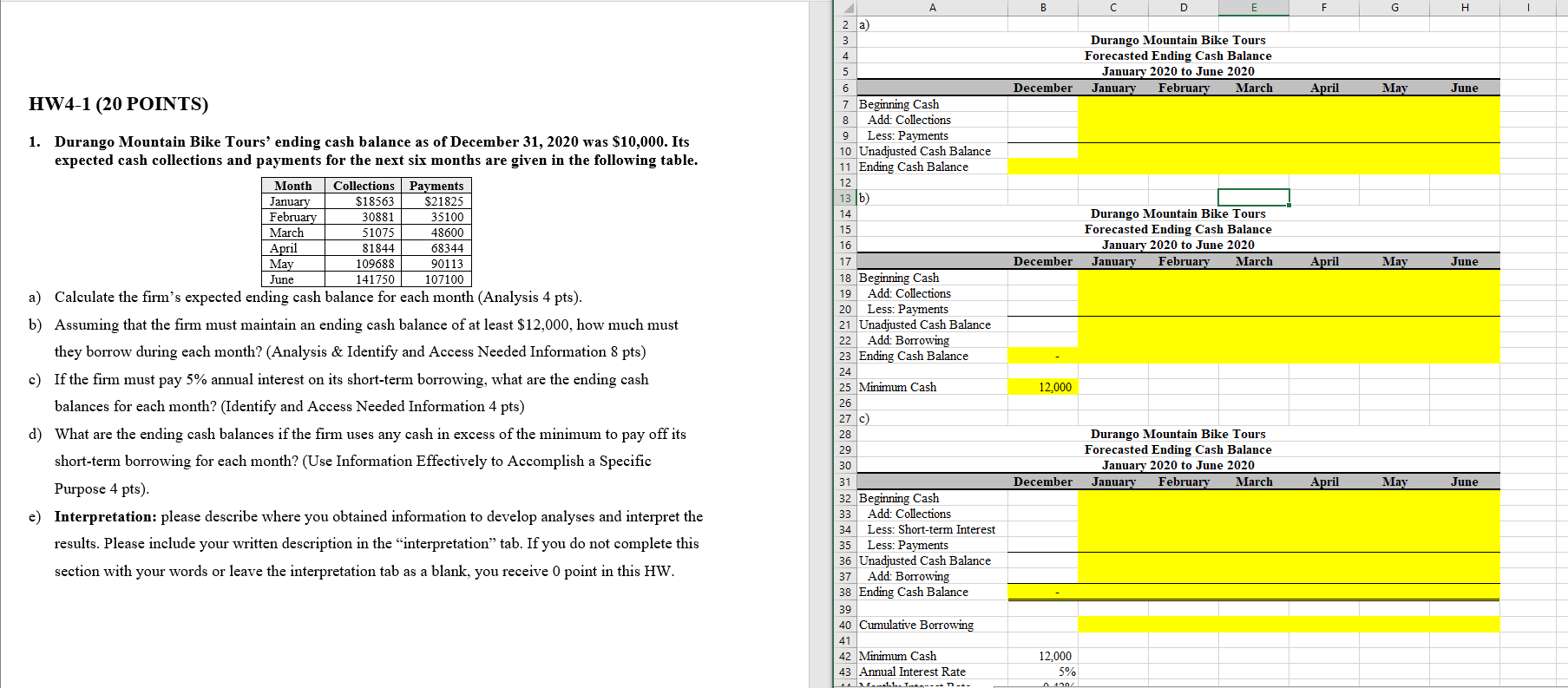

Question: A D F G H 2 a) 3 4 5 Durango Mountain Bike Tours Forecasted Ending Cash Balance January 2020 to June 2020 January February

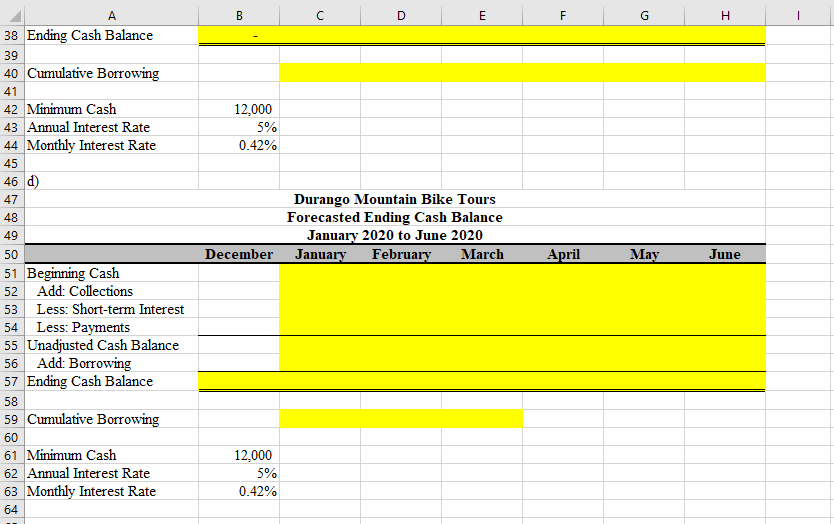

A D F G H 2 a) 3 4 5 Durango Mountain Bike Tours Forecasted Ending Cash Balance January 2020 to June 2020 January February March December April May June HW4-1 (20 POINTS) 51075 Durango Mountain Bike Tours Forecasted Ending Cash Balance January 2020 to June 2020 January February March 68344 December April May June 107100 1. Durango Mountain Bike Tours' ending cash balance as of December 31, 2020 was $10,000. Its expected cash collections and payments for the next six months are given in the following table. Month Collections Payments January $18563 $21825 February 30881 35100 March 48600 April 81844 May 109688 90113 June 141750 a) Calculate the firm's expected ending cash balance for each month (Analysis 4 pts). b) Assuming that the firm must maintain an ending cash balance of at least $12,000, how much must they borrow during each month? (Analysis & Identify and Access Needed Information 8 pts) c) If the firm must pay 5% annual interest on its short-term borrowing, what are the ending cash balances for each month? (Identify and Access Needed Information 4 pts) d) What are the ending cash balances if the firm uses any cash in excess of the minimum to pay off its short-term borrowing for each month? (Use Information Effectively to Accomplish a Specific Purpose 4 pts). e) Interpretation: please describe where you obtained information to develop analyses and interpret the results. Please include your written description in the interpretation tab. If you do not complete this section with your words or leave the interpretation tab as a blank, you receive 0 point in this HW. 6 7 Beginning Cash 8 Add: Collections 9 Less: Payments 10 Unadjusted Cash Balance 11 Ending Cash Balance 12 13 b) 14 15 16 17 18 Beginning Cash 19 Add: Collections 20 Less: Payments 21 Unadjusted Cash Balance 22 Add: Borrowing 23 Ending Cash Balance 24 25 Minimum Cash 26 27 C) 28 29 30 31 32 Beginning Cash 33 Add: Collections 34 Less: Short-term Interest 35 Less: Payments 36 Unadjusted Cash Balance 37 Add: Borrowing 38 Ending Cash Balance 39 40 Cumulative Borrowing 41 42 Minimum Cash 43 Annual Interest Rate M.11.L- 12,000 Durango Mountain Bike Tours Forecasted Ending Cash Balance January 2020 to June 2020 January February March December April May June 12,000 5% B D E F G H 12,000 5% 0.42% A 38 Ending Cash Balance 39 40 Cumulative Borrowing 41 42 Minimum Cash 43 Annual Interest Rate 44 Monthly Interest Rate 45 46 d) 47 48 49 50 51 Beginning Cash 52 Add: Collections 53 Less: Short-term Interest 54 Less: Payments 55 Unadjusted Cash Balance 56 Add: Borrowing 57 Ending Cash Balance 58 59 Cumulative Borrowing 60 61 Minimum Cash 62 Annual Interest Rate 63 Monthly Interest Rate 64 Durango Mountain Bike Tours Forecasted Ending Cash Balance January 2020 to June 2020 January February March December April May June 12,000 5% 0.42% A D F G H 2 a) 3 4 5 Durango Mountain Bike Tours Forecasted Ending Cash Balance January 2020 to June 2020 January February March December April May June HW4-1 (20 POINTS) 51075 Durango Mountain Bike Tours Forecasted Ending Cash Balance January 2020 to June 2020 January February March 68344 December April May June 107100 1. Durango Mountain Bike Tours' ending cash balance as of December 31, 2020 was $10,000. Its expected cash collections and payments for the next six months are given in the following table. Month Collections Payments January $18563 $21825 February 30881 35100 March 48600 April 81844 May 109688 90113 June 141750 a) Calculate the firm's expected ending cash balance for each month (Analysis 4 pts). b) Assuming that the firm must maintain an ending cash balance of at least $12,000, how much must they borrow during each month? (Analysis & Identify and Access Needed Information 8 pts) c) If the firm must pay 5% annual interest on its short-term borrowing, what are the ending cash balances for each month? (Identify and Access Needed Information 4 pts) d) What are the ending cash balances if the firm uses any cash in excess of the minimum to pay off its short-term borrowing for each month? (Use Information Effectively to Accomplish a Specific Purpose 4 pts). e) Interpretation: please describe where you obtained information to develop analyses and interpret the results. Please include your written description in the interpretation tab. If you do not complete this section with your words or leave the interpretation tab as a blank, you receive 0 point in this HW. 6 7 Beginning Cash 8 Add: Collections 9 Less: Payments 10 Unadjusted Cash Balance 11 Ending Cash Balance 12 13 b) 14 15 16 17 18 Beginning Cash 19 Add: Collections 20 Less: Payments 21 Unadjusted Cash Balance 22 Add: Borrowing 23 Ending Cash Balance 24 25 Minimum Cash 26 27 C) 28 29 30 31 32 Beginning Cash 33 Add: Collections 34 Less: Short-term Interest 35 Less: Payments 36 Unadjusted Cash Balance 37 Add: Borrowing 38 Ending Cash Balance 39 40 Cumulative Borrowing 41 42 Minimum Cash 43 Annual Interest Rate M.11.L- 12,000 Durango Mountain Bike Tours Forecasted Ending Cash Balance January 2020 to June 2020 January February March December April May June 12,000 5% B D E F G H 12,000 5% 0.42% A 38 Ending Cash Balance 39 40 Cumulative Borrowing 41 42 Minimum Cash 43 Annual Interest Rate 44 Monthly Interest Rate 45 46 d) 47 48 49 50 51 Beginning Cash 52 Add: Collections 53 Less: Short-term Interest 54 Less: Payments 55 Unadjusted Cash Balance 56 Add: Borrowing 57 Ending Cash Balance 58 59 Cumulative Borrowing 60 61 Minimum Cash 62 Annual Interest Rate 63 Monthly Interest Rate 64 Durango Mountain Bike Tours Forecasted Ending Cash Balance January 2020 to June 2020 January February March December April May June 12,000 5% 0.42%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts