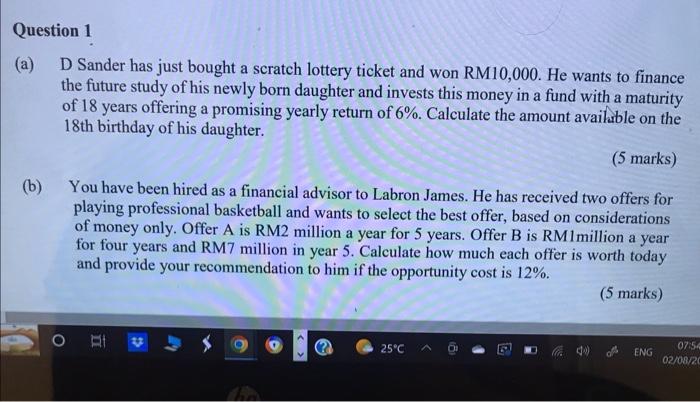

Question: (a) D Sander has just bought a scratch lottery ticket and won RM10,000. He wants to finance the future study of his newly born daughter

(a) D Sander has just bought a scratch lottery ticket and won RM10,000. He wants to finance the future study of his newly born daughter and invests this money in a fund with a maturity of 18 years offering a promising yearly return of 6%. Calculate the amount avaikble on the 18 th birthday of his daughter. (5 marks) (b) You have been hired as a financial advisor to Labron James. He has received two offers for playing professional basketball and wants to select the best offer, based on considerations of money only. Offer A is RM2 million a year for 5 years. Offer B is RM1million a year for four years and RM7 million in year 5 . Calculate how much each offer is worth today and provide your recommendation to him if the opportunity cost is 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts