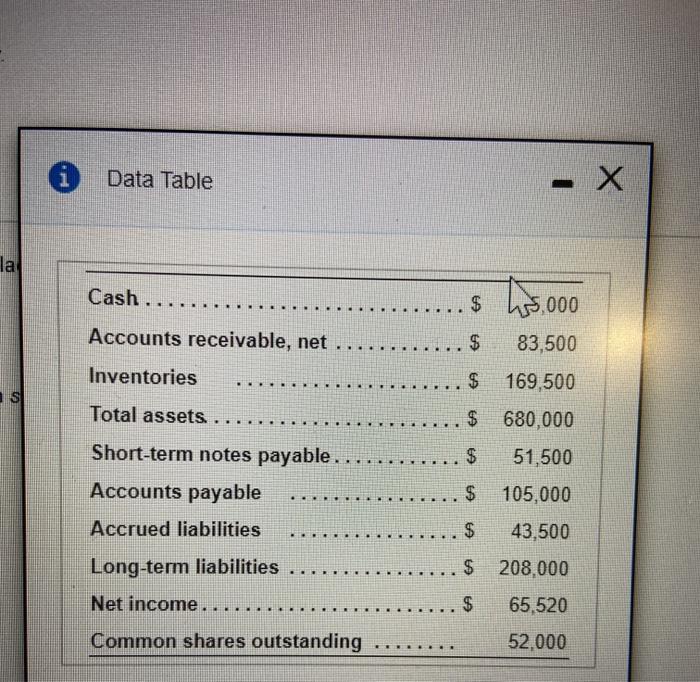

Question: A Data Table - X la . Cash .... Accounts receivable, net .. $ 115.000 $ 83,500 .... .. Inventories $ 169,500 GA $ 680,000

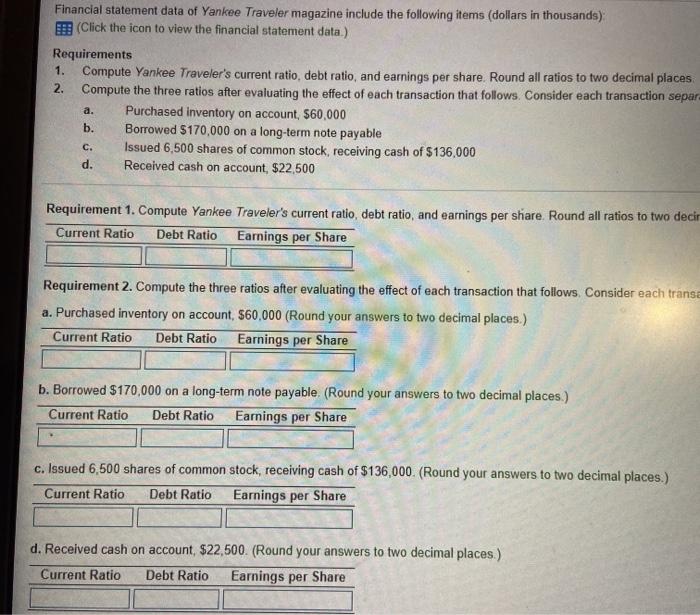

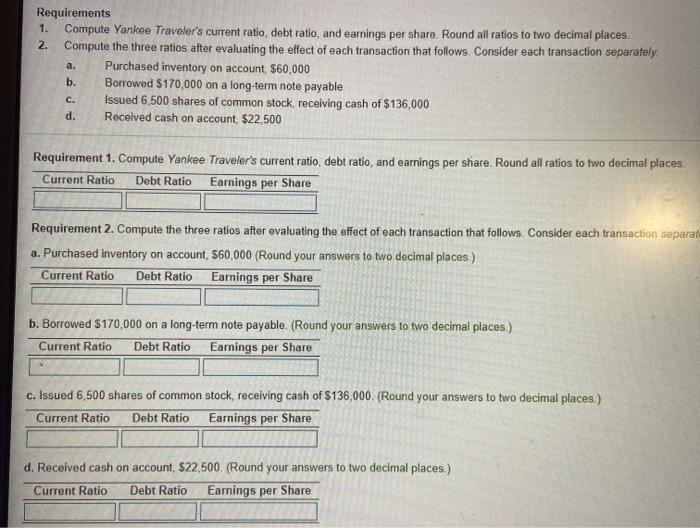

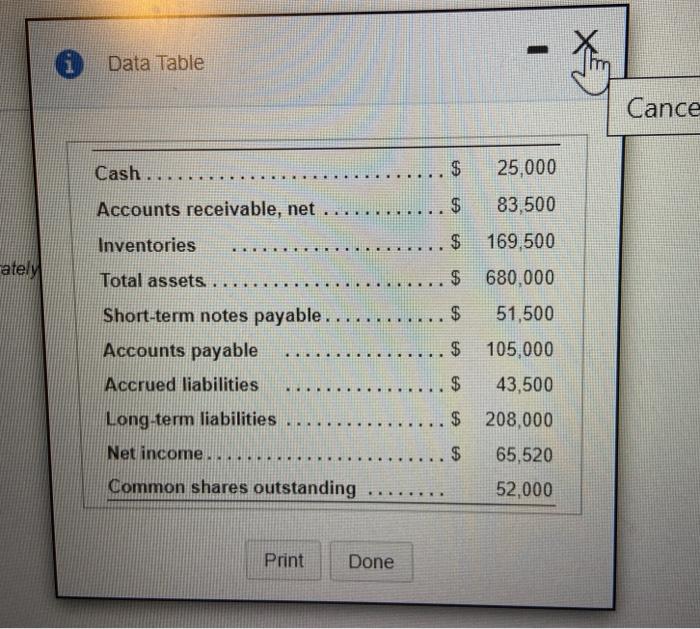

A Data Table - X la . Cash .... Accounts receivable, net .. $ 115.000 $ 83,500 .... .. Inventories $ 169,500 GA $ 680,000 $ 51,500 Total assets ... Short-term notes payable.. Accounts payable Accrued liabilities $ 105,000 .. ... $ 43,500 ... $ 208,000 Long-term liabilities $ 65,520 Net income... Common shares outstanding 52.000 .... Financial statement data of Yankee Traveler magazine include the following items (dollars in thousands) E!! (Click the icon to view the financial statement data.) Requirements 1. Compute Yankee Traveler's current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places 2. Compute the three ratios after evaluating the effect of each transaction that follows. Consider each transaction separ- Purchased inventory on account, $60,000 b. Borrowed $170,000 on a long-term note payable Issued 6,500 shares of common stock, receiving cash of $136,000 d. Received cash on account, $22,500 a. c. Requirement 1. Compute Yankee Traveler's current ratio, debt ratio, and earnings per share. Round all ratios to two decir Current Ratio Debt Ratio Earnings per Share Requirement 2. Compute the three ratios after evaluating the effect of each transaction that follows. Consider each transe a. Purchased inventory on account, $60,000 (Round your answers to two decimal places.) Current Ratio Debt Ratio Earnings per Share b. Borrowed $170,000 on a long-term note payable (Round your answers to two decimal places.) Current Ratio Debt Ratio Earnings per Share c. Issued 6,500 shares of common stock, receiving cash of $136,000 (Round your answers to two decimal places.) Current Ratio Debt Ratio Earnings per Share d. Received cash on account, $22,500. (Round your answers to two decimal places) Current Ratio Debt Ratio Earnings per Share Requirements 1. Compute Yankee Traveler's current ratio, debt ratio, and earnings per share Round all ratios to two decimal places. 2. Compute the three ratios after evaluating the effect of each transaction that follows. Consider each transaction separately Purchased inventory on account, $60,000 b. Borrowed $170,000 on a long-term note payable Issued 6,500 shares of common stock, receiving cash of $136,000 d. Received cash on account, $22,500 C. Requirement 1. Compute Yankee Traveler's current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places Current Ratio Debt Ratio Earnings per Share Requirement 2. Compute the three ratios after evaluating the effoct of each transaction that follows. Consider each transaction separat a. Purchased inventory on account. $60,000 (Round your answers to two decimal places ) Current Ratio Debt Ratio Earnings per Share b. Borrowed $170,000 on a long-term note payable. (Round your answers to two decimal places.) Current Ratio Debt Ratio Earnings per Share c. Issued 6,500 shares of common stock, receiving cash of $136,000. (Round your answers to two decimal places.) Current Ratio Debt Ratio Earnings per Share d. Received cash on account, $22,500 (Round your answers to two decimal places.) Current Ratio Debt Ratio Earnings per Share @ Data Table To Cance Cash $ $ 25,000 . . . $ 83,500 .. Accounts receivable, net Inventories EA 169,500 ately Total assets. ... $ 680,000 ... $ 51,500 Short-term notes payable... Accounts payable Accrued liabilities 105,000 .. .. $ . 43,500 Long-term liabilities . . $ 208,000 . ... $ $ 65,520 Net income.. Common shares outstanding 52,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts