Question: A decision maker with an exponential u - function and a risk aversion coefficient, = 0 . 0 0 1 , who is engaging in

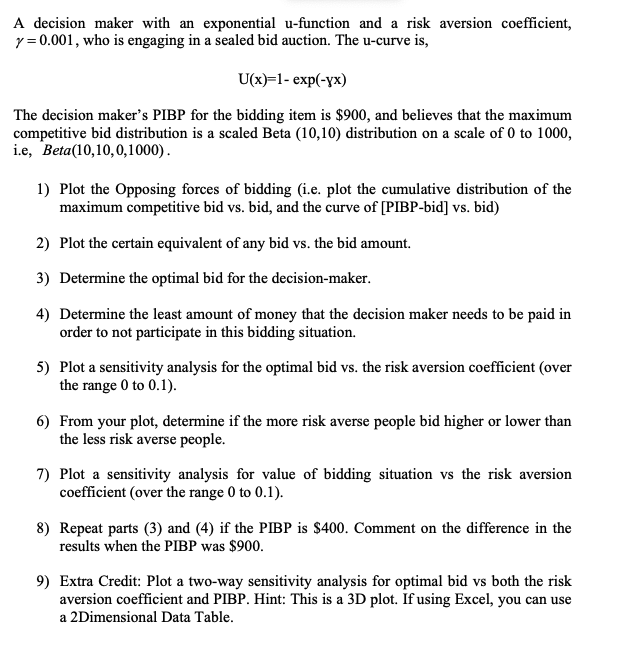

A decision maker with an exponential ufunction and a risk aversion coefficient,

who is engaging in a sealed bid auction. The ucurve is

exp

The decision maker's PIBP for the bidding item is $ and believes that the maximum

competitive bid distribution is a scaled Beta distribution on a scale of to

ie

Plot the Opposing forces of bidding ie plot the cumulative distribution of the

maximum competitive bid vs bid, and the curve of PIBPbid vs bid

Plot the certain equivalent of any bid vs the bid amount.

Determine the optimal bid for the decisionmaker.

Determine the least amount of money that the decision maker needs to be paid in

order to not participate in this bidding situation.

Plot a sensitivity analysis for the optimal bid vs the risk aversion coefficient over

the range to

From your plot, determine if the more risk averse people bid higher or lower than

the less risk averse people.

Plot a sensitivity analysis for value of bidding situation vs the risk aversion

coefficient over the range to

Repeat parts and if the PIBP is $ Comment on the difference in the

results when the PIBP was $

Extra Credit: Plot a twoway sensitivity analysis for optimal bid vs both the risk

aversion coefficient and PIBP. Hint: This is a D plot. If using Excel, you can use

a Dimensional Data Table.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock