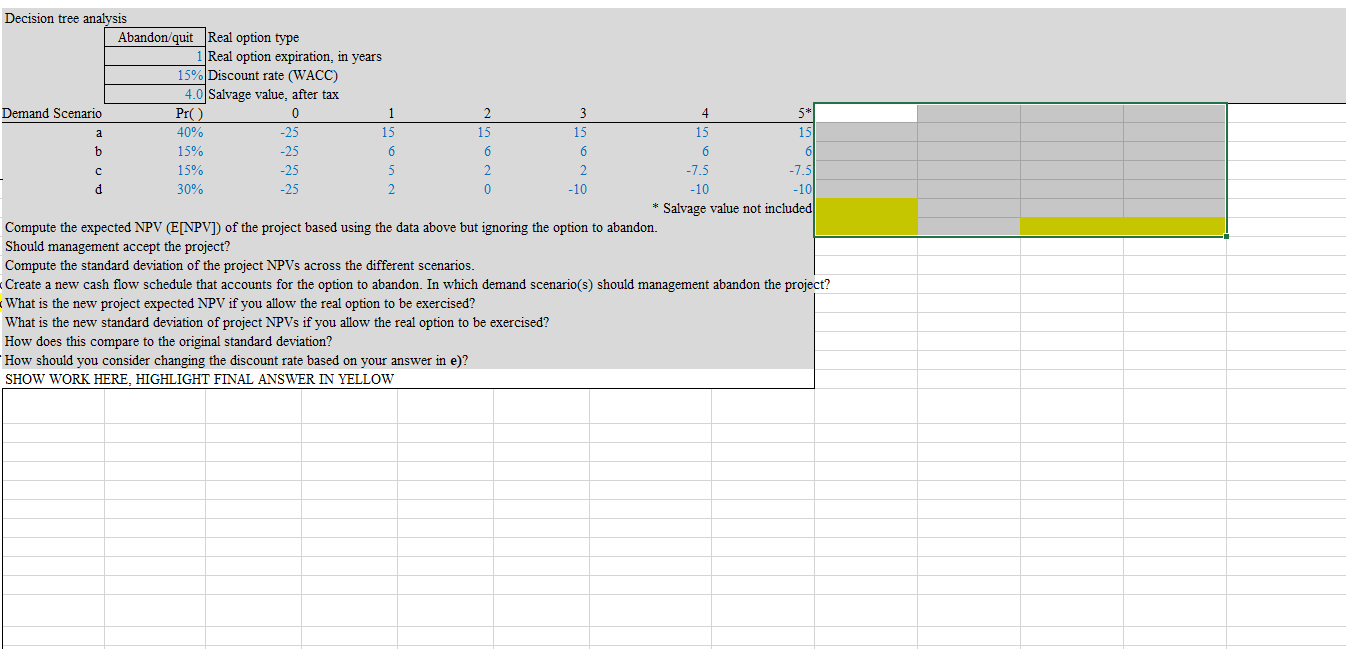

Question: a Decision tree analysis Abandon quit Real option type Real option expiration, in years 15% Discount rate (WACC) 4.0 Salvage value, after tax Demand Scenario

a Decision tree analysis Abandon quit Real option type Real option expiration, in years 15% Discount rate (WACC) 4.0 Salvage value, after tax Demand Scenario Pro 0 1 4 40% -25 15 15 15 15 15 b 15% -25 6 6 6 6 61 15% -25 5 2 2 -7.5 -7.5 d 30% -25 2 0 -10 -10 -101 * Salvage value not included Compute the expected NPV (E[NPV]) of the project based using the data above but ignoring the option to abandon. Should management accept the project? Compute the standard deviation of the project NPVs across the different scenarios. Create a new cash flow schedule that accounts for the option to abandon. In which demand scenario(s) should management abandon the project? What is the new project expected NPV if you allow the real option to be exercised? What is the new standard deviation of project NPVs if you allow the real option to be exercised? How does this compare to the original standard deviation? How should you consider changing the discount rate based on your answer in e)? SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW a Decision tree analysis Abandon quit Real option type Real option expiration, in years 15% Discount rate (WACC) 4.0 Salvage value, after tax Demand Scenario Pro 0 1 4 40% -25 15 15 15 15 15 b 15% -25 6 6 6 6 61 15% -25 5 2 2 -7.5 -7.5 d 30% -25 2 0 -10 -10 -101 * Salvage value not included Compute the expected NPV (E[NPV]) of the project based using the data above but ignoring the option to abandon. Should management accept the project? Compute the standard deviation of the project NPVs across the different scenarios. Create a new cash flow schedule that accounts for the option to abandon. In which demand scenario(s) should management abandon the project? What is the new project expected NPV if you allow the real option to be exercised? What is the new standard deviation of project NPVs if you allow the real option to be exercised? How does this compare to the original standard deviation? How should you consider changing the discount rate based on your answer in e)? SHOW WORK HERE, HIGHLIGHT FINAL ANSWER IN YELLOW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts