Question: (A) Define a forward contract for the underlying risky asset. Let F denote the contracted delivery price. Draw the binomial graph for this forward contract.

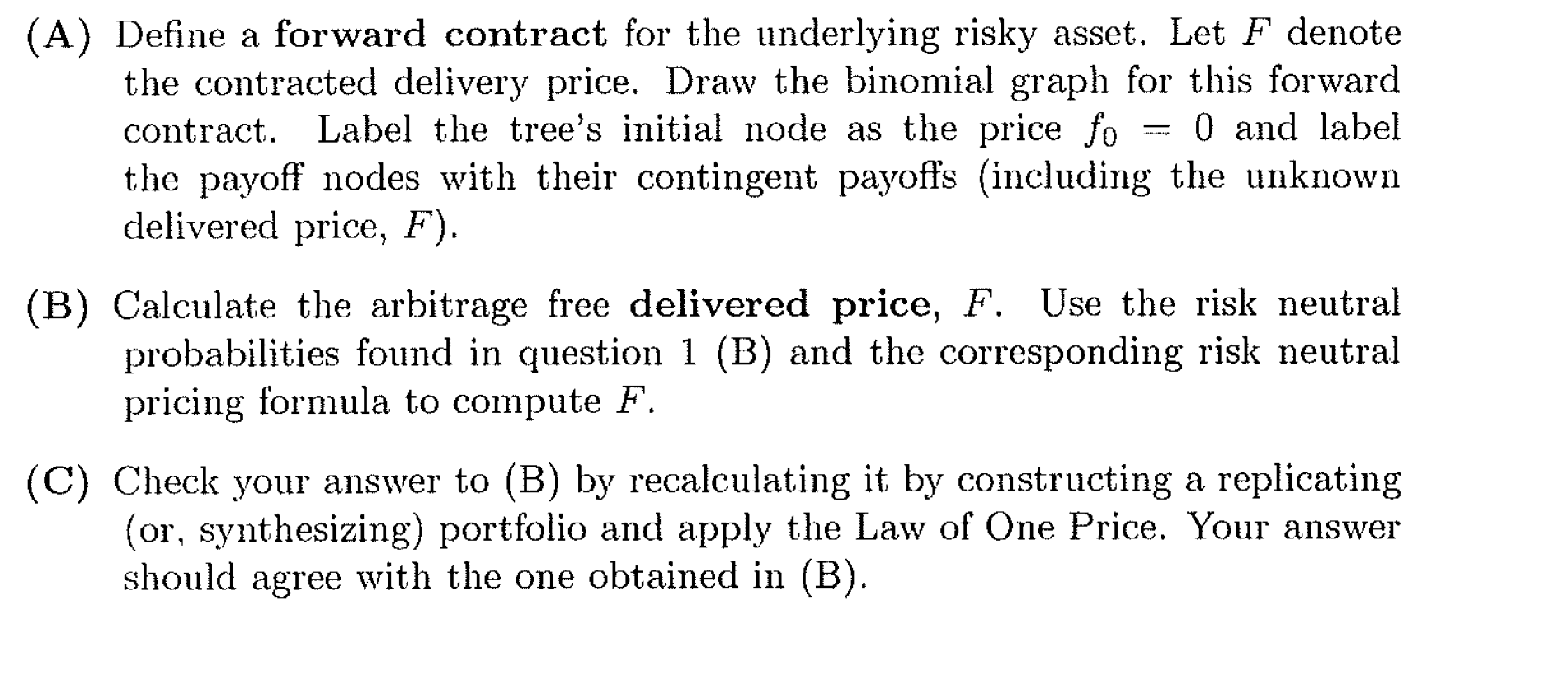

(A) Define a forward contract for the underlying risky asset. Let F denote the contracted delivery price. Draw the binomial graph for this forward contract. Label the tree's initial node as the price fo = 0 and label the payoff nodes with their contingent payoffs (including the unknown delivered price, F). (B) Calculate the arbitrage free delivered price, F. Use the risk neutral probabilities found in question 1 (B) and the corresponding risk neutral pricing formula to compute F. (C) Check your answer to (B) by recalculating it by constructing a replicating (or, synthesizing) portfolio and apply the Law of One Price. Your answer should agree with the one obtained in (B)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts