Question: a) Define monetary base. Describe and discuss the methods that the Federal Reserve controls the monetary base. [10 marks] b) Suppose that in the US,

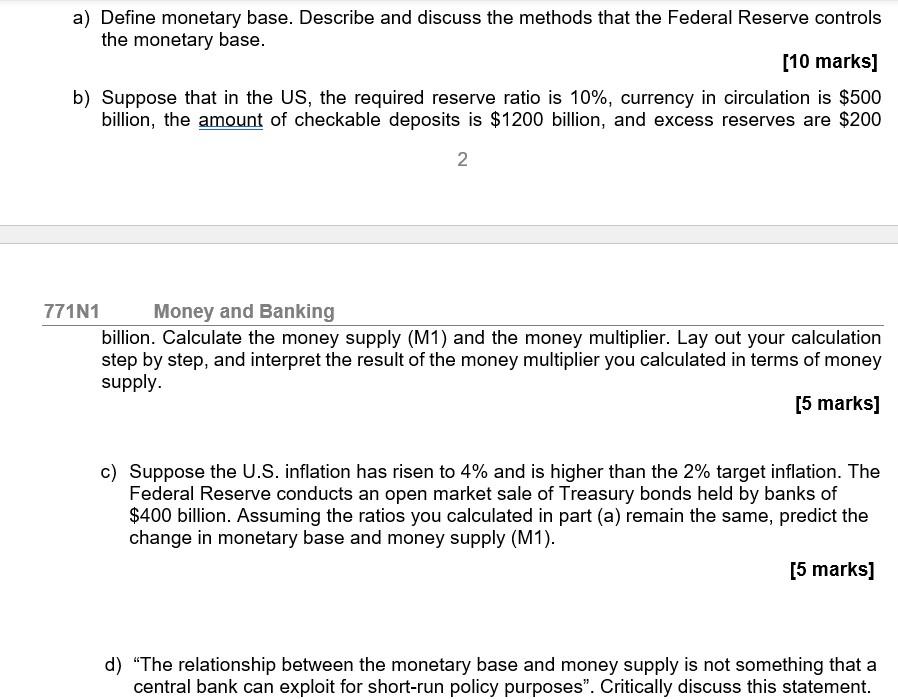

a) Define monetary base. Describe and discuss the methods that the Federal Reserve controls the monetary base. [10 marks] b) Suppose that in the US, the required reserve ratio is 10%, currency in circulation is $500 billion, the amount of checkable deposits is $1200 billion, and excess reserves are $200 2 1 Money and Banking billion. Calculate the money supply (M1) and the money multiplier. Lay out your calculation step by step, and interpret the result of the money multiplier you calculated in terms of money supply. [5 marks] c) Suppose the U.S. inflation has risen to 4% and is higher than the 2% target inflation. The Federal Reserve conducts an open market sale of Treasury bonds held by banks of $400 billion. Assuming the ratios you calculated in part (a) remain the same, predict the change in monetary base and money supply (M1). [5 marks] d) "The relationship between the monetary base and money supply is not something that a central bank can exploit for short-run policy purposes". Critically discuss this statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts