Question: (a) Define the coupon, par (face) value and yield to maturity of a bond. ( 4 marks) (b) Explain why the yield to maturity of

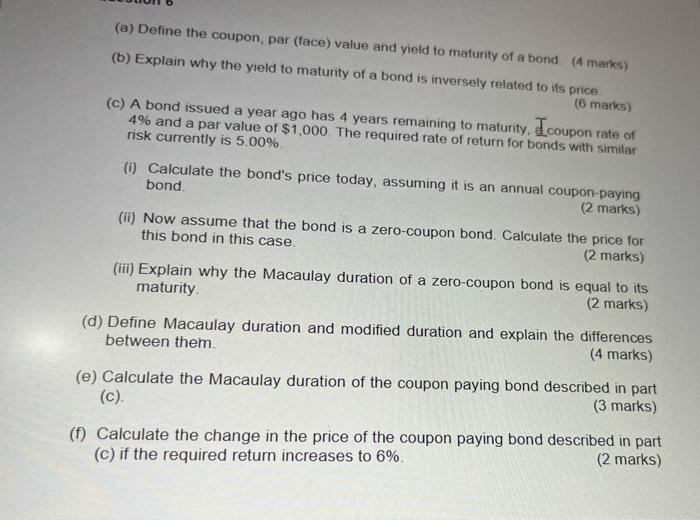

(a) Define the coupon, par (face) value and yield to maturity of a bond. ( 4 marks) (b) Explain why the yield to maturity of a bond is inversely related to its price. (c) A bond issued a year ago has 4 years remaining to maturity. Ecoupon rate of 4% and a par value of $1,000. The required rate of return for bonds with similar risk currently is 5.00%. (i) Calculate the bond's price today, assuming it is an annual coupon-paying bond: ( 2 marks) (ii) Now assume that the bond is a zero-coupon bond. Calculate the price for this bond in this case. ( 2 marks) (iii) Explain why the Macaulay duration of a zero-coupon bond is equal to its maturity. ( 2 marks) (d) Define Macaulay duration and modified duration and explain the differences between them. ( 4 marks) (e) Calculate the Macaulay duration of the coupon paying bond described in part (c). (3 marks) (f) Calculate the change in the price of the coupon paying bond described in part (c) if the required return increases to 6%. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts