Question: (a) Define the short and long runs and explain why it is important to distinguish between them. Provide an example of a firm for

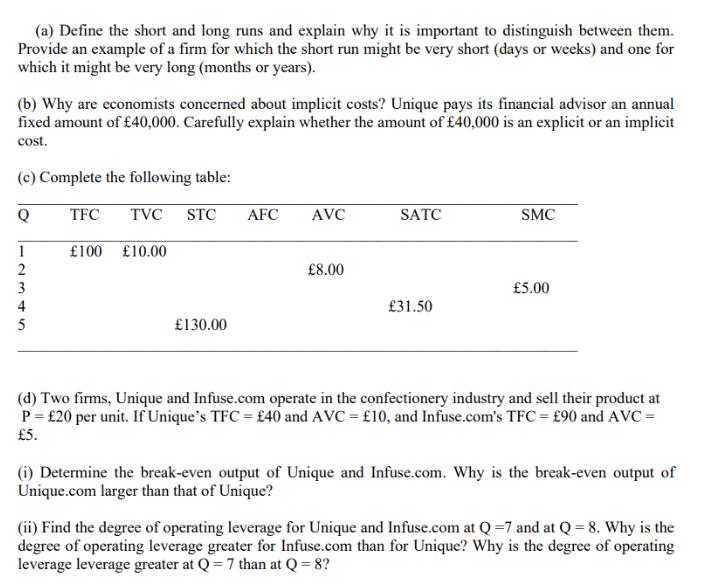

(a) Define the short and long runs and explain why it is important to distinguish between them. Provide an example of a firm for which the short run might be very short (days or weeks) and one for which it might be very long (months or years). (b) Why are economists concerned about implicit costs? Unique pays its financial advisor an annual fixed amount of 40,000. Carefully explain whether the amount of 40,000 is an explicit or an implicit cost. (c) Complete the following table: Q 1 23452 4 TFC TVC STC AFC 100 10.00 130.00 AVC 8.00 SATC 31.50 SMC 5.00 (d) Two firms, Unique and Infuse.com operate in the confectionery industry and sell their product at P = 20 per unit. If Unique's TFC = 40 and AVC = 10, and Infuse.com's TFC = 90 and AVC= 5. (1) Determine the break-even output of Unique and Infuse.com. Why is the break-even output of Unique.com larger than that of Unique? (ii) Find the degree of operating leverage for Unique and Infuse.com at Q=7 and at Q = 8. Why is the degree of operating leverage greater for Infuse.com than for Unique? Why is the degree of operating leverage leverage greater at Q=7 than at Q = 8? (a) Define the short and long runs and explain why it is important to distinguish between them. Provide an example of a firm for which the short run might be very short (days or weeks) and one for which it might be very long (months or years). (b) Why are economists concerned about implicit costs? Unique pays its financial advisor an annual fixed amount of 40,000. Carefully explain whether the amount of 40,000 is an explicit or an implicit cost. (c) Complete the following table: Q 1 23452 4 TFC TVC STC AFC 100 10.00 130.00 AVC 8.00 SATC 31.50 SMC 5.00 (d) Two firms, Unique and Infuse.com operate in the confectionery industry and sell their product at P = 20 per unit. If Unique's TFC = 40 and AVC = 10, and Infuse.com's TFC = 90 and AVC= 5. (1) Determine the break-even output of Unique and Infuse.com. Why is the break-even output of Unique.com larger than that of Unique? (ii) Find the degree of operating leverage for Unique and Infuse.com at Q=7 and at Q = 8. Why is the degree of operating leverage greater for Infuse.com than for Unique? Why is the degree of operating leverage leverage greater at Q=7 than at Q = 8?

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

a Short Run The short run refers to a period in which at least one input is fixed typically capital while others like labor are variable In the short ... View full answer

Get step-by-step solutions from verified subject matter experts