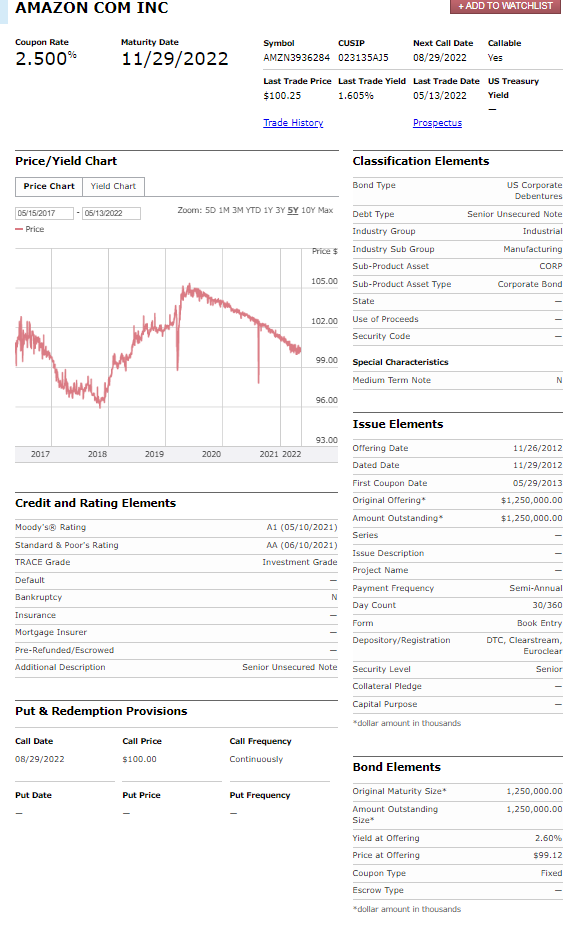

Question: a. Describe a particular bond issue (because there are usually many outstanding bond issues for the same company) by providing information on the following: purpose

a. Describe a particular bond issue (because there are usually many outstanding bond issues for the same company) by providing information on the following: purpose of the issue (from reading the prospectus), term of the bond, maturity date, coupon rate, coupon payment dates, $ amount for each coupon, whether it is convertible or callable (or neither), seniority, issuing price (as a ratio), premium/discount/par bond at issue, current bond price (as a ratio), premium/discount/par based on current price. Based on the relationship between premium/discount/par bond and yield, what can you tell about the relationship between yield to maturity and coupon rate?

-b. Examine the plot of yield and bond price over the year and summarize the relationship between bond yield and price in one sentence.

AMAZON COM INC +ADD TO WATCHLIST Coupon Rate Maturity Date 2.500% 11/29/2022 Symbol CUSIP Next Call Date Callable AMZN 3936284 023135135 08/29/2022 Yes Last Trade Price Last Trade Yield Last Trade Date US Treasury $100.25 1.605% 05/13/2022 Yield Trade History Prospectus Price/Yield Chart Classification Elements Price Chart Yield Chart Bond Type US Corporate Debentures 05/15/2017 05/13/2022 Zoom: 5D 1M 3M YTD 1Y 3Y 5Y 10Y Max Senior Unsecured Note Industria - Price Debt Type Industry Group Industry Sub Group Sub-Product Asset Price $ Manufacturing CORP 105.00 Sub-Product Asset Type Corporate Bond State 102.00 Use of Proceeds Security Code Why 99.00 Special Characteristics Medium Term Note N 96.00 Issue Elements 93.00 11/26/2012 2017 2018 2019 2020 2021 2022 11/29/2012 Offering Date Dated Date First Coupon Date Original Offering Amount Outstanding Series Credit and Rating Elements 05/29/2013 $1,250,000.00 $1,250,000.00 A1 (05/10/2021) Moody's Rating Standard & Poor's Rating TRACE Grade AA (06/10/2021) Investment Grade Default Bankruptcy Issue Description Project Name Payment Frequency Day Count N Semi-Annual 30/360 Form Insurance Mortgage Insurer Pre-Refunded/Escrowed Additional Description Depository/Registration Book Entry DTC, Clearstream, Euroclear Senior Unsecured Note Senior Security Level Collateral Pledge Capital Purpose *dollar amount in thousands Put & Redemption Provisions Call Date 08/29/2022 Call Price $100.00 Call Frequency Continuously Bond Elements Put Date Put Price Put Frequency Original Maturity Size 1,250,000.00 1,250,000.00 2.60% Amount Outstanding Size Yield at Offering Price at Offering Coupon Type Escrow Type $99.12 Fixed *dollar amount in thousands AMAZON COM INC +ADD TO WATCHLIST Coupon Rate Maturity Date 2.500% 11/29/2022 Symbol CUSIP Next Call Date Callable AMZN 3936284 023135135 08/29/2022 Yes Last Trade Price Last Trade Yield Last Trade Date US Treasury $100.25 1.605% 05/13/2022 Yield Trade History Prospectus Price/Yield Chart Classification Elements Price Chart Yield Chart Bond Type US Corporate Debentures 05/15/2017 05/13/2022 Zoom: 5D 1M 3M YTD 1Y 3Y 5Y 10Y Max Senior Unsecured Note Industria - Price Debt Type Industry Group Industry Sub Group Sub-Product Asset Price $ Manufacturing CORP 105.00 Sub-Product Asset Type Corporate Bond State 102.00 Use of Proceeds Security Code Why 99.00 Special Characteristics Medium Term Note N 96.00 Issue Elements 93.00 11/26/2012 2017 2018 2019 2020 2021 2022 11/29/2012 Offering Date Dated Date First Coupon Date Original Offering Amount Outstanding Series Credit and Rating Elements 05/29/2013 $1,250,000.00 $1,250,000.00 A1 (05/10/2021) Moody's Rating Standard & Poor's Rating TRACE Grade AA (06/10/2021) Investment Grade Default Bankruptcy Issue Description Project Name Payment Frequency Day Count N Semi-Annual 30/360 Form Insurance Mortgage Insurer Pre-Refunded/Escrowed Additional Description Depository/Registration Book Entry DTC, Clearstream, Euroclear Senior Unsecured Note Senior Security Level Collateral Pledge Capital Purpose *dollar amount in thousands Put & Redemption Provisions Call Date 08/29/2022 Call Price $100.00 Call Frequency Continuously Bond Elements Put Date Put Price Put Frequency Original Maturity Size 1,250,000.00 1,250,000.00 2.60% Amount Outstanding Size Yield at Offering Price at Offering Coupon Type Escrow Type $99.12 Fixed *dollar amount in thousands

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts