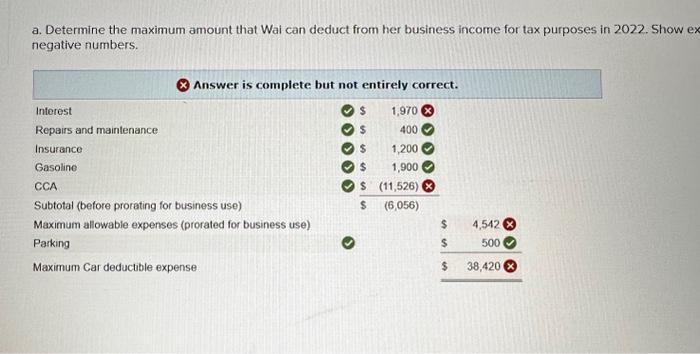

Question: a. Determine the maximum amount that Wai can deduct from her business income for tax purposes in 2022 . Show e negative numbers. b. Calculate

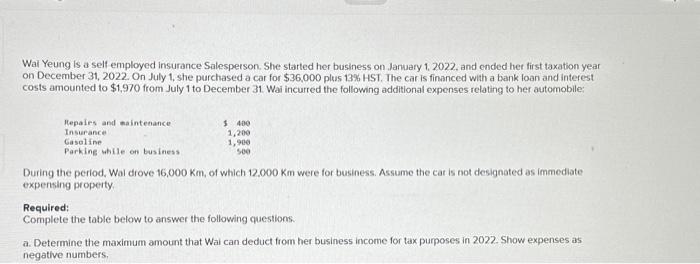

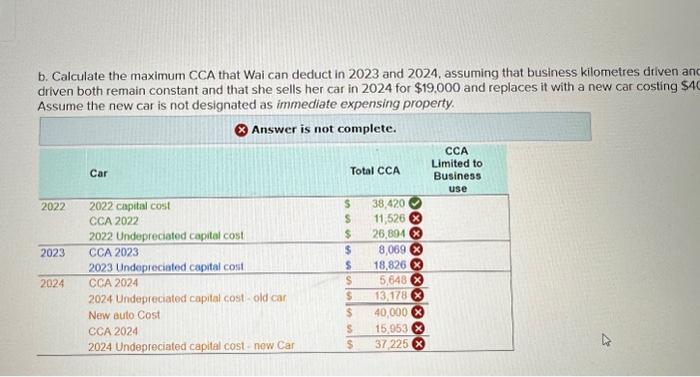

a. Determine the maximum amount that Wai can deduct from her business income for tax purposes in 2022 . Show e negative numbers. b. Calculate the maximum CCA that Wai can dectuct in 2023 and 2024, assuming that business kilometres driven and total kilometres driven both remain constant and that she selis her car in 2024 for $19,000 and replaces it with a new car costing $40,000 plus HST. Assume the new car is not designated as immediate expensing property. b. Calculate the maximum CCA that Wai can deduct in 2023 and 2024 , assuming that business kilometres driven an driven both remain constant and that she sells her car in 2024 for $19.000 and replaces it with a new car costing Assume the new car is not designated as immediate expensing property. Wai Yeung is a self employed insurance Salesperson. She started her business on January 1,2022, and ended her first taxation year on December 31, 2022. On July 1, she purchased a car for $36,000 plus 13% HST. The car is financed with a bank loan and interest costs amounted to $1,970 from July 1 to December 31 . Wai incurred the following additional expenses relating to her automobile: During the period, Wal drove 16,000Km, of which 12,000 Km were for business. Assume the cat is not designated as immedlate expensing property. Required: Complete the table below to answer the following questions. a. Determine the maximum amount that Wai can deduct from her business income for tax purposes in 2022 . Show expenses as negative numbers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts