Question: a) Develop a Net Income Statement (only the statement please-no supporting information) b) Develop a Net Cash Flow statement (only the statement please-no supporting information)

a) Develop a Net Income Statement (only the statement please-no supporting information)

b) Develop a Net Cash Flow statement (only the statement please-no supporting information)

c) Use the PW criterion to decide if the company should undertake this project

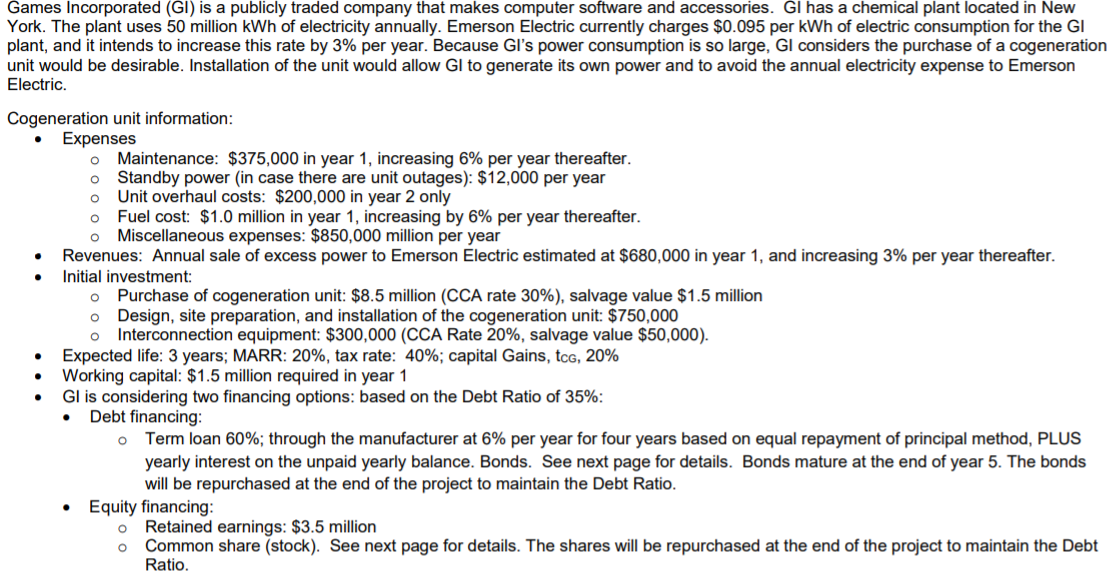

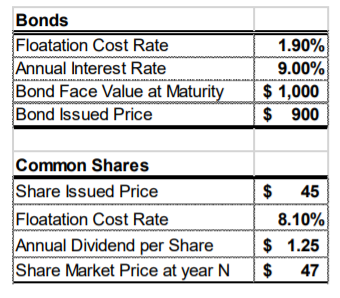

Games Incorporated (GI) is a publicly traded company that makes computer software and accessories. Gl has a chemical plant located in New York. The plant uses 50 million kWh of electricity annually. Emerson Electric currently charges $0.095 per kWh of electric consumption for the GI plant, and it intends to increase this rate by 3% per year. Because Gl's power consumption is so large, Gl considers the purchase of a cogeneration unit would be desirable. Installation of the unit would allow Gl to generate its own power and to avoid the annual electricity expense to Emerson Electric Cogeneration unit information: Expenses O Maintenance: $375,000 in year 1, increasing 6% per year thereafter. o Standby power in case there are unit outages): $12,000 per year o Unit overhaul costs: $200,000 in year 2 only o Fuel cost: $1.0 million in year 1, increasing by 6% per year thereafter. O Miscellaneous expenses: $850,000 million per year Revenues: Annual sale of excess power to Emerson Electric estimated at $680,000 in year 1, and increasing 3% per year thereafter. Initial investment: o Purchase of cogeneration unit: $8.5 million (CCA rate 30%), salvage value $1.5 million o Design, site preparation, and installation of the cogeneration unit: $750,000 o Interconnection equipment: $300,000 (CCA Rate 20%, salvage value $50,000). Expected life: 3 years; MARR: 20%, tax rate: 40%; capital Gains, tcg, 20% Working capital: $1.5 million required in year 1 Gl is considering two financing options: based on the Debt Ratio of 35%: Debt financing: o Term loan 60%, through the manufacturer at 6% per year for four years based on equal repayment of principal method, PLUS yearly interest on the unpaid yearly balance. Bonds. See next page for details. Bonds mature at the end of year 5. The bonds will be repurchased at the end of the project to maintain the Debt Ratio. Equity financing: Retained earnings: $3.5 million o Common share (stock). See next page for details. The shares will be repurchased at the end of the project to maintain the Debt Ratio. Bonds Floatation Cost Rate Annual Interest Rate Bond Face Value at Maturity Bond Issued Price 1.90% 9.00% $1,000 $ 900 $ Common Shares Share issued Price Floatation Cost Rate Annual Dividend per Share Share Market Price at year N 45 8.10% 1.25 47 $ $ Games Incorporated (GI) is a publicly traded company that makes computer software and accessories. Gl has a chemical plant located in New York. The plant uses 50 million kWh of electricity annually. Emerson Electric currently charges $0.095 per kWh of electric consumption for the GI plant, and it intends to increase this rate by 3% per year. Because Gl's power consumption is so large, Gl considers the purchase of a cogeneration unit would be desirable. Installation of the unit would allow Gl to generate its own power and to avoid the annual electricity expense to Emerson Electric Cogeneration unit information: Expenses O Maintenance: $375,000 in year 1, increasing 6% per year thereafter. o Standby power in case there are unit outages): $12,000 per year o Unit overhaul costs: $200,000 in year 2 only o Fuel cost: $1.0 million in year 1, increasing by 6% per year thereafter. O Miscellaneous expenses: $850,000 million per year Revenues: Annual sale of excess power to Emerson Electric estimated at $680,000 in year 1, and increasing 3% per year thereafter. Initial investment: o Purchase of cogeneration unit: $8.5 million (CCA rate 30%), salvage value $1.5 million o Design, site preparation, and installation of the cogeneration unit: $750,000 o Interconnection equipment: $300,000 (CCA Rate 20%, salvage value $50,000). Expected life: 3 years; MARR: 20%, tax rate: 40%; capital Gains, tcg, 20% Working capital: $1.5 million required in year 1 Gl is considering two financing options: based on the Debt Ratio of 35%: Debt financing: o Term loan 60%, through the manufacturer at 6% per year for four years based on equal repayment of principal method, PLUS yearly interest on the unpaid yearly balance. Bonds. See next page for details. Bonds mature at the end of year 5. The bonds will be repurchased at the end of the project to maintain the Debt Ratio. Equity financing: Retained earnings: $3.5 million o Common share (stock). See next page for details. The shares will be repurchased at the end of the project to maintain the Debt Ratio. Bonds Floatation Cost Rate Annual Interest Rate Bond Face Value at Maturity Bond Issued Price 1.90% 9.00% $1,000 $ 900 $ Common Shares Share issued Price Floatation Cost Rate Annual Dividend per Share Share Market Price at year N 45 8.10% 1.25 47 $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts