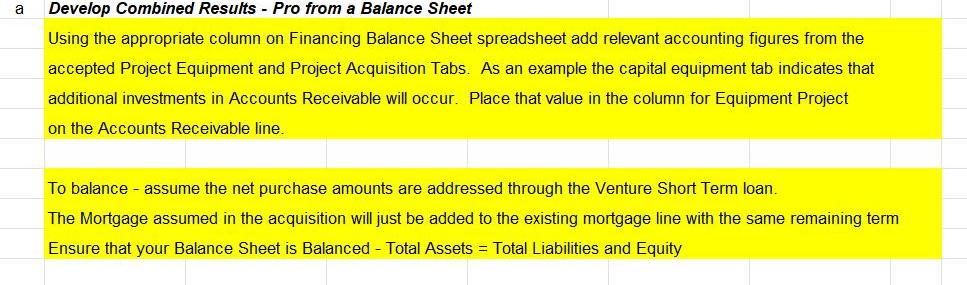

Question: a Develop Combined Results - Pro from a Balance Sheet Using the appropriate column on Financing Balance Sheet spreadsheet add relevant accounting figures from

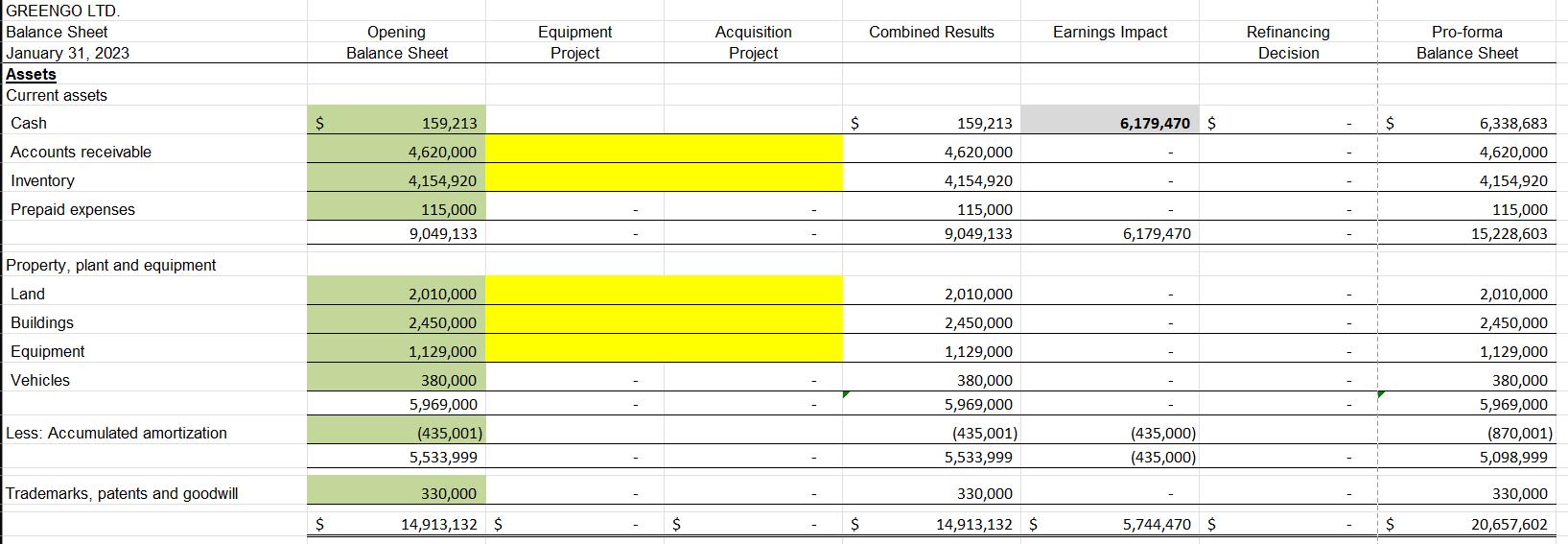

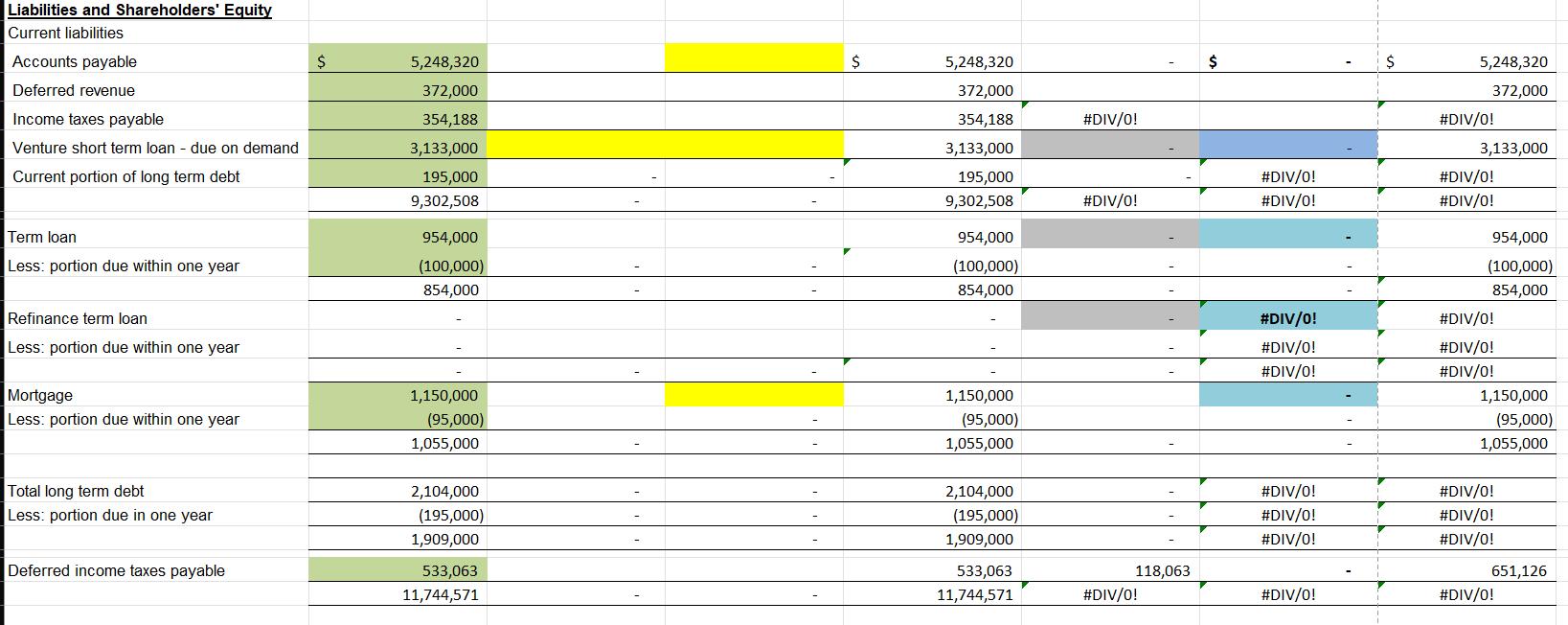

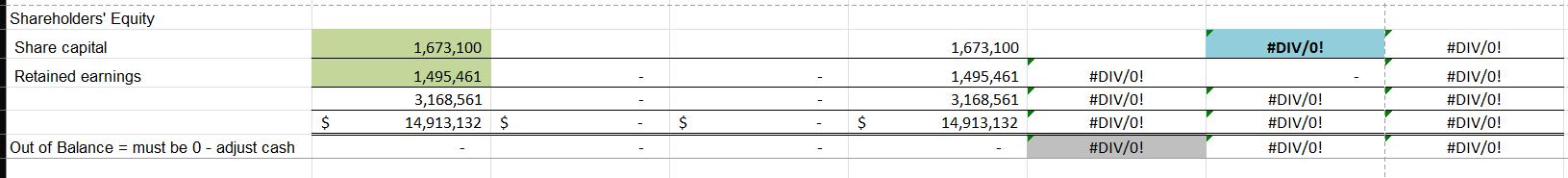

a Develop Combined Results - Pro from a Balance Sheet Using the appropriate column on Financing Balance Sheet spreadsheet add relevant accounting figures from the accepted Project Equipment and Project Acquisition Tabs. As an example the capital equipment tab indicates that additional investments in Accounts Receivable will occur. Place that value in the column for Equipment Project on the Accounts Receivable line. To balance - assume the net purchase amounts are addressed through the Venture Short Term loan. The Mortgage assumed in the acquisition will just be added to the existing mortgage line with the same remaining term Ensure that your Balance Sheet is Balanced - Total Assets = Total Liabilities and Equity GREENGO LTD. Opening Balance Sheet Equipment Project Acquisition Project Combined Results Earnings Impact Refinancing Decision Balance Sheet January 31, 2023 Assets Current assets Cash $ 159,213 Accounts receivable 4,620,000 Inventory Prepaid expenses Property, plant and equipment 4,154,920 115,000 9,049,133 $ 159,213 4,620,000 6,179,470 $ 4,154,920 115,000 9,049,133 6,179,470 Pro-forma Balance Sheet $ 6,338,683 4,620,000 4,154,920 115,000 15,228,603 Land Buildings 2,010,000 2,450,000 2,010,000 2,450,000 Equipment Vehicles 1,129,000 1,129,000 380,000 380,000 2,010,000 2,450,000 1,129,000 380,000 5,969,000 5,969,000 5,969,000 Less: Accumulated amortization (435,001) (435,001) 5,533,999 5,533,999 (435,000) (435,000) (870,001) 5,098,999 Trademarks, patents and goodwill 330,000 330,000 330,000 $ 14,913,132 $ $ $ 14,913,132 $ 5,744,470 $ $ 20,657,602 Liabilities and Shareholders' Equity Current liabilities Accounts payable $ 5,248,320 $ 5,248,320 $ $ 5,248,320 Deferred revenue 372,000 372,000 372,000 Income taxes payable 354,188 354,188 #DIV/O! #DIV/0! Venture short term loan - due on demand 3,133,000 3,133,000 3,133,000 Current portion of long term debt 195,000 195,000 #DIV/0! #DIV/0! 9,302,508 9,302,508 #DIV/O! #DIV/O! #DIV/0! Term loan 954,000 954,000 954,000 Less: portion due within one year (100,000) (100,000) (100,000) 854,000 854,000 854,000 Refinance term loan #DIV/0! #DIV/O! Less: portion due within one year #DIV/0! #DIV/O! #DIV/O! #DIV/0! Mortgage 1,150,000 1,150,000 1,150,000 Less: portion due within one year (95,000) (95,000) (95,000) 1,055,000 1,055,000 1,055,000 Total long term debt 2,104,000 2,104,000 #DIV/0! #DIV/0! Less: portion due in one year (195,000) (195,000) #DIV/O! #DIV/O! 1,909,000 1,909,000 #DIV/0! #DIV/0! Deferred income taxes payable 533,063 533,063 118,063 651,126 11,744,571 11,744,571 #DIV/0! #DIV/0! #DIV/0! Shareholders' Equity Share capital 1,673,100 1,673,100 #DIV/0! #DIV/O! Retained earnings 1,495,461 1,495,461 #DIV/0! #DIV/O! 3,168,561 3,168,561 #DIV/0! #DIV/0! #DIV/O! $ 14,913,132 $ $ $ 14,913,132 #DIV/O! #DIV/O! #DIV/O! Out of Balance = must be 0 - adjust cash #DIV/0! #DIV/0! #DIV/O! a Develop Combined Results - Pro from a Balance Sheet Using the appropriate column on Financing Balance Sheet spreadsheet add relevant accounting figures from the accepted Project Equipment and Project Acquisition Tabs. As an example the capital equipment tab indicates that additional investments in Accounts Receivable will occur. Place that value in the column for Equipment Project on the Accounts Receivable line. To balance - assume the net purchase amounts are addressed through the Venture Short Term loan. The Mortgage assumed in the acquisition will just be added to the existing mortgage line with the same remaining term Ensure that your Balance Sheet is Balanced - Total Assets = Total Liabilities and Equity GREENGO LTD. Opening Balance Sheet Equipment Project Acquisition Project Combined Results Earnings Impact Refinancing Decision Balance Sheet January 31, 2023 Assets Current assets Cash $ 159,213 Accounts receivable 4,620,000 Inventory Prepaid expenses Property, plant and equipment 4,154,920 115,000 9,049,133 $ 159,213 4,620,000 6,179,470 $ 4,154,920 115,000 9,049,133 6,179,470 Pro-forma Balance Sheet $ 6,338,683 4,620,000 4,154,920 115,000 15,228,603 Land Buildings 2,010,000 2,450,000 2,010,000 2,450,000 Equipment Vehicles 1,129,000 1,129,000 380,000 380,000 2,010,000 2,450,000 1,129,000 380,000 5,969,000 5,969,000 5,969,000 Less: Accumulated amortization (435,001) (435,001) 5,533,999 5,533,999 (435,000) (435,000) (870,001) 5,098,999 Trademarks, patents and goodwill 330,000 330,000 330,000 $ 14,913,132 $ $ $ 14,913,132 $ 5,744,470 $ $ 20,657,602 Liabilities and Shareholders' Equity Current liabilities Accounts payable $ 5,248,320 $ 5,248,320 $ $ 5,248,320 Deferred revenue 372,000 372,000 372,000 Income taxes payable 354,188 354,188 #DIV/O! #DIV/0! Venture short term loan - due on demand 3,133,000 3,133,000 3,133,000 Current portion of long term debt 195,000 195,000 #DIV/0! #DIV/0! 9,302,508 9,302,508 #DIV/O! #DIV/O! #DIV/0! Term loan 954,000 954,000 954,000 Less: portion due within one year (100,000) (100,000) (100,000) 854,000 854,000 854,000 Refinance term loan #DIV/0! #DIV/O! Less: portion due within one year #DIV/0! #DIV/O! #DIV/O! #DIV/0! Mortgage 1,150,000 1,150,000 1,150,000 Less: portion due within one year (95,000) (95,000) (95,000) 1,055,000 1,055,000 1,055,000 Total long term debt 2,104,000 2,104,000 #DIV/0! #DIV/0! Less: portion due in one year (195,000) (195,000) #DIV/O! #DIV/O! 1,909,000 1,909,000 #DIV/0! #DIV/0! Deferred income taxes payable 533,063 533,063 118,063 651,126 11,744,571 11,744,571 #DIV/0! #DIV/0! #DIV/0! Shareholders' Equity Share capital 1,673,100 1,673,100 #DIV/0! #DIV/O! Retained earnings 1,495,461 1,495,461 #DIV/0! #DIV/O! 3,168,561 3,168,561 #DIV/0! #DIV/0! #DIV/O! $ 14,913,132 $ $ $ 14,913,132 #DIV/O! #DIV/O! #DIV/O! Out of Balance = must be 0 - adjust cash #DIV/0! #DIV/0! #DIV/O!

Step by Step Solution

There are 3 Steps involved in it

In order to balance the proforma balance sheet for Greengo Ltd we need to adjust the cash amount to ... View full answer

Get step-by-step solutions from verified subject matter experts